Financial Assumptions and Your Business Plan

Written by Dave Lavinsky

Financial assumptions are an integral part of a well-written business plan. You can’t accurately forecast the future without them. Invest the time to write solid assumptions so you have a good foundation for your financial forecast.

Download our Ultimate Business Plan Template here

What are Financial Assumptions?

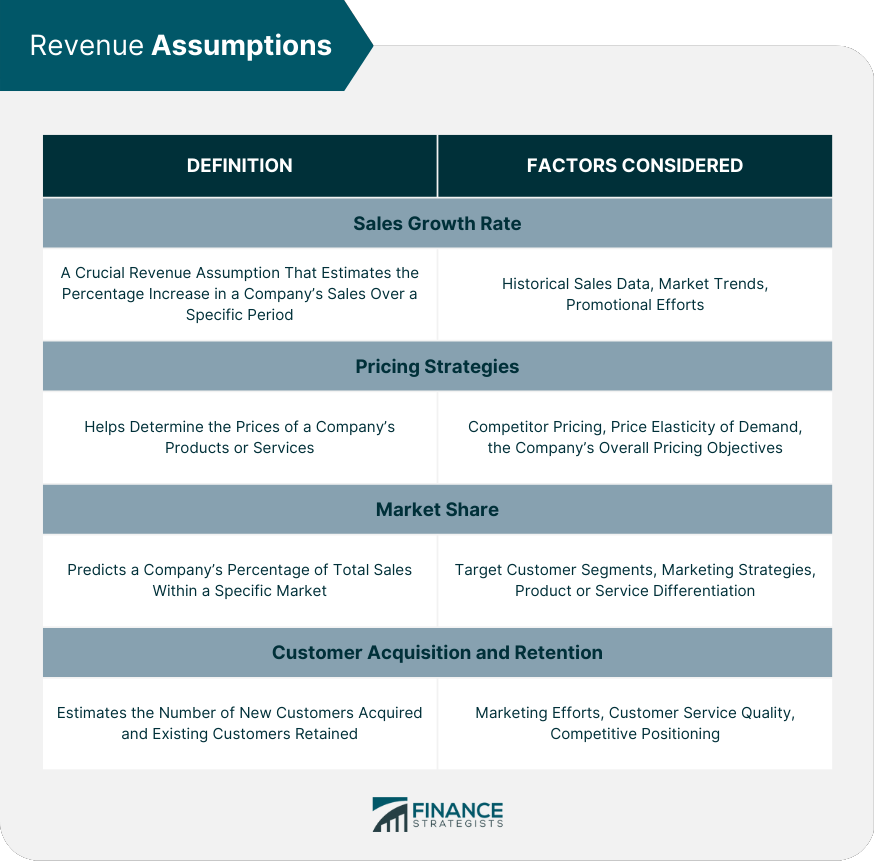

Financial assumptions are the guidelines you give your business plan to follow. They can range from financial forecasts about costs, revenue, return on investment, and operating and startup expenses. Basically, financial assumptions serve as a forecast of what your business will do in the future. You need to include them so that anyone reading your plan will have some idea of how accurate its projections may be.

Of course, your financial assumptions should accurately reflect the information you’ve given in your business plan and they should be reasonably accurate. You need to keep this in mind when you make them because if you make outlandish claims, it will make people less likely to believe any part of your business plan including other financial projections that may be accurate.

That’s why you always want to err on the side of caution when it comes to financial assumptions for your business plan. The more conservative your assumptions are the more likely you’ll be able to hit them, and the less likely you’ll be off by so much that people will ignore everything in your plan.

Why are Financial Assumptions Important?

Many investors skip straight to the financial section of your business plan. It is critical that your assumptions and projections in this section be realistic. Plans that show penetration, operating margin, and revenues per employee figures that are poorly reasoned; internally inconsistent, or simply unrealistic greatly damage the credibility of the entire business plan. In contrast, sober, well-reasoned financial assumptions and projections communicate operational maturity and credibility.

For instance, if the company is categorized as a networking infrastructure firm, and the business plan projects 80% operating margins, investors will raise a red flag. This is because investors can readily access the operating margins of publicly-traded networking infrastructure firms and find that none have operating margins this high.

As much as possible, the financial assumptions should be based on actual results from your or other firms. As the example above indicates, it is fairly easy to look at a public company’s operating margins and use these margins to approximate your own. Likewise, the business plan should base revenue growth on other firms.

Many firms find this impossible, since they believe they have a breakthrough product in their market, and no other company compares. In such a case, base revenue growth on companies in other industries that have had breakthrough products. If you expect to grow even faster than they did (maybe because of new technologies that those firms weren’t able to employ), you can include more aggressive assumptions in your business plan as long as you explain them in the text.

The financial assumptions can either enhance or significantly harm your business plan’s chances of assisting you in the capital-raising process. By doing the research to develop realistic assumptions, based on actual results of your or other companies, the financials can bolster your firm’s chances of winning investors. As importantly, the more realistic financials will also provide a better roadmap for your company’s success.

Finish Your Business Plan Today!

Financial assumptions vs projections.

Financial Assumptions – Estimates of future financial results that are based on historical data, an understanding of the business, and a company’s operational strategy.

Financial Projections – Estimates of future financial results that are calculated from the assumptions factored into the financial model.

The assumptions are your best guesses of what the future holds; the financial projections are numerical versions of those assumptions.

Key Assumptions By Financial Statement

Below you will find a list of the key business assumptions by the financial statement:

Income Statement

The income statement assumptions should include revenue, cost of goods sold, operating expenses, and depreciation/amortization, as well as any other line items that will impact the income statement.

When you are projecting future operating expenses, you should project these figures based on historical information and then adjust them as necessary with the intent to optimize and/or minimize them.

Balance Sheet

The balance sheet assumptions should include assets, liabilities, and owner’s equity, as well as any other line items that will impact the balance sheet. One of the most common mistakes is not including all cash inflows and outflows.

Cash Flow Statement

Cash flow assumptions should be made, but they do not impact the balance sheet or income statement until actually received or paid. You can include the cumulative cash flow assumption on the financial model to be sure it is included with each year’s projections.

The cumulative cash flow assumption is useful for showing your investors and potential investors how you will spend the money raised. This line item indicates how much of the initial investment will be spent each year, which allows you to control your spending over time.

Notes to Financial Statements

The notes to financial statements should explain assumptions made by management regarding accounting policies, carrying value of long-lived assets, goodwill impairment testing, contingencies, and income taxes. It is important not only to list these items within the notes but also to provide a brief explanation.

What are the Assumptions Needed in Preparing a Financial Model?

In our article on “ How to Create Financial Projections for Your Business Plan ,” we list the 25+ most common assumptions to include in your financial model. Below are a few of them:

For EACH key product or service you offer:

- What is the number of units you expect to sell each month?

- What is your expected monthly sales growth rate?

For EACH subscription/membership you offer:

- What is the monthly/quarterly/annual price of your membership?

- How many members do you have now or how many members do you expect to gain in the first month/quarter/year?

Cost Assumptions

- What is your monthly salary? What is the annual growth rate in your salary?

- What is your monthly salary for the rest of your team? What is the expected annual growth rate in your team’s salaries?

- What is your initial monthly marketing expense? What is the expected annual growth rate in your marketing expense?

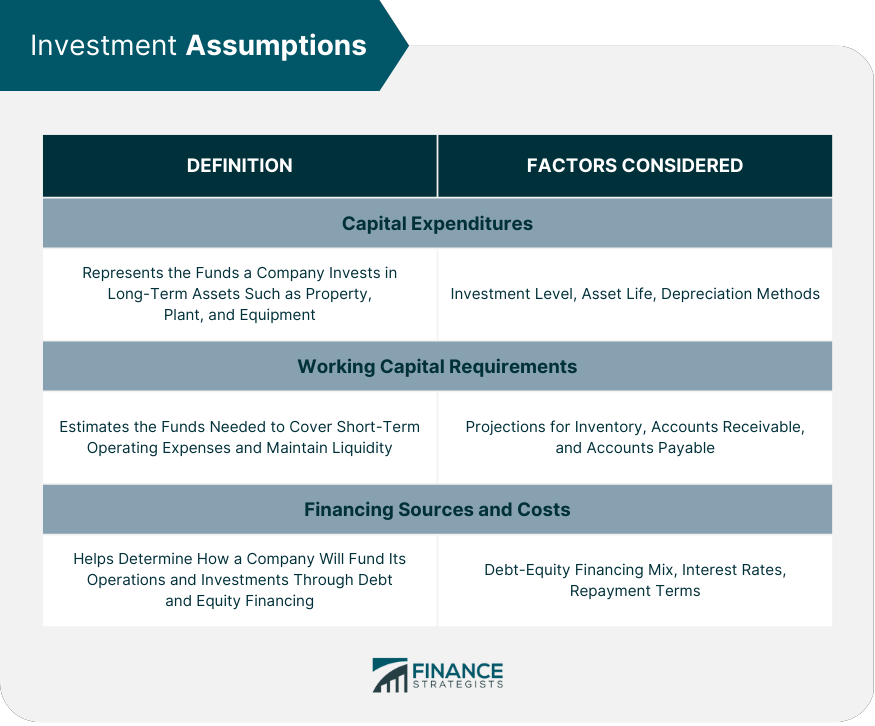

Assumptions related to Capital Expenditures, Funding, Tax and Balance Sheet Items

- How much money do you need for capital expenditures in your first year (to buy computers, desks, equipment, space build-out, etc.)

- How much other funding do you need right now?

- What is the number of years in which your debt (loan) must be paid back

Properly Preparing Your Financial Assumptions

So how do you prepare your financial assumptions? It’s recommended that you use a spreadsheet program like Microsoft Excel. You’ll need to create separate columns for each line item and then fill in the cells with the example information described below.

Part 1 – Current Financials

Year to date (YTD) units sold and units forecast for next year. This is the same as YTD revenue, but you divide by the number of days in the period to get an average daily amount. If your plan includes a pro forma financial section, your financial assumptions will be projections that are consistent with the pro forma numbers.

Part 2 – Financial Assumptions

Estimated sales forecasts for next year by product or service line, along with the associated margin. List all major items in this section, not just products. For instance, you might include “Professional Services” as a separate item, with revenue and margin information.

List the number of employees needed to support this level of business, including yourself or key managers, along with your cost assumptions for compensation, equipment leasing (if applicable), professional services (accounting/legal/consultants), and other line items.

Part 3 – Projected Cash Flow Statement and Balance Sheet

List all key assumptions like: sources and uses of cash, capital expenditures, Planned and Unplanned D&A (depreciation & amortization), changes in operating assets and liabilities, along with those for investing activities. For example, you might list the assumptions as follows:

- Increases in accounts receivable from customers based on assumed sales levels

- Decreases in inventory due to increased sales

- Increases in accounts payable due to higher expenses for the year

- Decrease in unearned revenue as evidenced by billings received compared with those projected (if there is no change, enter 0)

- Increase/decrease in other current assets due to changes in business conditions

- Increase/decrease in other current liabilities due to changes in business conditions

- Increases in long term debt (if necessary)

- Cash acquired from financing activities (interest expense, dividends paid, etc.)

You make many of these assumptions based on your own experience. It is also helpful to look at the numbers for public companies and use those as a benchmark.

Part 4 – Future Financials

This section is for more aggressive financial projections that can be part of your plan, but which you cannot necessarily prove at the present time. This could include:

- A projection of earnings per share (EPS) using the assumptions above and additional information such as new products, new customer acquisition, expansion into new markets

- New product lines or services to be added in the second year. List the projected amount of revenue and margin associated with these items

- A change in your gross margins due to a specific initiative you are planning, such as moving from a high volume/low margin business to a low volume/high margin business

Part 5 – Calculations

Calculate all critical financial numbers like:

- Cash flow from operating activities (CFO)

- Operating income or loss (EBITDA) (earnings before interest, taxes, depreciation, and amortization)

- EBITDA margin (gross profits divided by revenue less cost of goods sold)

- Adjusted EBITDA (CFO plus other cash changes like capital expenditure, deferred taxes, non-cash stock compensation, and other items)

- Net income or loss before tax (EBT)

- Cash from financing activities (increase/decrease in debt and equity)

Part 6 – Sensitivity Analysis

If your assumptions are reasonably accurate, you will have a column for “base case” and a column for “worst case.” If you have a lot of variables with different possible outcomes, just list the potential range in one cell.

Calculate both EBITDA margins and EPS ranges at each level.

Part 7 – Section Highlights

Just list the two or three key points you want to make. If it is hard to distill them down, you need to go back and work on Part 3 until it makes sense.

Part 8 – Financial Summary

Include all the key numbers from your assumptions, section highlights, and calculations. In one place, you can add up CFO, EPS at different levels, and EBITDA margins under both base case and worst-case scenarios to give a complete range for each assumption.

The key to a successful business plan is being able to clearly communicate your financial assumptions. Be sure to include your assumptions in the narrative of your plan so you can clearly explain why you are making them. If you are using the business plan for financing or other purposes, it may also be helpful to include a separate “financials” section so people unfamiliar with your industry can quickly find and understand key information. A business plan generator can help you in creating your financial projections.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan and financial projections?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

It includes a full financial model. It lists all the key financial assumptions and you simply need to plug in answers to the assumptions and your complete financial projections (income statement, balance sheet, cash flow statement, charts and graphs) are automatically generated!

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how our professional business plan writers can create your business plan for you.

If you just need a financial model for your business plan, learn more about our financial modeling services .

Other Resources for Writing Your Business Plan

- How to Write an Executive Summary

- How to Expertly Write the Company Description in Your Business Plan

- How to Write the Market Analysis Section of a Business Plan

- The Customer Analysis Section of Your Business Plan

- Completing the Competitive Analysis Section of Your Business Plan

- How to Write the Management Team Section of a Business Plan + Examples

- How to Create Financial Projections for Your Business Plan

- Everything You Need to Know about the Business Plan Appendix

- Business Plan Conclusion: Summary & Recap

Other Helpful Business Plan Articles & Templates

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Questioning Key Assumptions in Your Business Plan

Asking the hard questions now will save you time and money in the future

Amanda McCormick is an entrepreneur, marketing consultant, and content strategist who has worked with arts and government organizations, including the New York City Ballet. She is the co-founder of a small marketing agency focused on arts and media companies.

:max_bytes(150000):strip_icc():format(webp)/DanielRathburn-a16946b87e45469aaae5b4998db2397a.jpeg)

Is There a Need for Your Product or Service?

Is there a significant customer base, can your business turn a profit, are you the right person to run your business, is your business funded appropriately, the swot analysis, frequently asked questions (faqs).

The Balance / Getty Images

Constructing a business plan is all about looking at and confronting assumptions. Consider the five following key assumptions, and you'll have a business plan—and future—in which you can be confident.

Key Takeaways

- A business plan is a document that helps a business communicate and organize its plans and strategies for the future.

- Sufficient market research is perhaps the most important part of starting a business.

- A SWOT analysis clarifies the business' strengths, weaknesses, opportunities, and threats.

- Asking yourself if you have the expertise to run all aspects of the business and whether or not you have sufficient capital is also important.

It's an obvious question, but many entrepreneurs overlook it. Knowing that there's a need for your product is different than having a hunch or a feeling. How do you know the difference? You do the research to find out. First, look at the competition. Are there others who have a similar offering and are they profitable?

Maybe you are breaking new ground -- that's no excuse for saying "there is no competition." Look around for evidence that your proposed business fulfills a concrete need. Without evidence to validate the need for your business, your business plan will fail.

As of December 2021, there were 32,540,953 million small businesses in the U.S.

The second assumption that's important to look at in your business planning preparation is whether or not there is a significant customer base for the business you are proposing. It can be a highly subjective question, as there are a number of successful niche businesses that serve small markets quite profitably. You are well-served to look at the concrete size of a potential market and to assign real dollar values to its potential.

Once you can decide that A) there is a need for your business and B) there is a sizable market for it, you are on solid ground to establish your business's potential profitability. But don't pluck numbers from the air.

You'll need to figure out what your startup costs are, as well as ongoing business-related expenses. You'll need to figure out a pricing structure that your customers will pay and will generate enough cash flow to keep the business running. After generating a set of realistic financial projections, you'll have a solid picture of your business' profit potential.

You believe in your business. You eat, sleep, and breathe it. But you're still going to have to make the case why you are uniquely qualified to start and run the business. As CEO, you'll also need to demonstrate the ability to delegate and find employees to complement your weaker points. First, know yourself, and second, be able to find the right people to bring into your management structure.

Financial projections are the place in the business plan that investors will flip to first. They want to know if you can understand the financial bottom line of running a business, or if your vision is unrealistic. Demonstrate in your business plan that you have a realistic startup budget, and you don't expect revenue to pour in within the first few months magically. Show that you have sufficient capitalization to run the business to break even.

Lack of sufficient capital is cited again and again as one of the top reasons why businesses fail.

A SWOT analysis , which stands for Strengths, Weaknesses, Opportunities, and Threats and is a popular strategic framework for business planners, is a great tool for questioning assumptions. The first two items refer to qualities that are internal to the business. The second two items are external factors. Consider the following in questioning your assumptions in writing a business plan around your fledgling operation:

- What does this company do well?

- What are our assets?

- What expert or specialized knowledge does the company have?

- What advantages do we have over competitors?

- What makes us unique?

- What resources do we lack?

- Where can we improve?

- What parts of the business are not profitable?

- What costs us the most time and money?

Opportunities

- What has the competition missed?

- What are the emerging needs of the customer?

- How can we use technology to cut costs and enhance reach?

- Are there new market segments to exploit?

- What are our competitors doing well?

- How do larger forces in the economy affecting our business?

- What is happening in the industry?

What is a SWOT analysis?

A SWOT analysis is a popular strategic framework used by business owners. It is performed throughout a business' existence and asks about its Strengths, Weaknesses, Opportunities, and Threats.

What percent of businesses fail within the first year?

According to data from the Bureau of Labor Statistics, around 1 in 5 (18.4%) of businesses fail within the first year and nearly half (49.7%) fail in the first five years.

Small Business Association. " Frequently Asked Questions ."

Small Business Association. " Selecting a Business That Fits ."

Bureau of Labor Statistics. " Survival of Private Sector Establishments by Opening Year ."

Planning, Startups, Stories

Tim berry on business planning, starting and growing your business, and having a life in the meantime., the value of business plan assumptions.

Identifying assumptions is extremely important for getting real business benefits from your business planning. Planning is about managing change, and in today’s world, change happens very fast. Assumptions solve the dilemma about managing consistency over time, without banging your head against a brick wall.

Assumptions might be different for each company. There is no set list. What’s best is to think about those assumptions as you build your twin action plans.

If you can, highlight product-related and marketing-related assumptions. Keep them in separate groups or separate lists.

The key here is to be able to identify and distinguish, later (during your regular reviews and revisions, in Section 3), between changed assumptions and the difference between planned and actual performance. You don’t truly build accountability into a planning process until you have a good list of assumptions that might change.

Some of these assumptions go into a table, with numbers, if you want. For example, you might have a table with interest rates if you’re paying off debt, or tax rates, and so on.

Many assumptions deserve special attention. Maybe in bullet points. Maybe in slides. Maybe just a simple list. Keep them on top of your mind, where they’ll come up quickly at review meetings.

Maybe you’re assuming starting dates of one project or another, and these affect other projects. Contingencies pile up. Maybe you’re assuming product release, or seeking a liquor license, or finding a location, or winning the dealership, or choosing a partner, or finding the missing link on the team.

Maybe you’re assuming some technology coming on line at a certain time. You’re probably assuming some factors in your sales forecast, or your expense budget; if they change, note it, and deal with them as changed assumptions. You may be assuming something about competition. How long do you have before the competition does something unexpected? Do you have that on your assumptions list?

The illustration below shows the simple assumptions in a bicycle shop sample business plan.

Sample List of Assumptions

Thanks for the good read, Tim. This will be helpful to small businesses to minimize and manage future risks.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Link to Follow us on Twitter

- Link to Like us on Facebook

- Link to Connect with us on LinkedIn

Ivey Business Journal

Strategic assumptions: the essential (and missing) element of your strategic plan.

- Share on LinkedIn

- Share on googlePlus

- Share on facebook

- Share on twitter

- Share by email

Stakeholders often approve a strategic plan without scrutinizing the strategic assumptions, the very foundation on which the plan has been built (Sound familiar? As in, “…the value of this derivative, which we call a Collaterized Debt Obligation, is built on the value of the underlying securities.” (which we have looked at…but uh..not very closely). This author sees an inherent danger in such a practice and states that stakeholders need to start scrutinizing the strategic assumptions that underlie the very plan they are being asked to approve.

In the field of strategy, the admission that assumptions are being made in the preparation of strategic plans needs to be acknowledged. Moreover, transparency and discussion surrounding these assumptions need to be viewed as key elements and the responsibility of the strategy creators.

In doing so, the practitioners themselves – be they CEOs, consultants, Chief Strategy Officers, or employees in the Strategy Management Office – will be forced to elevate both their own performance standards and the rigor of the strategy process to a level comparable to that exercised in the fields of science, economics and finance, where the publication and debate of assumptions are the norm. This will pave the way for strategy creators to gain greater credibility and build a stronger voice on executive teams. Finally, it will provide them with the opportunity to increase their contributions in determining direction and forecasting the future performance of the organization.

The reality is that strategic assumptions form an identical, underlying foundation for the strategic plan. They underpin everything contained therein – and hence reflect the vision, strategic map, performance targets and project portfolio which subsequently follow. The problem is that in the field of strategic planning, the assumptions that have been made are almost never clearly documented or highlighted. As a consequence, they are rarely scrutinized or challenged as they should be.

Too often, shareholders, employees and other major stakeholders unnecessarily invest time, money and energy in supporting an organization’s vision and strategic plan, not recognizing that the vision and plan were doomed to fail from the day they were conceived.

This article posits that the identification and in-depth analysis of an organization’s strategic assumptions need to become an integral part of the strategic planning process, and that the presentation of these underlying strategic assumptions should become an implied and required part of any written strategic plan.

The rationale for preparing a set of strategic assumptions

Financial analysts examining a set of projections insist on seeing a complete and detailed set of financial assumptions. These assumptions represent the raw material — the opinions, beliefs and more often, the hopes, of the management team — on which the projections are based. They usually receive very close scrutiny, especially since financial projections are only as valid as the assumptions upon which they are based. If the assumptions are deemed unrealistic or otherwise questionable, so are the projections. Analysts also understand that while financial projections can be manipulated, clearly presented financial assumptions cannot.

It is not just in the realm of finance that stakeholders demand to see assumptions. In almost all other fields, be they marketing and sales, or even engineering, science and economics, the assumptions used for future predictions are the first element to be examined and rigorously challenged.

Generally, this is not due to management duplicity – although in certain cases that cannot be ruled out. After all, it is easier to defend a set of financial projections when the financial assumptions are not attached; that is the reason financial analysts insist on receiving them. Likewise, it is easier to defend a strategy, business model, value proposition, value chain network, etc. when interlocutors are not aware of the underlying assumptions.

A major reason for the absence of a set of strategic assumptions is that often senior management does not recognize that assumptions are, indeed, being made. They genuinely believe that future markets, competition, customer needs, etc. will evolve exactly as they are expected to. The resulting “group think” – valid and well-founded or not – is therefore not viewed as a set of assumptions at all. It is viewed as fact, the most dangerous assumption of all!

Given today’s shift towards greater transparency, tighter governance, greater accountability for board members, and most importantly, the high levels of uncertainty about tomorrow, next quarter or next year, the business community requires a new paradigm for preparing and certifying a plan as “strategic.” Quite clearly, the moment has come to recognize that the content of any organization’s strategic plan is incomplete unless a complete set of strategic assumptions are included.

Preparing a set of strategic assumptions

The contents of an organization’s business plan often reflect the difficult choices made by management during the strategic planning process. The identification and discussion of the key issues are not intended to generate right or wrong “answers;” rather, they represent choices and shared points-of-view about what the team believes will happen. Together, they form a set of approximately 12-15 strategic assumptions upon which management intends to build its strategic plan and business.

Because all markets and organizations are unique, there is no universal set of strategic questions that must be posed when assembling a business plan. Indeed, a major challenge in strategic planning is the identification of the major questions an organization needs to address. Likewise, there is no universal set of strategic assumptions that must absolutely be generated and covered in every organization’s strategic plan. There are, however, generic areas where strategic assumptions generally must be made and which stakeholders should realistically expect management to disclose:

| Generic Areas | Possible Strategic Questions: What is the Strategic Assumption about? |

|---|---|

| 1) Macro-Environmental Forces | |

| e.g. Technological Forces | |

| e.g. Socio-demographic Forces | |

| 2) Markets | |

| e.g. Substitutes | |

| e.g. Potential Competitors | |

| e.g. Market Rivalry | |

| 3) Customers | |

| 4) Stakeholders | |

| 5) Financial Management | |

| 6) Internal Processes | |

| 7) Asset Management | |

| 8) The Workforce | |

| 9) Background of Shared Obviousness |

The category “Background of Shared Obviousness” makes explicit the existing, but often hidden strategic assumptions (or shared beliefs) that emerge from conversations and discussions that take place during the strategic planning process.

Shared beliefs about who the company is and beliefs on how it must operate in order to be successful are often seen as “obvious” by the participants and are rarely challenged, unless captured in real-time – often by a consultant, facilitator, or other outsider present –during the strategic planning sessions. Simple examples include:

| Strategic Assumptions “Background of Shared Obviousness” | Possible Negative Consequences |

|---|---|

| “Industry winners always manufacture in-house – so we manufacture in-house.” | Opportunities to partner or out-source are never explored. Higher capital costs are incurred. Migration into new areas of the value-chain is avoided. |

| “Customers want face-to-face contact with us.” | Automated orders are limited. Internet sales are not explored. Sales costs on repeat business are potentially higher than required. |

| “We only acquire companies with tangible assets.” | Service or knowledge-based businesses are not acquired. Branding opportunities are not fully explored. |

| “We do not partner on R&D projects.” | Many opportunities to reduce R&D risks and lever R&D funding are never explored. Competencies must be built-up internally. |

| “We only hire people with engineering backgrounds.” | The organization remains production-and design-focused. The recruitment pool and employee diversity is limited. |

These types of assumptions are very powerful and can be the sources of best practices, historical wisdom, norms of positive organizational culture or, alternatively, barriers to change. They can epitomize strategic and organizational rigidity, and guarantee that mistakes of the past are likely to be repeated. As with all strategic assumptions, this category of assumptions is not, by definition, positive or negative. It is, however, crucial that they be identified and recognized as being merely assumptions, not fact. They should also be made explicit, challenged, and only retained if they remain valid in the context of the future of the market and not as remnants of the past.

An example: The importance of a single strategic assumption

Let’s consider a simple example and examine the role of just one key strategic assumption: the strategic assumption about the future structure of an industry.

Imagine that we are considering investing in a relatively small steel company, “X”. There are major differences in the strategic assumptions X’s management team might make about the future development of the global steel industry. Will the business plan for the company be built upon the strategic assumption that:

- The steel market will be dominated by a few global players, with all other contenders seeking to partner or avoid direct competition?

- There will be regional consolidation, with key (different) players dominating markets in Asia, Europe and the Americas?

- The high-margin steel businesses of the future will lie in specialty steel that serves one or several specific industries (i.e. automotive, aerospace, medical, etc.), thereby allowing for “niche” players?

- There is no future in the steel industry for small players; the company needs to reposition itself as a supplier of “materials” (i.e. a supplier of composites, plastics, rubber as well steel) as opposed to being a supplier of steel products exclusively?

- All trading of commodity steel products will soon be done through one global web site?

The contents of the strategic plan – and the future success of the company – will largely depend upon which of these, and perhaps a dozen other, strategic assumptions are made.

Lakshmi Mittal, President of Arcelor Mittal Steel, made his own personal strategic assumption about the future structure of the steel industry very clear in the following quote:

“I strongly believe that in the steel industry, scale is a crucial ingredient in the pursuit of value. Arcelor Mittal will be three times the size of its nearest competitor. The steel industry consolidation is under way and I have repeatedly said that by 2015, I expect each of the two to three largest global players to produce 150 million to 200 million tons of steel a year. This compares to 116 million tons produced by Arcelor and Mittal today.” Wall Street Journal, August 3, 2006

In this quote, Mr. Mittal clearly communicates one of his strategic assumptions about the future of the steel industry. The company’s corporate strategy, M&A activities, global distribution and marketing strategies, are all built upon this fundamental strategic assumption.

As potential investors in steel company “X”, we need to know whether and why its CEO agrees or disagrees with Mittal’s strategic assumption. We also need to know which other strategic assumptions that he is making. If he provides us with a complete list, we should be able to do a very accurate and thorough initial screening of the company’s request for funds – before we invest more of our time and energy examining the contents of the business plan.

Other examples of powerful strategic assumptions

- In 2002, when one Canadian dollar was worth approximately US $0.65, a shared strategic assumption of almost all Canadian manufacturers was that parity between the Canadian/US dollar was simply unthinkable. In 2008, how have their beliefs changed? What is their strategic assumption of exchange rates for 2013? It is a crucial assumption that will form the foundation of their production strategy for the next five years.

- An Asian hydro-electricity corporation built many facilities based upon two strategic assumptions: that there would always be glacial melt waters, and that there would be a predictable monsoon season each year. These strategic assumptions are no longer valid.

- One of Jack Welch’s major strategic assumptions while at GE was that the company could not compete in commodity markets. Therefore, during his entire tenure, he moved GE in the direction of product differentiation and value-added services. This “Background of Shared Obviousness” strategic assumption drove GE’s strategic direction for many years.

- What is a wine merchant’s strategic assumption around packaging? Will bottles prevail? Will the green movement see Tetrapak packaging make significant penetration in the market? Investment in manufacturing lines will rely on this assumption. Based on these assumptions, will the company perceive itself as a “packager of liquids” or as an “exclusive wine packager”?

- What are the strategic assumptions envisioned by a university? Is it a research-based university? Does it serve the global market or is it focused on local population needs? Does it see e-learning as the way of the future or does it believe that students will always choose to “come to class”? The types of professors recruited, courses offered and delivery mechanisms all depend on the answers to these questions.

- Does the mayor of a town located close to a major urban centre see itself as a bedroom-community or as a fast–growing potential rival which should attempt to attract new industry to locate within its boundaries?

- Is the strategic assumption of a country based upon the assumption that economic growth (GNP) is paramount or does it subscribe to the theory of Gross National Happiness (GNH)?

Examples of the strategic assumptions adopted by the individuals, teams, organizations and nations in the above cases will determine their future plans and all the actions, projects, programs that will follow. We, as stakeholders in any of them, should be able to identify the strategic assumptions that have been made without having to try to read between the lines of a strategic plan. They should be clearly and proudly highlighted for all to see, for Strategic Assumptions show how we view the world, how we view ourselves, and who we really are.

Publicizing strategic Assumptions: The tipping point

It is unlikely that all CEOs will voluntarily choose to publish their strategic assumptions for evaluation overnight. Divulgence will only occur when important stakeholders demand to see them included as outcomes of the strategic-planning process and included as a separate item in the contents page of the plan.

There are several benefits which result from demanding to see the set of strategic assumptions included in a strategic plan:

- Inclusion facilitates the analysis of any organization’s business plan by a financial institution, venture capitalist or angel investor. The risk of making a bad investment will be reduced if the investors understand and share the strategic assumptions of the organization’s management team.

- Differences in points-of-view about strategic assumptions are the source of many of the conflicts that arise between investors and company management – and within a management team itself. Strategic assumptions represent the shared values, beliefs and vision of the management team. Demanding that they be included in a strategic plan will force management teams to hold the difficult internal conversations required and that allow them to uncover, challenge, and capture their shared assumptions.

- Knowing they need to exit a strategic planning process with a complete, shared set of strategic assumptions forces a management team to use a much more rigorous strategic planning process.

- Face-to-face, it is very difficult for most people to defend strategic assumptions which are ungrounded or that they do not believe or share.

- Developing and debating strategic assumptions with groups of employees is an excellent way to gain buy-in and commitment to the organization. Having to declare and justify the assumptions upon which a plan is built means that it is difficult for a CEO to impose his or her views. With increased levels of employee buy-in, there is a greater probability that the strategic plan will actually be implemented.

- By presenting strategic assumptions for rigorous debate and analysis, the probability is minimized that investors, employees, management and any other stakeholders will waste time, money and energy on trying to implement plans that have little chance of generating the promised results.

Strategic assumptions have been missing from the strategic planning lexicon for too long. It is time to put them in their rightful place.

© Copyright 2022 Ivey Business School Foundation. All rights reserved. Privacy Policy .

Lean Business Planning

Get what you want from your business.

List Business Plan Assumptions

Identify and list business plan assumptions. You will get real business benefits from the assumptions list in your business plan. Planning is about managing change, and in today’s world, change happens very fast. Assumptions solve the dilemma about managing consistency over time, without banging your head against a brick wall.

Assumptions might be different for each company. There is no set list. What’s best is to think about those assumptions as you build your twin action plans.

If you can, highlight product-related and marketing-related assumptions. Keep them in separate groups or separate lists.

You will use your business plan assumptions often

The key here is to be able to identify and distinguish, later (during your regular reviews and revisions, in Section 3), between changed assumptions and the difference between planned and actual performance. You don’t truly build accountability into a planning process until you have a good list of assumptions that might change.

Some of these business plan assumptions assumptions go into a table, with numbers, if you want. For example, you might have a table with interest rates if you’re paying off debt, or tax rates, and so on.

Many assumptions deserve special attention. Have a bullet point list. Maybe in slides. Maybe just a simple list. Keep them on top of your mind, where they’ll come up quickly at review meetings.

Maybe you’re assuming starting dates of one project or another, and these affect other projects. Contingencies pile up. Maybe you’re assuming product release, or seeking a liquor license, or finding a location, or winning the dealership, or choosing a partner, or finding the missing link on the team.

Maybe you’re assuming some technology coming on line at a certain time. You’re probably assuming some factors in your sales forecast, or your expense budget; if they change, note it, and deal with them as changed assumptions. You may be assuming something about competition. How long do you have before the competition does something unexpected? Do you have that on your assumptions list?

An Assumptions Example

The illustration below shows the simple assumptions in the bicycle shop sample business plan.

Share this:

Leave a comment cancel reply, discover more from lean business planning.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

4. Marketing Plan

A marketing plan defines how your business aims to reach its target customers, generate sales leads, and, ultimately, make sales.

Promotion is at the center of any successful marketing plan. It is a series of steps to pitch a product or service to a larger audience to generate engagement. Note that the marketing strategy for a business should not be stagnant and must evolve depending on its outcome.

Include the budgetary requirement for successfully implementing your marketing plan in this section to make it easy for readers to measure your marketing plan's impact in terms of numbers.

The information to include in your marketing plan includes marketing and promotion strategies, pricing plans and strategies , and sales proposals. You need to include how you intend to get customers to return and make repeat purchases in your business plan.

5. Sales Strategy

Sales strategy defines how you intend to get your product or service to your target customers and works hand in hand with your business marketing strategy.

Your sales strategy approach should not be complex. Break it down into simple and understandable steps to promote your product or service to target customers.

Apart from the steps to promote your product or service, define the budget you need to implement your sales strategies and the number of sales reps needed to help the business assist in direct sales.

Your sales strategy should be specific on what you need and how you intend to deliver on your sales targets, where numbers are reflected to make it easier for readers to understand and relate better.

6. Competitive Analysis

Providing transparent and honest information, even with direct and indirect competitors, defines a good business plan. Provide the reader with a clear picture of your rank against major competitors.

Identifying your competitors' weaknesses and strengths is useful in drawing up a market analysis. It is one information investors look out for when assessing business plans.

The competitive analysis section clearly defines the notable differences between your company and your competitors as measured against their strengths and weaknesses.

This section should define the following:

- Your competitors' identified advantages in the market

- How do you plan to set up your company to challenge your competitors’ advantage and gain grounds from them?

- The standout qualities that distinguish you from other companies

- Potential bottlenecks you have identified that have plagued competitors in the same industry and how you intend to overcome these bottlenecks

In your business plan, you need to prove your industry knowledge to anyone who reads your business plan. The competitive analysis section is designed for that purpose.

7. Management and Organization

Management and organization are key components of a business plan. They define its structure and how it is positioned to run.

Whether you intend to run a sole proprietorship, general or limited partnership, or corporation, the legal structure of your business needs to be clearly defined in your business plan.

Use an organizational chart that illustrates the hierarchy of operations of your company and spells out separate departments and their roles and functions in this business plan section.

The management and organization section includes profiles of advisors, board of directors, and executive team members and their roles and responsibilities in guaranteeing the company's success.

Apparent factors that influence your company's corporate culture, such as human resources requirements and legal structure, should be well defined in the management and organization section.

Defining the business's chain of command if you are not a sole proprietor is necessary. It leaves room for little or no confusion about who is in charge or responsible during business operations.

This section provides relevant information on how the management team intends to help employees maximize their strengths and address their identified weaknesses to help all quarters improve for the business's success.

8. Products and Services

This business plan section describes what a company has to offer regarding products and services to the maximum benefit and satisfaction of its target market.

Boldly spell out pending patents or copyright products and intellectual property in this section alongside costs, expected sales revenue, research and development, and competitors' advantage as an overview.

At this stage of your business plan, the reader needs to know what your business plans to produce and sell and the benefits these products offer in meeting customers' needs.

The supply network of your business product, production costs, and how you intend to sell the products are crucial components of the products and services section.

Investors are always keen on this information to help them reach a balanced assessment of if investing in your business is risky or offer benefits to them.

You need to create a link in this section on how your products or services are designed to meet the market's needs and how you intend to keep those customers and carve out a market share for your company.

Repeat purchases are the backing that a successful business relies on and measure how much customers are into what your company is offering.

This section is more like an expansion of the executive summary section. You need to analyze each product or service under the business.

9. Operating Plan

An operations plan describes how you plan to carry out your business operations and processes.

The operating plan for your business should include:

- Information about how your company plans to carry out its operations.

- The base location from which your company intends to operate.

- The number of employees to be utilized and other information about your company's operations.

- Key business processes.

This section should highlight how your organization is set up to run. You can also introduce your company's management team in this section, alongside their skills, roles, and responsibilities in the company.

The best way to introduce the company team is by drawing up an organizational chart that effectively maps out an organization's rank and chain of command.

What should be spelled out to readers when they come across this business plan section is how the business plans to operate day-in and day-out successfully.

10. Financial Projections and Assumptions

Bringing your great business ideas into reality is why business plans are important. They help create a sustainable and viable business.

The financial section of your business plan offers significant value. A business uses a financial plan to solve all its financial concerns, which usually involves startup costs, labor expenses, financial projections, and funding and investor pitches.

All key assumptions about the business finances need to be listed alongside the business financial projection, and changes to be made on the assumptions side until it balances with the projection for the business.

The financial plan should also include how the business plans to generate income and the capital expenditure budgets that tend to eat into the budget to arrive at an accurate cash flow projection for the business.

Base your financial goals and expectations on extensive market research backed with relevant financial statements for the relevant period.

Examples of financial statements you can include in the financial projections and assumptions section of your business plan include:

- Projected income statements

- Cash flow statements

- Balance sheets

- Income statements

Revealing the financial goals and potentials of the business is what the financial projection and assumption section of your business plan is all about. It needs to be purely based on facts that can be measurable and attainable.

11. Request For Funding

The request for funding section focuses on the amount of money needed to set up your business and underlying plans for raising the money required. This section includes plans for utilizing the funds for your business's operational and manufacturing processes.

When seeking funding, a reasonable timeline is required alongside it. If the need arises for additional funding to complete other business-related projects, you are not left scampering and desperate for funds.

If you do not have the funds to start up your business, then you should devote a whole section of your business plan to explaining the amount of money you need and how you plan to utilize every penny of the funds. You need to explain it in detail for a future funding request.

When an investor picks up your business plan to analyze it, with all your plans for the funds well spelled out, they are motivated to invest as they have gotten a backing guarantee from your funding request section.

Include timelines and plans for how you intend to repay the loans received in your funding request section. This addition keeps investors assured that they could recoup their investment in the business.

12. Exhibits and Appendices

Exhibits and appendices comprise the final section of your business plan and contain all supporting documents for other sections of the business plan.

Some of the documents that comprise the exhibits and appendices section includes:

- Legal documents

- Licenses and permits

- Credit histories

- Customer lists

The choice of what additional document to include in your business plan to support your statements depends mainly on the intended audience of your business plan. Hence, it is better to play it safe and not leave anything out when drawing up the appendix and exhibit section.

Supporting documentation is particularly helpful when you need funding or support for your business. This section provides investors with a clearer understanding of the research that backs the claims made in your business plan.

There are key points to include in the appendix and exhibits section of your business plan.

- The management team and other stakeholders resume

- Marketing research

- Permits and relevant legal documents

- Financial documents

Was This Article Helpful?

Martin luenendonk.

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

Plan Projections

ideas to numbers .. simple financial projections

Home > Business Plan > Business Plan Assumptions

Business Plan Assumptions

Financial projections business plan assumptions.

All financial projections are based on business plan assumptions. Listed below is a selection of the most important assumptions which need to be considered and decided upon when using the Financial Projections Template to produce the financials section of your business plan.

Business Plan Assumptions List

Inflation rates and foreign exchange rates, sales and marketing, cash collection, distribution, research and development, fixed assets, gross margin, operating expenses, depreciation.

You need to prepare a business plan assumptions sheet as part of your plan, however, the important point to remember is that the assumptions should be kept simple and to a minimum, to avoid over complicating the financial projection. Remember this is planning not accounting. The calculation of key assumptions is further discussed in our financial projection assumptions post.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

How to Write the Perfect Business Plan: A Comprehensive Guide

Thinking of starting a business here's the best step-by-step template for writing the perfect business plan when creating your startup..

Maybe you think you don't need a step-by-step guide to writing a great business plan . Maybe you think you don't need a template for writing a business plan. After all, some entrepreneurs succeed without writing a business plan. With great timing, solid business skills, entrepreneurial drive, and a little luck , some founders build thriving businesses without creating even an informal business plan .

But the odds are greater that those entrepreneurs will fail.

Does a business plan make startup success inevitable? Absolutely not. But great planning often means the difference between success and failure. Where your entrepreneurial dreams are concerned, you should do everything possible to set the stage for success.

And that's why a great business plan is one that helps you succeed .

The following is a comprehensive guide to creating a great business plan. We'll start with an overview of key concepts. Then we'll look at each section of a typical business plan:

Executive Summary

Overview and objectives, products and services, market opportunities, sales and marketing.

- Competitive Analysis

Management Team

Financial analysis.

So first let's gain a little perspective on why you need a business plan.

Key Concepts

Many business plans are fantasies. That's because many aspiring entrepreneurs see a business plan as simply a tool--filled with strategies and projections and hyperbole--that will convince lenders or investors the business makes sense.

That's a huge mistake.

First and foremost, your business plan should convince you that your idea makes sense--because your time, your money, and your effort are on the line.

So a solid business plan should be a blueprint for a successful business . It should flesh out strategic plans, develop marketing and sales plans, create the foundation for smooth operations, and maybe--just maybe--persuade a lender or investor to jump on board.

For many entrepreneurs, developing a business plan is the first step in the process of deciding whether to actually start a business. Determining if an idea fails on paper can help a prospective founder avoid wasting time and money on a business with no realistic hope of success.

So, at a minimum, your plan should:

- Be as objective and logical as possible. What may have seemed like a good idea for a business can, after some thought and analysis, prove not viable because of heavy competition, insufficient funding, or a nonexistent market. (Sometimes even the best ideas are simply ahead of their time.)

- Serve as a guide to the business's operations for the first months and sometimes years, creating a blueprint for company leaders to follow.

- Communicate the company's purpose and vision, describe management responsibilities, detail personnel requirements, provide an overview of marketing plans, and evaluate current and future competition in the marketplace.

- Create the foundation of a financing proposal for investors and lenders to use to evaluate the company.

A good business plan delves into each of the above categories, but it should also accomplish other objectives. Most of all, a good business plan is convincing . It proves a case. It provides concrete, factual evidence showing your idea for a business is in fact sound and reasonable and has every chance of success.

Who must your business plan convince?

First and foremost, your business plan should convince you that your idea for a business is not just a dream but can be a viable reality. Entrepreneurs are by nature confident, positive, can-do people. After you objectively evaluate your capital needs, products or services, competition, marketing plans, and potential to make a profit, you'll have a much better grasp on your chances for success.

And if you're not convinced, fine: Take a step back and refine your ideas and your plans.

Who can your business plan convince?

1. Potential sources of financing. If you need seed money from a bank or friends and relatives, your business plan can help you make a great case. Financial statements can show where you have been. Financial projections describe where you plan to go.

Your business plan shows how you will get there. Lending naturally involves risk, and a great business plan can help lenders understand and quantity that risk, increasing your chances for approval.

2. Potential partners and investors. Where friends and family are concerned, sharing your business plan may not be necessary (although it certainly could help).

Other investors--including angel investors or venture capitalists--generally require a business plan in order to evaluate your business.

3. Skilled employees . When you need to attract talent, you need something to show prospective employees since you're still in the startup phase. Early on, your business is more of an idea than a reality, so your business plan can help prospective employees understand your goals--and, more important, their place in helping you achieve those goals.

4. Potential joint ventures. Joint ventures are like partnerships between two companies. A joint venture is a formal agreement to share the work--and share the revenue and profit. As a new company, you will likely be an unknown quantity in your market. Setting up a joint venture with an established partner could make all the difference in getting your business off the ground.

But above all, your business plan should convince you that it makes sense to move forward.

As you map out your plan, you may discover issues or challenges you had not anticipated.

Maybe the market isn't as large as you thought. Maybe, after evaluating the competition, you realize your plan to be the low-cost provider isn't feasible since the profit margins will be too low to cover your costs.

Or you might realize the fundamental idea for your business is sound, but how you implement that idea should change. Maybe establishing a storefront for your operation isn't as cost-effective as taking your products directly to customers--not only will your operating costs be lower, but you can charge a premium since you provide additional customer convenience.

Think of it this way. Successful businesses do not remain static. They learn from mistakes, and adapt and react to changes: changes in the economy, the marketplace, their customers, their products and services, etc. Successful businesses identify opportunities and challenges and react accordingly.

Creating a business plan lets you spot opportunities and challenges without risk. Use your plan to dip your toe in the business water. It's the perfect way to review and revise your ideas and concepts before you ever spend a penny.

Many people see writing a business plan as a "necessary evil" required to attract financing or investors. Instead, see your plan as a no-cost way to explore the viability of your potential business and avoid costly mistakes.

Now let's look at the first section of your business plan: The Executive Summary.

The Executive Summary is a brief outline of the company's purpose and goals. While it can be tough to fit on one or two pages, a good Summary includes:

- A brief description of products and services

- A summary of objectives

- A solid description of the market

- A high-level justification for viability (including a quick look at your competition and your competitive advantage)

- A snapshot of growth potential

- An overview of funding requirements

I know that seems like a lot, and that's why it's so important you get it right. The Executive Summary is often the make-or-break section of your business plan.

A great business solves customer problems. If your Summary cannot clearly describe, in one or two pages, how your business will solve a particular problem and make a profit, then it's very possible the opportunity does not exist--or your plan to take advantage of a genuine opportunity is not well developed.

So think of it as a snapshot of your business plan. Don't try to "hype" your business--focus on helping a busy reader get a great feel for what you plan to do, how you plan to do it, and how you will succeed.

Since a business plan should above all help you start and grow your business, your Executive Summary should first and foremost help you do the following.

1. Refine and tighten your concept.

Think of it as a written elevator pitch (with more detail, of course). Your Summary describes the highlights of your plan, includes only the most critical points, and leaves out less important issues and factors.

As you develop your Summary, you will naturally focus on the issues that contribute most to potential success. If your concept is too fuzzy, too broad, or too complicated, go back and start again. Most great businesses can be described in several sentences, not several pages.

2. Determine your priorities.

Your business plan walks the reader through your plan. What ranks high in terms of importance? Product development? Research? Acquiring the right location? Creating strategic partnerships?

Your Summary can serve as a guide to writing the rest of your plan.

3. Make the rest of the process easy.

Once your Summary is complete, you can use it as an outline for the rest of your plan. Simply flesh out the highlights with more detail.

Then work to accomplish your secondary objective by focusing on your readers. Even though you may be creating a business plan solely for your own purposes, at some point you may decide to seek financing or to bring on other investors, so make sure your Summary meets their needs as well. Work hard to set the stage for the rest of the plan. Let your excitement for your idea and your business shine through.

In short, make readers want to turn the page and keep reading. Just make sure your sizzle meets your steak by providing clear, factual descriptions.

How? The following is how an Executive Summary for a bicycle rental store might read.

Introduction

Blue Mountain Cycle Rentals will offer road and mountain bike rentals in a strategic location directly adjacent to an entrance to the George Washington National Forest. Our primary strategy is to develop Blue Mountain Cycle Rentals as the most convenient and cost-effective rental alternative for the thousands of visitors who flock to the area each year.

Once underway, we will expand our scope and take advantage of high-margin new equipment sales and leverage our existing labor force to sell and service those products. Within three years we intend to create the area's premier destination for cycling enthusiasts.

Company and Management

Blue Mountain Cycle Rentals will be located at 321 Mountain Drive, a location providing extremely high visibility as well as direct entry and exit from a primary national park access road. The owner of the company, Marty Cycle, has over 20 years experience in the bicycle business, having served as a product manager for Acme Cycles as well as the general manager of Epic Cycling.

Because of his extensive industry contacts, initial equipment inventory will be purchased at significant discounts from OEM suppliers as well by sourcing excess inventory from shops around the country.