Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

6.2 What Is the Role of the IMF and the World Bank?

Learning objectives.

- Understand the history and purpose of the IMF.

- Describe the IMF’s current role and major challenges and opportunities.

- Understand the history and purpose of the World Bank.

- Describe the World Bank’s current role and major challenges and opportunities.

Section 6.1 “What Is the International Monetary System?” discusses how, during the 1930s, the Great Depression resulted in failing economies. The fall of the gold standard led countries to raise trade barriers, devalue their currencies to compete against one another for export markets and curtail usage of foreign exchange by their citizens. All these factors led to declining world trade, high unemployment, and plummeting living standards in many countries. In 1944, the Bretton Woods Agreement established a new international monetary system. The creation of the International Monetary Fund (IMF) and the World Bank were two of its most enduring legacies.

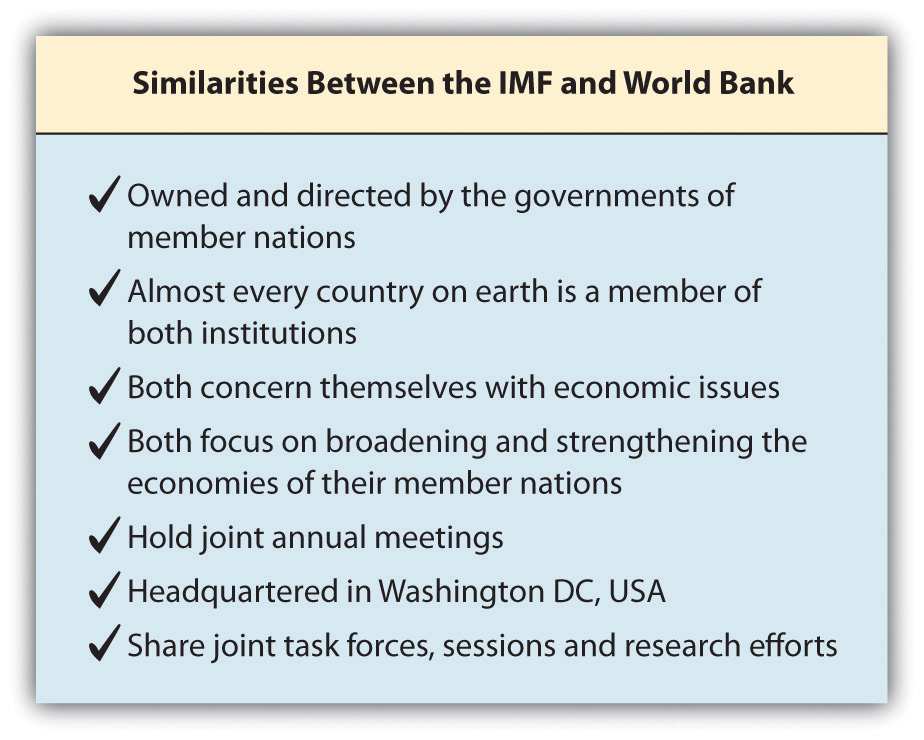

The World Bank and the IMF, often called the Bretton Woods Institutions, are twin intergovernmental pillars supporting the structure of the world’s economic and financial order. Both have taken on expanding roles, and there have been renewed calls for additional expansion of their responsibilities, particularly in the continuing absence of a single global monetary agreement. The two institutions may seem to have confusing or overlapping functions. However, while some similarities exist (see the following figure), they are two distinct organizations with different roles.

“Despite these and other similarities, however, the Bank and the IMF remain distinct. The fundamental difference is this: the Bank is primarily a development institution; the IMF is a cooperative institution that seeks to maintain an orderly system of payments and receipts between nations. Each has a different purpose, a distinct structure, receives its funding from different sources, assists different categories of members, and strives to achieve distinct goals through methods peculiar to itself” (Driscoll, 1996). This section explores both of these institutions and how they have evolved in the almost seventy years since their creation.

International Monetary Fund

History and purpose.

Figure 6.1 IMF Headquarters in Washington, DC

Wikimedia Commons – public domain.

The architects of the Bretton Woods Agreement, John Maynard Keynes and Harry Dexter White, envisioned an institution that would oversee the international monetary system, exchange rates, and international payments to enable countries and their citizens to buy goods and services from each other. They expected that this new global entity would ensure exchange rate stability and encourage its member countries to eliminate the exchange restrictions that hindered trade. Officially, the IMF came into existence in December 1945 with twenty-nine member countries. (The Soviets, who were at Bretton Woods, refused to join the IMF.)

In 1947, the institution’s first formal year of operations, the French became the first nation to borrow from the IMF. Over the next thirty years, more countries joined the IMF, including some African countries in the 1960s. The Soviet bloc nations remained the exception and were not part of the IMF until the fall of the Berlin Wall in 1989. The IMF experienced another large increase in members in the 1990s with the addition of Russia; Russia was also placed on the IMF’s executive committee. Today, 187 countries are members of the IMF; twenty-four of those countries or groups of countries are represented on the executive board.

The purposes of the International Monetary Fund are as follows:

- To promote international monetary cooperation through a permanent institution which provides the machinery for consultation and collaboration on international monetary problems.

- To facilitate the expansion and balanced growth of international trade, and to contribute thereby to the promotion and maintenance of high levels of employment and real income and to the development of the productive resources of all members as primary objectives of economic policy.

- To promote exchange stability, to maintain orderly exchange arrangements among members, and to avoid competitive exchange depreciation.

- To assist in the establishment of a multilateral system of payments in respect of current transactions between members and in the elimination of foreign exchange restrictions which hamper the growth of world trade.

- To give confidence to members by making the general resources of the Fund temporarily available to them under adequate safeguards, thus providing them with opportunity to correct maladjustments in their balance of payments without resorting to measures destructive of national or international prosperity.

- In accordance with the above, to shorten the duration and lessen the degree of disequilibrium in the international balances of payments of members. [1]

In addition to financial assistance, the IMF also provides member countries with technical assistance to create and implement effective policies, particularly economic, monetary, and banking policy and regulations.

Special Drawing Rights (SDRs)

A Special Drawing Right (SDR) is basically an international monetary reserve asset. SDRs were created in 1969 by the IMF in response to the Triffin Paradox. The Triffin Paradox stated that the more US dollars were used as a base reserve currency, the less faith that countries had in the ability of the US government to convert those dollars to gold. The world was still using the Bretton Woods system, and the initial expectation was that SDRs would replace the US dollar as the global monetary reserve currency, thus solving the Triffin Paradox. Bretton Woods collapsed a few years later, but the concept of an SDR solidified. Today the value of an SDR consists of the value of four of the IMF’s biggest members’ currencies—the US dollar, the British pound, the Japanese yen, and the euro—but the currencies do not hold equal weight. SDRs are quoted in terms of US dollars. The basket, or group of currencies, is reviewed every five years by the IMF executive board and is based on the currency’s role in international trade and finance. The following chart shows the current valuation in percentages of the four currencies.

The SDR is not a currency, but some refer to it as a form of IMF currency. It does not constitute a claim on the IMF, which only serves to provide a mechanism for buying, selling, and exchanging SDRs. Countries are allocated SDRs, which are included in the member country’s reserves. SDRs can be exchanged between countries along with currencies. The SDR serves as the unit of account of the IMF and some other international organizations, and countries borrow from the IMF in SDRs in times of economic need.

The IMF’s Current Role and Major Challenges and Opportunities

Criticism and challenging areas for the imf.

The IMF supports many developing nations by helping them overcome monetary challenges and to maintain a stable international financial system. Despite this clearly defined purpose, the execution of its work can be very complicated and can have wide repercussions for the recipient nations. As a result, the IMF has both its critics and its supporters. The challenges for organizations like the the IMF and the World Bank center not only on some of their operating deficiencies but also on the global political environment in which they operate. The IMF has been subject to a range of criticisms that are generally focused on the conditions of its loans, its lack of accountability, and its willingness to lend to countries with bad human rights records (Balaam & Veseth, 2005).

These criticisms include the following:

- Reducing government borrowing (higher taxes and lower spending)

- Higher interest rates to stabilize the currency

- Allowing failing firms to go bankrupt

- Structural adjustment (privatization, deregulation, reducing corruption and bureaucracy) [2]

The austere policies have worked at times but always extract a political toll as the impact on average citizens is usually quite harsh. The opening case in Chapter 2 “International Trade and Foreign Direct Investment” presents the current impact of IMF policies on Greece. Some suggest that the loan conditions are “based on what is termed the ‘Washington Consensus,’ focusing on liberalisation—of trade, investment and the financial sector—, deregulation and privatisation of nationalised industries. Often the conditionalities are attached without due regard for the borrower countries’ individual circumstances and the prescriptive recommendations by the World Bank and IMF fail to resolve the economic problems within the countries. IMF conditionalities may additionally result in the loss of a state’s authority to govern its own economy as national economic policies are predetermined under IMF packages.” [3]

- Exchange rate reforms. “When the IMF intervened in Kenya in the 1990s, they made the Central bank remove controls over flows of capital. The consensus was that this decision made it easier for corrupt politicians to transfer money out of the economy (known as the Goldman scandal). Critics argue this is another example of how the IMF failed to understand the dynamics of the country that they were dealing with—insisting on blanket reforms.” [4]

- Devaluations. In the initial stages, the IMF has been criticized for allowing inflationary devaluations. [5]

- Free-market criticisms of the IMF. “Believers in free markets argue that it is better to let capital markets operate without attempts at intervention. They argue attempts to influence exchange rates only make things worse—it is better to allow currencies to reach their market level.” [6] They also assert that bailing out countries with large debts is morally hazardous; countries that know that there is always a bailout provision will borrow and spend more recklessly.

- Lack of transparency and involvement. The IMF has been criticized for “imposing policy with little or no consultation with affected countries.” [7]

- Supporting military dictatorships. The IMF has been criticized over the decades for supporting military dictatorships. [8]

Opportunities and Future Outlook for the IMF

The 2008 global economic crisis is one of the toughest situations that the IMF has had to contend with since the Great Depression.

For most of the first decade of the twenty-first century, global trade and finance fueled a global expansion that enabled many countries to repay any money they had borrowed from the IMF and other official creditors. These countries also used surpluses in trade to accumulate foreign exchange reserves. The global economic crisis that began with the 2007 collapse of mortgage lending in the United States and spread around the world in 2008 was preceded by large imbalances in global capital flows. Global capital flows fluctuated between 2 and 6 percent of world GDP between 1980 and 1995, but since then they have risen to 15 percent of GDP. The most rapid increase has been experienced by advanced economies, but emerging markets and developing countries have also become more financially integrated.

The founders of the Bretton Woods system had taken for granted that private capital flows would never again resume the prominent role they had in the nineteenth and early twentieth centuries, and the IMF had traditionally lent to members facing current account difficulties. The 2008 global crisis uncovered fragility in the advanced financial markets that soon led to the worst global downturn since the Great Depression. Suddenly, the IMF was inundated with requests for standby arrangements and other forms of financial and policy support.

The international community recognized that the IMF’s financial resources were as important as ever and were likely to be stretched thin before the crisis was over. With broad support from creditor countries, the IMF’s lending capacity tripled to around $750 billion. To use those funds effectively, the IMF overhauled its lending policies. It created a flexible credit line for countries with strong economic fundamentals and a track record of successful policy implementation. Other reforms targeted low-income countries. These factors enabled the IMF to disburse very large sums quickly; the disbursements were based on the needs of borrowing countries and were not as tightly constrained by quotas as in the past. [9]

Many observers credit the IMF’s quick responses and leadership role in helping avoid a potentially worse global financial crisis. As noted in the Chapter 5 “Global and Regional Economic Cooperation and Integration” opening case on Greece, the IMF has played a role in helping countries avert widespread financial disasters. The IMF’s requirements are not always popular but are usually effective, which has led to its expanding influence. The IMF has sought to correct some of the criticisms; according to a Foreign Policy in Focus essay designed to stimulate dialogue on the IMF, the fund’s strengths and opportunities include the following:

- Flexibility and speed. “In March 2009, the IMF created the Flexible Credit Line (FCL), which is a fast-disbursing loan facility with low conditionality aimed at reassuring investors by injecting liquidity…Traditionally, IMF loan programs require the imposition of austerity measures such as raising interest rates that can reduce foreign investment…In the case of the FCL, countries qualify for it not on the basis of their promises, but on the basis of their history. Just as individual borrowers with good credit histories are eligible for loans at lower interest rates than their risky counterparts, similarly, countries with sound macroeconomic fundamentals are eligible for drawings under the FCL. A similar program has been proposed for low-income countries. Known as the Rapid Credit Facility, it is front-loaded (allowing for a single, up-front payout as with the FCL) and is also intended to have low conditionality” (Edwards, 2009).

- Cheerleading. “The Fund is positioning itself to be less of an adversary and more of a cheerleader to member countries. For some countries that need loans more for reassurance than reform, these changes to the Fund toolkit are welcome” (Edwards, 2009). This enables more domestic political and economic stability.

- Adaptability. “Instead of providing the same medicine to all countries regardless of their particular problems, the new loan facilities are intended to aid reform-minded governments by providing short-term resources to reassure investors. In this manner, they help politicians in developing countries manage the downside costs of integration” (Edwards, 2009).

- Transparency. The IMF has made efforts to improve its own transparency and continues to encourage its member countries to do so. Supporters note that this creates a barrier to any one or more countries that have more geopolitical influence in the organization. In reality, the major economies continue to exert influence on policy and implementation.

To underscore the global expectations for the IMF’s role, China, Russia, and other global economies have renewed calls for the G20 to replace the US dollar as the international reserve currency with a new global system controlled by the IMF.

The Financial Times reported that Zhou Xiaochuan, the Chinese central bank’s governor, said the goal would be to create a reserve currency that is disconnected from individual nations and is able to remain stable in the long run, thus removing the inherent deficiencies caused by using credit-based national currencies. “‘This is a clear sign that China, as the largest holder of US dollar financial assets, is concerned about the potential inflationary risk of the US Federal Reserve printing money,’ said Qu Hongbin, chief China economist for HSBC” (Anderlini, 2009).

Although Mr. Zhou did not mention the US dollar, the essay gave a pointed critique of the current dollar-dominated monetary system:

“The outbreak of the [current] crisis and its spillover to the entire world reflected the inherent vulnerabilities and systemic risks in the existing international monetary system,” Mr Zhou wrote. China has little choice but to hold the bulk of its $2,000bn of foreign exchange reserves in US dollars, and this is unlikely to change in the near future. To replace the current system, Mr. Zhou suggested expanding the role of special drawing rights, which were introduced by the IMF in 1969 to support the Bretton Woods fixed exchange rate regime but became less relevant once that collapsed in the 1970s…. Mr Zhou said the proposal would require “extraordinary political vision and courage” and acknowledged a debt to John Maynard Keynes, who made a similar suggestion in the 1940s (Anderlini, 2009).

China is politically and economically motivated to recommend an alternative reserve currency. Politically, the country whose currency is the reserve currency is perceived as the dominant economic power, as Section 6.1 “What Is the International Monetary System?” discusses. Economically, China has come under increasing global pressure to increase the value of its currency, the renminbi, which Section 6.3 “Understanding How International Monetary Policy, the IMF, and the World Bank Impact Business Practices” discusses in greater depth.

The World Bank and the World Bank Group

Figure 6.2 World Bank Headquarters in Washington, DC

Wikimedia Commons – CC BY 2.0.

The World Bank came into existence in 1944 at the Bretton Woods conference. Its formal name is the International Bank for Reconstruction and Development (IBRD), which clearly states its primary purpose of financing economic development. The World Bank’s first loans were extended during the late 1940s to finance the reconstruction of the war-ravaged economies of Western Europe. When these nations recovered some measure of economic self-sufficiency, the World Bank turned its attention to assisting the world’s poorer nations. The World Bank has one central purpose: to promote economic and social progress in developing countries by helping raise productivity so that their people may live a better and fuller life:

[In 2009,] the World Bank provided $46.9 billion for 303 projects in developing countries worldwide, with our financial and/or technical expertise aimed at helping those countries reduce poverty. The Bank is currently involved in more than 1,800 projects in virtually every sector and developing country. The projects are as diverse as providing microcredit in Bosnia and Herzegovina, raising AIDS-prevention awareness in Guinea, supporting education of girls in Bangladesh, improving health care delivery in Mexico, and helping East Timor rebuild upon independence and India rebuild Gujarat after a devastating earthquake. [10]

Today, The World Bank consists of two main bodies, the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA), established in 1960. The World Bank is part of the broader World Bank Group, which consists of five interrelated institutions: the IBRD; the IDA; the International Finance Corporation (IFC), which was established in 1956; the Multilateral Investment Guarantee Agency (MIGA), which was established in 1988; and the International Centre for Settlement of Investment Disputes (ICSID), which was established in 1966. These additional members of the World Bank Group have specific purposes as well. The IDA typically provides interest-free loans to countries with sovereign guarantees. The IFC provides loans, equity, risk-management tools, and structured finance. Its goal is to facilitate sustainable development by improving investments in the private sector. The MIGA focuses on improving the foreign direct investment of developing countries. The ICSID provides a means for dispute resolution between governments and private investors with the end goal of enhancing the flow of capital.

The current primary focus of the World Bank centers on six strategic themes:

- The poorest countries. Poverty reduction and sustainable growth in the poorest countries, especially in Africa.

- Postconflict and fragile states. Solutions to the special challenges of postconflict countries and fragile states.

- Middle-income countries. Development solutions with customized services as well as financing for middle-income countries.

- Global public goods. Addressing regional and global issues that cross national borders, such as climate change, infectious diseases, and trade.

- The Arab world. Greater development and opportunity in the Arab world.

- Knowledge and learning. Leveraging the best global knowledge to support development. [11]

The World Bank provides low-interest loans, interest-free credits, and grants to developing countries. There’s always a government (or “sovereign”) guarantee of repayment subject to general conditions. The World Bank is directed to make loans for projects but never to fund a trade deficit. These loans must have a reasonable likelihood of being repaid. The IDA was created to offer an alternative loan option. IDA loans are free of interest and offered for several decades, with a ten-year grace period before the country receiving the loan needs to begin repayment. These loans are often called soft loans .

Since it issued its first bonds in 1947, the IBRD generates funds for its development work through the international capital markets (which Chapter 7 “Foreign Exchange and the Global Capital Markets” covers). The World Bank issues bonds, typically about $25 billion a year. These bonds are rated AAA (the highest possible rating) because they are backed by member states’ shared capital and by borrowers’ sovereign guarantees. Because of the AAA credit rating, the World Bank is able to borrow at relatively low interest rates. This provides a cheaper funding source for developing countries, as most developing countries have considerably low credit ratings. The World Bank charges a fee of about 1 percent to cover its administrative overheads.

What Are the World Bank’s Current Role and Major Challenges and Opportunities?

Like the IMF, the World Bank has both its critics and its supporters. The criticisms of the World Bank extend from the challenges that it faces in the global operating environment. Some of these challenges have complicated causes; some result from the conflict between nations and the global financial crisis. The following are four examples of the world’s difficult needs that the World Bank tries to address:

- Even in 2010, over 3 billion people lived on less than $2.50 a day.

- At the start of the twenty-first century, almost a billion people couldn’t read a book or sign their names.

- Less than 1 percent of what the world spends each year on weapons would have put every child into school by the year 2000, but it didn’t happen.

- Fragile states such as Afghanistan, Rwanda, and Sri Lanka face severe development challenges: weak institutional capacity, poor governance, political instability, and often ongoing violence or the legacy of past conflict (Shah, 2010).

According to the Encyclopedia of the New American Nation and the New York Times , the World Bank is criticized primarily for the following reasons:

- Administrative incompetence. The World Bank and its lending practices are increasingly scrutinized, with critics asserting that “the World Bank has shifted from being a ‘lender of last resort’ to an international welfare organization,” resulting in an institution that is “bloated, incompetent, and even corrupt.” Also incriminating is that “the bank’s lax lending standards have led to a rapidly deteriorating loan portfolio” (Encyclopedia of the New American Nation, 2010).

- Rewarding or supporting inefficient or corrupt countries. The bank’s lending policies often reward macroeconomic inefficiency in the underdeveloped world, allowing inefficient nations to avoid the types of fundamental reforms that would in the long run end poverty in their countries. Many analysts note that the best example is to compare

the fantastic growth in East Asia to the deplorable economic conditions of Africa. In 1950 the regions were alike—South Korea had a lower per capita GDP than Nigeria. But by pursuing macroeconomic reforms, high savings, investing in education and basic social services, and opening their economies to the global trading order, the “Pacific Tigers” have been able to lift themselves out of poverty and into wealth with very little help from the World Bank. Many countries in Africa, however, have relied primarily on multilateral assistance from organizations like the World Bank while avoiding fundamental macroeconomic reforms, with deplorable but predictable results. Conservatives point out that the World Bank has lent more than $350 billion over a half-century, mostly to the underdeveloped world, with little to show for it. One study argued that of the sixty-six countries that received funding from the bank from 1975 to 2000, well over half were no better off than before, and twenty were actually worse off. The study pointed out that Niger received $637 million between 1965 and 1995, yet its per capita GNP had fallen, in real terms, more than 50 percent during that time. In the same period Singapore, which received one-seventh as much World Bank aid, had seen its per capita GNP increase by more than 6 percent a year (Encyclopedia of the New American Nation, 2010).

Another example was in 2009, when an internal audit found that the IFC had “ignored its own environmental and social protection standards when it approved nearly $200 million in loan guarantees for palm oil production in Indonesia…Indonesia is home to the world’s second-largest reserves of natural forests and peat swamps, which naturally trap carbon dioxide—the main greenhouse gas that causes climate change. But rampant destruction of the forests to make way for palm oil plantations has caused giant releases of CO 2 into the atmosphere, making Indonesia the third-largest emitter of greenhouse gases on the planet…‘For each investment, commercial pressures were allowed to prevail,’ auditors wrote” (Friedman, 2009). However, such issues are not always as clear-cut as they may seem. The IFC responded to the audit by acknowledging “shortcomings in the review process. But the lender also defended investment in palm oil production as a way to alleviate poverty in Indonesia. ‘IFC believes that production of palm oil, when carried out in an environmentally and socially sustainable fashion, can provide core support for a strong rural economy, providing employment and improved quality of life for millions of the rural poor in tropical areas,’ it said” (Friedman, 2009).

- Negative influence on theory and practice. As one of the two Bretton Woods Institutions, the World Bank plays a large role in research, training, and policy formulation. Critics worry that because “the World Bank and the IMF are regarded as experts in the field of financial regulation and economic development, their views and prescriptions may undermine or eliminate alternative perspectives on development.” [12]

- Dominance of G7 countries. The industrialized countries dominate the World Bank (and IMF) governance structures. Decisions are typically made and policies implemented by these leading countries—the G7—because they are the largest donors, some suggest without sufficient consultation with poor and developing countries. [13]

Opportunities and Future Outlook for the World Bank

As vocal as the World Bank’s critics are, so too are its supporters. The World Bank is praised by many for engaging in development projects in remote locations around the globe to improve living standards and reduce poverty. The World Bank’s current focus is on helping countries achieve the Millennium Development Goals (MDGs), which are eight international development goals, established in 2000 at the Millennium Summit, that all 192 United Nations member states and twenty-three international organizations have agreed to achieve by the year 2015. They include reducing extreme poverty, reducing child mortality rates, fighting disease epidemics such as AIDS, and developing a global partnership for development. The World Bank is focused on the following four key issues:

- Increased transparency. In response to the criticisms over the decades, the World Bank has made progress. More of the World Bank’s decision making and country assessments are available publicly. The World Bank has continued to work with countries to combat corruption both at the country and bank levels.

- Expanding social issues in the fight on poverty. In 2001, the World Bank began to incorporate gender issues into its policy. “Two years later the World Bank announced that it was starting to evaluate all of its projects for their effects on women and girls,” noting that “poverty is experienced differently by men and women” and “a full understanding of the gender dimensions of poverty can significantly change the definition of priority policy and program interventions” (Brym et al., 2005).

- Improvements in countries’ competitiveness and increasing exports. The World Bank’s policies and its role as a donor have helped improve the ability of some countries to secure more of the global revenues for basic commodities. In Rwanda, for example, reforms transformed the country’s coffee industry and increased exports. Kenya has expanded its exports of cut flowers, and Uganda has improved its fish-processing industry. World Bank efforts have also helped African financial companies develop (Devarajan, 2009).

- Improving efficiencies in diverse industries and leveraging the private sector. The World Bank has worked closely with businesses in the private sector to develop local infrastructure, including power, transportation, telecommunications, health care, and education (Devarajan, 2009). In Afghanistan, for example, small dams are built and maintained by the locals themselves to support small industries processing local produce.

The World Bank continues to play an integral role in helping countries reduce poverty and improve the well-being of their citizens. World Bank funding provides a resource to countries to utilize the services of global companies to accomplish their objectives.

Key Takeaways

The IMF is playing an expanding role in the global monetary system. The IMF’s key roles are the following:

- To promote international monetary cooperation

- To facilitate the expansion and balanced growth of international trade

- To promote exchange stability

- To assist in the establishment of a multilateral system of payments

- To give confidence to members by making the IMF’s general resources temporarily available to them under adequate safeguards

- To shorten the duration and lessen the degree of disequilibrium in the international balances of payments of members

- The World Bank consists of two main bodies, the IBRD and the International Development Association (IDA).

The World Bank Group includes the following interrelated institutions:

- IBRD, which makes loans to countries with the purpose of building economies and reducing poverty

- IDA, which typically provides interest-free loans to countries with sovereign guarantees

- International Finance Corporation (IFC), which provides loans, equity, risk-management tools, and structured finance with the goal of facilitating sustainable development by improving investments in the private sector

- Multilateral Investment Guarantee Agency (MIGA), which focuses on improving the foreign direct investment of the developing countries

- International Centre for Settlement of Investment Disputes (ICSID), which provides a means for dispute resolution between governments and private investors, with the end goal of enhancing the flow of capital

(AACSB: Reflective Thinking, Analytical Skills)

- What is the IMF, and what role does it play?

- What are two criticisms of the IMF and two of its opportunities for the future?

- Discuss whether SDRs or another global currency created by the IMF should replace the US dollar as the international reserve currency.

- What is the World Bank, and what role does it play?

- What are two criticisms of the World Bank and two of its opportunities for the future?

Anderlini, J., “China Calls for New Reserve Currency,” Financial Times , March 24, 2009, accessed February 9, 2011, http://www.ft.com/cms/s/0/7851925a-17a2-11de-8c9d-0000779fd2ac.html#axzz1DTvW5KyI .

Balaam, D. N. and Michael Veseth, Introduction to International Political Economy , 4th ed. (Upper Saddle River, NJ: Pearson Education International/Prentice Hall), 2005.

Brym, R. J., et al., “In Faint Praise of the World Bank’s Gender Development Policy,” Canadian Journal of Sociology Online , March–April 2005, accessed May 23, 2011, http://www.cjsonline.ca/articles/brymetal05.html .

Devarajan, S., “African Successes—Listing the Success Stories,” Africa Can…End Poverty (blog), The World Bank Group, September 17, 2009, accessed May 23, 2011, http://blogs.worldbank.org/africacan/african-successes-listing-the-success-stories .

Driscoll, D. D., “The IMF and the World Bank: How Do They Differ?,” International Monetary Fund, last updated August 1996, accessed February 9, 2011, http://www.imf.org/external/pubs/ft/exrp/differ/differ.htm (emphasis added).

Edwards, M. S., “The IMF’s New Toolkit: New Opportunities, Old Challenges,” Foreign Policy in Focus, September 17, 2009, accessed June 28, 2010, http://www.fpif.org/articles/the_imfs_new_toolkit_new_opportunities_old_challenges .

Encyclopedia of the New American Nation , s.v., “International Monetary Fund and World Bank—World Bank Critics on the Right and Left,” accessed June 29, 2010, http://www.americanforeignrelations.com/E-N/International-Monetary-Fund-and-World-Bank-World-bank-critics-on-the-right-and-left.html .

Friedman, L., “How the World Bank Let ‘Deal Making’ Torch the Rainforests,” New York Times , August 19, 2009, accessed February 9, 2011, http://www.nytimes.com/cwire/2009/08/19/19climatewire-how-the-world-bank-let-deal-making-torch-the-33255.html .

Shah, A., “Causes of Poverty,” Global Issues , last modified April 25, 2010, accessed August 1, 2010, http://www.globalissues.org/issue/2/causes-of-poverty .

- “Articles of Agreement: Article I—Purposes,” International Monetary Fund, accessed May 23, 2011, http://www.imf.org/external/pubs/ft/aa/aa01.htm . ↵

- “Criticism of IMF,” Economics Help, accessed June 28, 2010, http://www.economicshelp.org/dictionary/i/imf-criticism.html . ↵

- “What Are the Main Concerns and Criticism about the World Bank and IMF?,” Bretton Woods Project, January 25, 2007, accessed February 9, 2011, http://www.brettonwoodsproject.org/item.shtml?x=320869 . ↵

- “Globalization and the Crisis (2005–Present),” International Monetary Fund, accessed July 26, 2010, http://www.imf.org/external/about/histglob.htm . ↵

- “Projects,” The World Bank, accessed February 9, 2011, http://go.worldbank.org/M7ARDFNB60 . ↵

- “To Meet Global Challenges, Six Strategic Themes,” The World Bank, accessed February 9, 2011, http://go.worldbank.org/56O9ZVPO70 . ↵

International Business Copyright © 2017 by [Author removed at request of original publisher] is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

Share This Book

- Search Search Please fill out this field.

What Is the IMF?

How does the imf work, imf benefits, not everyone has the same opinion, the bottom line.

- Monetary Policy

An Introduction to the International Monetary Fund (IMF)

:max_bytes(150000):strip_icc():format(webp)/image0-MichaelBoyle-d90f2cc61d274246a2be03cdd144f699.jpeg)

The International Monetary Fund (IMF) is an international organization that provides financial assistance and advice to member countries. This article will discuss the main functions of the IMF, which has become integral to the development of financial markets worldwide and the growth of developing countries.

Key Takeaways

- The IMF came into existence in 1944. Along with the World Bank, it was created to bring financial stability to the world following World War II.

- The IMF is funded by quota subscriptions. Member states pay according to the size of their economy, and voting rights are based on this quota.

- Special Drawing Rights (SDRs) is the unit of account of the IMF. The SDR is made up of a basket of five currencies: the U.S. dollar, the euro, the Japanese yen, the Chinese RMB, and the British pound.

- When member countries run into trouble, they can turn to the IMF for advice and financial assistance.

- Out of the 195 countries in the world, 190 countries are members of the IMF.

The IMF came into formal existence in 1944 following the Bretton Woods Conference held the year before. Along with its sister organization, the World Bank , it was created to prevent economic crises such as the Great Depression . It is a specialized agency of the United Nations and is run by its 190 member countries. Membership is open to any country that conducts foreign policy and accepts the organization's statutes.

The IMF is responsible for the creation and maintenance of the international monetary system, the system by which international payments among countries take place. It provides a systematic mechanism for foreign exchange transactions in order to foster investment and promote balanced global economic trade.

To achieve these goals, the IMF focuses and advises on the macroeconomic policies of a country, which impacts its exchange rate , governmental budget, money, and credit management . The IMF will also appraise a country's financial sector and regulatory policies, as well as structural policies within the macroeconomy that relate to the labor market and employment.

In addition, as a fund, it may offer financial assistance to nations in need of correcting balance of payment discrepancies. The IMF is entrusted with nurturing economic growth and maintaining high levels of employment within countries.

The IMF is funded by quota subscriptions paid by member states. The size of each quota is determined by the size of each member's economy. The quota in turn determines the weight each country has within the IMF — and hence its voting rights —as well as how much financing it can receive from the IMF. Twenty-five percent of each country's quota is paid in the form of special drawing rights (SDRs), which are a claim on the freely usable currencies of IMF members.

Before SDRs, the Bretton Woods system had been based on a fixed exchange rate , and it was feared that there would not be enough reserves to finance global economic growth. Therefore, in 1969, the IMF created the SDRs, which are a kind of international reserve asset. They were created to supplement the international reserves of the time, which were gold and the U.S. dollar.

The SDR is not a currency; it is a unit of account by which member states can exchange with one another in order to settle international accounts.

The SDR can also be used in exchange for other freely traded currencies of IMF members. A country may do this when it has a deficit and needs more foreign currency to pay its international obligations.

The value of SDRs lies in the fact that member states commit to honor their obligations to use and accept SDRs. Each member country is assigned a certain amount of SDRs based on how much the country contributes to the IMF (which is based on the size of the country's economy). However, the need for SDRs lessened when major economies dropped the fixed exchange rate and opted for floating rates instead.

The IMF does all of its accounting in SDRs, and commercial banks accept SDR denominated accounts. The value of the SDR is adjusted daily against a basket of currencies, which includes the U.S. dollar, the Japanese yen, the euro, and the British pound. In November 2015, the IMF added the Chinese RMB to the basket.

The larger the country, the larger its contribution. Thus the U.S. contributes 17.44% while the Seychelles Islands contribute a modest 0.005%. If called upon by the IMF, a country can pay the rest of its quota in its local currency. So far, SDR 204.2 billion (about $293 billion) have been allocated to members.

The IMF offers its assistance in the form of surveillance, which it conducts on a yearly basis for individual countries, regions, and the global economy as a whole. However, a country may ask for financial assistance if it finds itself in an economic crisis, whether caused by a sudden shock to its economy or poor macroeconomic planning. A financial crisis will result in severe devaluation of the country's currency or a major depletion of the nation's foreign reserves. In return for the IMF's help, a country is usually required to embark on an IMF-monitored economic reform program, otherwise known as Structural Adjustment Programs (SAPs).

Types of IMF Loans

There are three more widely implemented facilities by which the IMF can lend its money. A Stand-By Arrangement (SBA) offers financing of a short-term balance of payments, usually between 12 to 24 months, but no more than 36 months.

The Extended Fund Facility (EFF) is a medium-term arrangement by which countries can borrow a certain amount of money, typically over four to 10 years. The EFF aims to address structural problems within the macroeconomy that are causing chronic balance of payment inequities. The structural problems are addressed through financial and tax sector reform and the privatization of public enterprises.

The third main facility offered by the IMF is known as the Poverty Reduction and Growth Facility (PRGF). As the name implies, it aims to reduce poverty in the poorest of member countries while laying the foundations for economic development. Loans are administered with especially low interest rates .

The IMF offers technical assistance to transitional economies in the changeover from centrally planned to market-run economies. The IMF also offers emergency funds to collapsed economies, as it did for South Korea during the 1997 financial crisis in Asia, which allowed it to avoid sovereign default . Emergency funds can also be loaned to countries that have faced an economic crisis as a result of a natural disaster.

All facilities of the IMF aim to create sustainable development within a country and try to create policies that will be accepted by the local population. However, the IMF is not an aid agency, so all loans are given on the condition that the country implements the SAPs and makes it a priority to pay back what it has borrowed. Countries that are under IMF programs are typically developing, transitional, and emerging market countries (countries that have faced financial crises).

Because the IMF lends its money with "strings attached" in the form of its SAPs, many people and organizations are vehemently opposed to its activities. Opposition groups claim that structural adjustment is an undemocratic and inhumane means of loaning funds to countries facing economic failure. Debtor countries to the IMF are often faced with having to put financial concerns ahead of social ones.

Thus, by being required to open up their economies to foreign investment , privatize public enterprises, and cut government spending, these countries suffer an inability to properly fund their education and health programs.

Moreover, foreign corporations often exploit the situation by taking advantage of local cheap labor while showing no regard for the environment. The oppositional groups say that locally cultivated programs, with a more grassroots approach towards development, would provide greater relief to these economies. Critics of the IMF say that, as it stands now, the IMF is only deepening the rift between the wealthy and the poor nations of the world.

What Has Been the Role of the IMF in Helping Latin American Countries?

The IMF greatly helped Latin American countries in the 1980s during its debt crisis, helping nations overcome the financial difficulties and turning around their economies. Today, it has helped with policy advice, technical assistance, and financing. The IMF has provided $66 billion to 21 countries.

What Are the Differences Between the IMF and the World Bank?

Both the World Bank and the IMF were founded in 1944 at the Bretton Woods conference. The primary responsibility of the World Bank is to aid developing nations in reducing their poverty and increasing their well-being. The IMF's main purpose is to stabilize the international monetary system and oversee the world's currencies.

The World Bank provides "financing, policy advice, and technical assistance to governments, and also focuses on strengthening the private sector in developing countries. The IMF keeps track of the economy globally and in member countries, lends to countries with balance of payment difficulties, and gives practical help to members."

Which Countries Are Not Members of the IMF?

The IMF consists of 190 countries out of 195 in the world. The countries not part of the IMF include Cuba, North Korea, East Timor, Liechtenstein, and Monaco. Vatican City and Taiwan are also not part of the IMF.

How Is the IMF Involved in International Trade?

According to the IMF, its mandate includes "facilitating the expansion and balanced growth of international trade." The organization utilizes tariffs, quotas, export subsidies and taxes, and preferential trade agreements.

What Is an IMF Grant?

The IMF grant "supports charities in the Washington DC metro area and in IMF member countries abroad through annual monetary grants, which focus primarily on fostering economic independence through education and economic development."

Providing assistance with development is an ever-evolving and dynamic endeavor. While the international system aims to create a balanced global economy, it should strive to address local needs and solutions. On the other hand, we cannot ignore the benefits that can be achieved by learning from others.

Federal Reserve Bank of St. Louis. " Creation of the Bretton Woods System ."

International Monetary Fund. " Quota Reform ."

International Monetary Fund. " Special Drawing Rights (SDR) ."

International Monetary Fund. " List of Members ."

International Monetary Fund. " Selected Decisions and Selected Documents of the IMF, Fortieth Issue—A. Agreement Between the United Nations and the International Monetary Fund ."

International Monetary Fund. " Obligations and Benefits of IMF Membership ."

International Monetary Fund. " IMF Members' Quotas and Voting Power, and IMF Board of Governors. "

International Monetary Fund. " IMF Stand-By Arrangement (SBA) ."

International Monetary Fund. " IMF Extended Fund Facility (EFF) ."

International Monetary Fund. " Key Features of IMF Poverty Reduction and Growth Facility (PRGF) Supported Programs ."

International Monetary Fund. " The 1997-98 Korean Financial Crisis: Causes, Policy Response, and Lessons ," Page 2.

Federation of American Scientists. Congressional Research Service. " The Greek Debt Crisis: Overview and Implications for the United States ."

The Guardian. " The IMF Is Hurting Countries It Claims to Help ."

International Monetary Fund. " Latin America and Caribbean's Winding Road to Recovery ."

The World Bank. " The World Bank Group and the International Monetary Fund (IMF) ."

International Monetary Fund. " IMF and the World Trade Organization ."

International Monetary Fund. eLibrary. " Chapter 1 Introduction ."

International Monetary Fund. " Online Guidelines to Submit a Grant Request ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1227917506-b8093677aac4470f9dd57bde83098b22.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

IMAGES

COMMENTS

The IMF is playing an expanding role in the global monetary system. The IMF’s key roles are the following: To promote international monetary cooperation; To facilitate the expansion and balanced growth of international trade; To promote exchange stability; To assist in the establishment of a multilateral system of payments

Summary. The IMF was created in the wake of World War II to manage the global regime of exchange rates and international payments. Since the collapse of fixed exchange rates...

The IMF is governed by and accountable to its member countries. The IMF has three critical missions: furthering international monetary cooperation, encouraging the expansion of trade and economic growth, and discouraging policies that would harm prosperity.

International Monetary Fund (IMF), United Nations (UN) specialized agency, founded at the Bretton Woods Conference in 1944 to secure international monetary cooperation, to stabilize currency exchange rates, and to expand international liquidity (access to hard currencies).

The International Monetary Fund aims to reduce global poverty, encourage international trade, and promote financial stability and economic growth. The IMF has three main functions: overseeing...

The International Monetary Fund (IMF) is an international organization that promotes global economic growth and financial stability, encourages international trade, and reduces poverty....

The International Monetary Fund (IMF) and the World Bank share a common goal of raising living standards in their member countries. Their approaches to achieving this shared goal are complementary: the IMF focuses on macroeconomic and financial stability while the World Bank concentrates on long-term economic development and poverty reduction.

The IMF is a global organization that works to achieve sustainable growth and prosperity for all of its 191 member countries. It does so by supporting economic policies that promote financial stability and monetary cooperation, which are essential to increase productivity, job creation, and economic well-being.

The IMF works to stabilize and foster the economies of its member countries by its use of the fund, as well as other activities such as gathering and analyzing economic statistics and surveillance of its members' economies. [12][13]

The IMF is responsible for the creation and maintenance of the international monetary system, the system by which international payments among countries take place. It provides a systematic...