ZenBusinessPlans

Home » Sample Business Plans » Education

How to Write a School Supplies Business Plan [Sample Template]

Are you about starting a school supplies company? If YES, here is a complete sample school supplies business plan template & feasibility report you can use FREE. School supplies businesses sell and distribute teaching materials to schools, parents, teachers and students. These stores frequently carry a wide selection of educational materials and decorations for classroom teachers such as books, pencils, pens, etc.

With this type of business, you can choose to own a store/warehouse if you have the financial capacity to or you can choose to operate without a store. The bottom line is that you must own your own distribution truck/van, you should know how to source for school supplies and how to get them delivered to your customers.

Come to think of it, starting a school supplies business is profitable, it is a very easy business to start and it is not so capital intensive especially if you get the goods on trust from the production companies. Getting the right products that people want to buy and good networking and stock keeping records are the secrets of running a school supplies business.

So, if you have decided to start a school supplies business, then you should ensure that you carry out thorough feasibility studies and also market survey. This will enable you locate the business in a location with the right demography, network with school supplies retailers and then hit the ground running.

Business plan is yet another very important business document that you should not take for granted while launching your own school supplies business. Below is a sample school supplies business plan template that will give you the needed guide to write yours with ease.

A Sample School Supplies Business Plan Template

1. industry overview.

Businesses in the School Supplies Wholesaling industry are involved in the sale and distribution of office tools, writing implements, stamps and stencils, stationery and loose-leaf paper, notebooks, binders and organizers and other related items.

If you have been keeping close tabs with happenings in the School Supplies Wholesaling industry, you would have noticed that the industry has struggled over the five years to 2018 with low demand and declining supply-chain relevance.

The School Supplies Wholesaling industry is a thriving sector of the economy of the united states of America and they generate a whooping over billion annually from more than 508 registered and licensed School Supplies Wholesaling businesses scattered all around the United States of America.

The industry is responsible for the employment of over 2,698 people. Experts project the industry to grow at a -2.0 percent annual rate within 2013 and 2018. It is important to state that the company holding the largest market share in the School Supplies Wholesaling industry is School Specialty Inc.

A recent report released by IBISWorld shows that over the past five years, the School Supplies Wholesaling industry has declined by -2.0 percent to reach revenue of $2bn in 2018. In the same timeframe, the number of businesses has declined by -0.2 percent and the number of employees has declined by -3.0 percent.

It is a fact that an estimated two-thirds of the United States’ gross domestic product (GDP) comes from retail consumption of which the School Supplies Wholesaling industry contributes greatly. This is why the United States of America’s economy is measured with the yardstick of how well the retailing business is fairing there.

When there is an unstable economy, purchasing power drops and it impacts the retailing / distribution industry negatively which may result in the closure of some of these businesses.

School supplies business is indeed a profitable business venture and it is open for any aspiring entrepreneur to come in and establish his or her business; you can choose to start on a small scale without a store/warehouse or you can choose to start on a large scale with standard store/warehouse, dozens of distribution trucks and a strong online presence.

2. Executive Summary

Regina Trent® School Supplies Company, LLC is a registered distribution company that will be involved in the distribution of teaching resources to schools and retail centers. Our warehouse and store will be located around Los Angeles Unified – California which happens to be the district with the second highest number of schools (646,683 schools) in the whole of the United States.

We have been able to lease a warehouse facility that is big enough to fit into the kind of school supplies company that we intend launching and the facility is centrally located in the heart of town with easy delivery network.

Regina Trent® School Supplies Company, LLC will distribute a wide range of school supplies at affordable prices from different brands. We will engage in the sale and distribution of office tools, writing implements, stamps and stencils, stationery and loose-leaf paper, notebooks, binders, organizers and other related items.

We are aware that there are several school supplies companies all around Los Angeles- California which is why we spent time and resources to conduct our feasibility studies and market survey so as to offer much more than our competitors will be offering. We have robust distribution network; strong online presence and our distributors are armed with the various payment options available in the United States.

Our customer care is going to be second to none in the whole of Los Angeles Unified – California and our deliveries will be highly reliable. We know that our customers are the reason why we are in business which is why we will go the extra mile to get them satisfied when they patronize our products.

Regina Trent® School Supplies Company, LLC will ensure that all our customers are given first class treatment whenever they visit our warehouse or order school supplies from us. We have a CRM software that will enable us manage a one on one relationship with our customers no matter how large the numbers of our customers’ base and distribution network may grow to.

We will ensure that we get our customers involved in the selection of brands and also when making some business decisions that directly affect them.

Regina Trent® School Supplies Company, LLC will at all times demonstrate her commitment to sustainability, both individually and as a firm, by actively participating in our communities and integrating sustainable business practices wherever possible. We will ensure that we hold ourselves accountable to the highest standards by meeting our client’s needs precisely and completely.

Regina Trent® School Supplies Company, LLC is a family business that is owned by Regina Trent and her immediate family members. Regina Trent has a B.Sc. in Business Administration with over 8 years’ experience in the retailing and distribution industry, working for some of the leading brand in the United States.

Although the business is launching out with focusing on Los Angeles Unified – California, but there is a plan to expand our distribution network all across the state of California.

3. Our Products and Services

Regina Trent® School Supplies Company, LLC is in the School Supplies Wholesaling industry and we will be involved in the distribution of a wide range of products from top manufacturing brands in the United States. Our products and services offerings are listed below;

- Writing implements, stamps and stencils

- Stationery (Pencil box, Crayons, Colored pencils, Washable markers, Ballpoint pens, Pencil sharpener, Erasers, Glue sticks, Ruler, Blunt-tipped scissors, Plastic folders, Assorted construction paper, Wide-ruled notebook or pad, Index cards, Loose-leaf paper)

- Notebooks, binders and organizers

- Lunchbox or bag

4. Our Mission and Vision Statement

- Our vision is to become the leading brand in the school supplies line of business in the whole of Los Angeles Unified – California.

- Our mission is to establish a highly reliable school supplies business brand that will distribute a wide range of teaching resources to schools and retail centers in Los Angeles Unified and other cities in California where we intend launching out.

Our Business Structure

Our intention of starting a school supplies business is to build a standard retail and distribution business in Los Angeles Unified – California. We will ensure that we put the right structure in place that will support the kind of growth that we have in mind while setting up the business.

We will make sure that we hire people that are qualified, honest, customer centric and are ready to work to help us build a prosperous business that will benefit all our stakeholders. As a matter of fact, profit-sharing arrangement will be made available to all our senior management staff and it will be based on their performance for a period of ten years or more.

In view of that, we have decided to hire qualified and competent hands to occupy the following positions that will be made available at Regina Trent® School Supplies Company, LLC;

- Chief Executive Officer (Owner)

- Warehouse Manager

- Human Resources and Admin Manager

Merchandize Manager

Sales and Marketing Manager

Information Technologist

- Accountants/Cashiers

- Customer Services Executive

- Drivers/Distributors

5. Job Roles and Responsibilities

Chief Executive Officer – CEO:

- Increases management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, and appraising job results and developing incentives

- Creating, communicating, and implementing the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for fixing prices and signing business deals

- Responsible for providing direction for the business

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

- Reports to the board

Admin and HR Manager

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Maintains office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Ensures operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Defining job positions for recruitment and managing interviewing process

- Carrying out induction for new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Oversee the smooth running of the daily office activities.

Warehouse Manager:

- Responsible for organizing the safe and efficient receipt, storage and dispatch of warehoused goods

- In charge of planning, coordinating and monitoring the receipt, order assembly and dispatch of goods

- In charge of coordinating the use of automated and computerized systems where necessary

- Responsible for keeping stock control systems up to date and making sure inventories are accurate

- Responsible for producing regular reports and statistics on a daily, weekly and monthly basis

- Ensures that proper records of goods are kept and warehouse does not run out of products

- Ensure that the warehouse facility is in tip top shape and goods are properly arranged and easy to locate

- Supervise the workforce in the warehouse floor.

- Manage vendor relations, market visits, and the ongoing education and development of the organizations’ buying teams

- Responsible for the purchase of office tools, writing implements, stamps and stencils, stationery and loose-leaf paper, notebooks, binders and organizers and other related items for the organizations

- Ensures that the organization operates within stipulated budget.

- Manage external research and coordinate all the internal sources of information to retain the organizations’ best customers and attract new ones

- Model demographic information and analyze the volumes of transactional data generated by customer purchases

- Identify, prioritize, and reach out to new partners, and business opportunities et al

- Identifies development opportunities; follows up on development leads and contacts

- Responsible for supervising implementation, advocate for the customer’s needs, and communicate with clients

- Document all customer contact and information

- Represent the company in strategic meetings

- Help increase sales and growth for the company

- Manage the organization website

- Handles ecommerce aspect of the business

- Responsible for installing and maintenance of computer software and hardware for the organization

- Manage logistics and supply chain software, Web servers, e-commerce software and POS (point of sale) systems

- Manage the organization’s CCTV

- Handles any other technological and IT related duties.

Accountant/Cashier:

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Provides managements with financial analyses, market research to forecast trends and business conditions.

- Responsible for financial forecasting and risks analysis.

- Performs cash management, general ledger accounting, and financial reporting

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensuring compliance with taxation legislation

- Handles all financial transactions for the organization

- Serves as internal auditor for the organization

Client Service Executive

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Through interaction with customers on the phone, uses every opportunity to build client’s interest in the company’s products and services

- Manages administrative duties assigned by the human resources and admin manager in an effective and timely manner

- Consistently stays abreast of any new information on the organizations’ products, promotional campaigns etc. to ensure accurate and helpful information is supplied to customers when they make enquiries

Distribution Truck Drivers

- Assist in loading and unloading stock

- Maintain a logbook of their driving activities to ensure compliance with federal regulations governing the rest and work periods for operators.

- Keep a record of vehicle inspections and make sure the truck is equipped with safety equipment

- Assist the transport and logistics manager in planning their route according to a distribution schedule.

- Local-delivery drivers may be required to sell products or services to stores and businesses on their route, obtain signatures from recipients and collect cash.

- Inspect vehicles for mechanical items and safety issues and perform preventative maintenance

- Comply with truck driving rules and regulations (size, weight, route designations, parking, break periods etc.) as well as with company policies and procedures

- Collect and verify delivery instructions

- Report defects, accidents or violations

6. SWOT Analysis

Our intention of starting out in Los Angeles Unified and distribute our goods only within the are is to test run the business for a period of 2 to 5 years to know if we will invest more money and then expand all around the state of California.

We are quite aware that there are several school supplies companies all over Los Angeles Unified and even in the same location where we intend locating ours, which is why we are following the due process of establishing a business.

We know that if a proper SWOT analysis is conducted for our business, we will be able to position our business to maximize our strength, leverage on the opportunities that will be available to us, mitigate our risks and be equipped to confront our threats.

Regina Trent® School Supplies Company, LLC employed the services of an expert HR and Business Analyst with bias in retailing and distribution to help us conduct a thorough SWOT analysis and to help us create a Business model that will help us achieve our business goals and objectives. This is the summary of the SWOT analysis that was conducted for Regina Trent® School Supplies Company, LLC;

Our location, the business model we will be operating (robust distribution network), varieties of payment options, wide range of products from top brands and our excellent customer service culture will definitely count as a strong strength for Regina Trent® School Supplies Company, LLC. So, also our management team has what it takes to grow a business from startup to profitability with a record time.

A major weakness that may count against us is the fact that we are a new school supplies business and we don’t have the financial capacity to compete with leaders in the industry for now.

- Opportunities:

The fact that we are going to be operating our school supplies business in Los Angeles Unified – California provides us with unlimited opportunities to supply our school supplies to a large number of schools and retail facilities. We have been able to conduct thorough feasibility studies and market survey and we know what our potential clients will be looking for when they patronize our products and services; we are well positioned to take on the opportunities that will come our way.

Just like any other business, one of the major threats that we are likely going to face is economic downturn. It is a fact that economic downturn affects purchasing / spending power. Another threat that may likely confront us is the arrival of a similar business in same location where ours is located. We are not ignoring the fact that unfavorable government policies can also affect our business.

7. MARKET ANALYSIS

- Market Trends

A broader trend toward ecommerce has been particularly pronounced in this industry, which resulted into encouraging more consumers to circumvent retailers and the wholesalers that supply them. In addition to that, brick-and-mortar retail sales have increasingly shifted to big-box department and discount stores who also retail school supplies.

They have been able to overtime make use of their purchasing power to source products directly from manufacturers, internalizing distribution functions and eliminating independent wholesalers from the school supply chain.

It is now a common phenomenon for distribution companies to leverage on technology to effectively predict consumer demand patterns and to strategically position their business to meet their needs; in essence, the use of technology has helped businesses like school supplies to maximize supply chain efficiencies.

8. Our Target Market

The school supplies wholesaling industry has a wide range of customers. In view of that, we have positioned our school supplies company to service schools and retail centers in Los Angeles Unified – California and every other location we will cover.

We have conducted our market research and we have ideas of what our target market would be expecting from us. We are in business to retail (distribute) a wide range of school supplies from different production companies to the following businesses;

- Retailers of school supplies

Our competitive advantage

A close study of the school supplies industry reveals that the market has become much more intensely competitive over the last decade. As a matter of fact, you have to be highly creative, customer centric and proactive if you must survive in this industry. We are aware of the stiff competition and we are prepared to compete favorably with other leading school supplies businesses in and around Los Angeles Unified – California.

One thing is certain; we will ensure that we have a wide range of products available in our warehouse at all times. One of our business goals is to make Regina Trent® School Supplies Company, LLC a one stop school supplies company. Our excellent customer service culture, timely and reliable delivery services, online presence, and various payment options will serve as a competitive advantage for us.

Lastly, our employees will be well taken care of, and their welfare package will be among the best within our category (startups school supplies businesses) in the industry meaning that they will be more than willing to build the business with us and help deliver our set goals and achieve all our aims and objectives. We will also give good working conditions and commissions to freelance sales agents that we will recruit from time to time.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Regina Trent® School Supplies Company, LLC is in business to retail (distribute) a wide range of school supplies from top production companies to schools in Los Angeles Unified – California. We are in the school supplies wholesaling industry to maximize profits and we are going to go all the way out to ensure that we achieve or business goals and objectives.

We will generate income for the business by retailing and distributing;

10. Sales Forecast

One thing is certain when it comes to school supplies business, if your business is centrally positioned coupled with effective and reliable distribution network, you will always attract sales and that will sure translate to increase in revenue generation for the business.

We are well positioned to take on the available market in Los Angeles Unified – California and we are quite optimistic that we will meet our set target of generating enough income / profits from our first six months of operation and grow the business and our clientele base.

We have been able to examine the school supplies wholesaling industry, we have analyzed our chances in the industry and we have been able to come up with the following sales forecast.

Below are the sales projections for Regina Trent® School Supplies Company, LLC, it is based on the location of our business, the list of school supplies and other factors as it relates to school supplies startups in the United States;

- First Fiscal Year: $240,000

- Second Fiscal Year: $350,000

- Third Fiscal Year: $600,000

N.B : This projection was done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and there won’t be any major competitor offering same products and customer care services as we do within same location. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

Before choosing a location for Regina Trent® School Supplies Company, LLC, we conducted a thorough market survey and feasibility studies in order for us to be able to penetrate the available market and become the preferred choice for schools, teachers, students and parents in Los Angeles Unified – California.

We hired experts who have good understanding of the retailing and distribution industry to help us develop marketing strategies that will help us achieve our business goal of winning a larger percentage of the available market in Los Angeles Unified – California.

In summary, Regina Trent® School Supplies Company, LLC will adopt the following sales and marketing approach to win customers over;

- Open our business in a grand style with a party for all.

- Introduce our business by sending introductory letters alongside our brochure to small – scale school supplies retailers, schools, teachers, students, households and key stakeholders in Los Angeles Unified – California

- Ensure that we have a wide range of school supplies from different brands within and outside the United States at all times.

- Make use of attractive hand bills to create awareness business

- Position our signage / flexi banners at strategic places around Los Angeles Unified – California

- Create a loyalty plan that will enable us reward our regular customers

- Engage on roadshows within our neighborhood to create awareness for our school supplies business.

11. Publicity and Advertising Strategy

Despite the fact that our school supplies business is well structured and well located, we will still go ahead to intensify publicity for the business.

Regina Trent® School Supplies Company, LLC has a long-term plan of opening distribution channels all around the state of California which is why we will deliberately build our brand to be well accepted in Los Angeles Unified School District area before venturing out.

Here are the platforms we intend leveraging on to promote and advertise Regina Trent® School Supplies Company, LLC;

- Place adverts on community – based newspapers, radio and TV stations

- Encourage the use of word of mouth publicity from our loyal customers

- Leverage on the internet and social media platforms like; YouTube, Instagram, Facebook, Twitter, LinkedIn, Google+ and other platforms to promote our business.

- Ensure that our we position our banners and billboards in strategic positions all around Los Angeles Unified – California

- Distribute our fliers and handbills in target areas in and around schools within Los Angeles Unified school district areas

- Brand all our official cars and distribution vans/trucks and ensure that all our staff members wear our branded shirt or cap at regular intervals.

12. Our Pricing Strategy

Pricing is one of the key factors that gives leverage to distribution companies and retailers, it is normal for retailers to purchase products from distribution companies where they can goods at cheaper price. We will work towards ensuring that all our goods are distributed at highly competitive prices compared to what is obtainable in the United States of America.

We also have plans in place to discount our goods once in a while and also to reward our loyal customers from time to time.

- Payment Options

The payment policy adopted by Regina Trent® School Supplies Company, LLC is all inclusive because we are quite aware that different customers prefer different payment options as it suits them but at the same time, we will ensure that we abide by the financial rules and regulation of the United States of America.

Here are the payment options that Regina Trent® School Supplies Company, LLC will make available to her clients;

- Payment via bank transfer

- Payment with cash

- Payment via credit cards

- Payment via POS machines

- Payment via online bank transfer

- Payment via check

- Payment via bank draft

In view of the above, we have chosen banking platforms that will enable our client make payment for our products without any stress on their part. Our bank account numbers will be made available on our website and promotional materials

13. Startup Expenditure (Budget)

From our market research and feasibility studies, we were able to come up with the following financial projections and costing as it relates to establishing a standard school supplies business in the United States of America;

- The total fee for registering the business in the United States of America – $750.

- Legal expenses for obtaining licenses and permits as well as the accounting services (software, P.O.S machines and other software) – $3,300.

- Marketing promotion expenses for the grand opening of Regina Trent® School Supplies Company, LLC in the amount of $3,500 and as well as flyer printing (2,000 flyers at $0.04 per copy) for the total amount of $3,580.

- The cost for hiring business consultant – $2,500.

- The cost for insurance (general liability, workers’ compensation and property casualty) coverage at a total premium – $2,400.

- The cost for payment of rent for 12 months at $1.76 per square feet warehouse facility in the total amount of $105,600.

- The total cost for warehouse facility remodeling (construction of racks and shelves) – $20,000.

- Other start-up expenses including stationery ($500) and phone and utility deposits ($2,500).

- Operational cost for the first 3 months (salaries of employees, payments of bills et al) – $60,000

- The cost for Start-up inventory (stocking with a wide range of office tools, writing implements, stamps and stencils, stationery and loose-leaf paper, notebooks, binders, organizers and other related items) – $100,000

- The cost for store equipment (cash register, security, ventilation, signage) – $13,750

- The cost of purchase and installation of CCTVs – $5,000

- The cost for the purchase of furniture and gadgets (Computers, Printers, Telephone, TVs, Sound System, tables and chairs et al) – $4,000.

- The cost for the purchase of distribution vans / trucks – $25,000

- The cost of launching a website – $600

- The cost for our opening party – $7,000

- Miscellaneous – $10,000

We would need an estimate of $350,000 to successfully set up our school supplies business in Los Angeles Unified – California.

Generating Funds/Startup Capital for Regina Trent® School Supplies Company, LLC

Regina Trent® School Supplies Company, LLC is a private business that is solely owned and financed by Regina Trent and her immediate family members. They do not intend to welcome any external business partner which is why she has decided to restrict the sourcing of the startup capital to 3 major sources.

- Generate part of the startup capital from personal savings

- Source for soft loans from family members and friends

- Apply for loan from the bank

N.B: We have been able to generate about $100,000 (Personal savings $80,000 and soft loan from family members $10,000) and we are at the final stages of obtaining a loan facility of $250,000 from our bank. All the papers and documents have been signed and submitted, the loan has been approved and any moment from now our account will be credited with the amount.

14. Sustainability and Expansion Strategy

The future of a business lies in the number of loyal customers that they have, the capacity and competence of their employees, their investment strategy and business structure. If all of these factors are missing from a business (company), then it won’t be too long before the business close shop.

One of our major goals of starting Regina Trent® School Supplies Company, LLC is to build a business that will survive off its own cash flow without injecting finance from external sources once the business is officially running. We know that one of the ways of gaining approval and winning customers over is to distribute our school supplies a little bit cheaper than what is obtainable in the market and we are prepared to survive on lower profit margin for a while.

Regina Trent® School Supplies Company, LLC will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare are well taken of. Our company’s corporate culture is designed to drive our business to greater heights and training and retraining of our workforce is at the top burner.

We know that if we diligently put in place all that is stated above, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List/Milestone

- Business Name Availability Check: Completed

- Business Registration: Completed

- Opening of Corporate Bank Accounts: Completed

- Securing Point of Sales (POS) Machines: Completed

- Opening Mobile Money Accounts: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of Insurance for the Business: Completed

- Leasing of warehouse facility and remodeling the facility: In Progress

- Conducting Feasibility Studies: Completed

- Generating capital from family members: Completed

- Applications for Loan from the bank: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents and other relevant Legal Documents: In Progress

- Design of The Company’s Logo: Completed

- Printing of Promotional Materials: In Progress

- Recruitment of employees: In Progress

- Purchase of furniture, racks, shelves, computers, electronic appliances, office appliances and CCTV: In progress

- Purchase of distribution vans: Completed

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business both online and around the community: In Progress

- Health and Safety and Fire Safety Arrangement (License): Secured

- Opening party/launching party planning: In Progress

- Compilation of our list of products that will be distribute: Completed

- Establishing business relationship with school supplies manufacturing companies within and outside of the United States of America: In Progress

More on Education

6 Tips On How To Start And Manage A School & Office Supplies Store

Many school and office supplies store owners say that this type of business is almost as stable as any food business. While many have closed their physical stores due to the pandemic, shifting to an online store still leads to profits. Even during a recession, students and offices will still need supplies such as paper, notebooks, pens, etc.

If you’re interested in starting a school and office supplies store, we listed 6 tips that could help you.

1. Business Plan

You might be excited to start this business that you’re already full of ideas. To get those ideas working, you need to have a well-research business plan . This will put together all your thoughts, ideas, plans, projections, actions to be done, requirements, and more. Basically, a business plan will be your guide on how to plan, operate, market, and earn. In your business plan, you can include the following:

- Financial statement

- Projected Sales

- List of suppliers

- Marketing and promotion

- Target Market

- Competitors (price comparison, advantage, etc.)

2. Offer Value

Part of making your business plan is researching the market and your competitors. Think of something that your customers will value. Maybe lower price, better customer service, convenience, etc. These are important because they will set you apart from your competitors.

3. Order From Direct Suppliers

Often, pricing and variety are keys to a successful school and office supplies store. The target market for these businesses is often students who are working on a budget. Whenever possible, order directly from a manufacturer or importer, so you can obtain your goods at a lower price. However, keep in mind that they often require a minimum number of items. So, it’s best to research which suppliers suit your budget and funds.

4. Have A Market-Based Pricing Strategy

A tip to help make your business more profitable is to survey the market-based price. Research the market price of your items by knowing the price of your competitors. From there, you can play around with your profit margin. Remember that your customers don’t know the actual cost of your goods from suppliers but they know the price of your competitors.

5. Keep Up With Trends

The retail business is dynamic and always changing, so you still need to keep up with the trends. Research for new items to sell and discontinue slow-moving items in your inventory.

6. Look For Reliable Suppliers

There are tons of suppliers, and stores that offer paper products, school supplies, office supplies, and general merchandise in retail and wholesale. The popular go-to places when looking for the most affordable supplies are:

- Commonwealth Market

- 168 Mall Binondo

- Marikina Riverbanks

You can also reach out to local school and office supplies companies such as:

- JB Merchandising Inc. (JBM)

- Goldwings Stationery Products

- Risco Stationery Trading

- Crown Supply Corporation

- NGBROS Enterprises

If you prefer online stores, there are tons of suppliers on Lazada, Alibaba, etc. You just have to inquire about their rules and requirements.

The school and office supplies business has great potential if you do it right. Like any business, always research and learn. Good luck!

- Recent Posts

- IT Engineer Quits Job To Sell Siomai, Now Earns P5,000 A Day - June 30, 2023

- From Chocolate Cakes To Noodles: Maricar Reyes’ Food Businesses - June 25, 2023

- How To Be A Cebuana Lhuillier Authorized Agent - June 17, 2023

Recommended Reading...

Starting a Startup in the Philippines: 15 Strategic Tips for Success

5 Practical Tips for Staying on Top of Your Credit Card Payments

Top 5 Tips to Protect Your Money From Inflation

7 Ways to Contact the Converge Customer Service

8 Ways to Contact the Smart Communications Customer Service in the Philippines

6 Best Unlimited Samgyupsal Restaurants in the Philippines

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

For security, use of Google's reCAPTCHA service is required which is subject to the Google Privacy Policy and Terms of Use .

I agree to these terms (required).

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

- Grades 6-12

- School Leaders

Get our mega Halloween worksheets bundle! 👻

How to Start a Student-Run School Store

For sale: pencils, T-shirts, and important life skills.

Looking to start a school store? A school store offers the chance to teach students real-world skills like accounting, sales, marketing, and so much more. Here’s how to get yours up and running. It may seem like there’s a lot to do, but we’ve broken it all down into 10 basic steps that will have you and your students selling pencils and T-shirts in no time.

1. Decide who’s in charge.

Although you’ll want to involve students as much as you can, you will need at least one adult to manage things. In some schools, the store is run by a specific class (e.g., a high school accounting or marketing class, a middle school math class, or even an upper elementary class), and the teacher of that class is in charge. In others, the PTA is involved, and a parent or committee oversees the store. No matter who will manage the store, remember that your goal is to involve students in every step of the process.

Pro tip: Adults will need to ensure that the actual daily cash is handled according to the school district’s policies. Take this into account when considering school-store management.

2. Find a location.

SOURCE: Cypress Elementary

Like real estate agents say, location is everything. Many stores operate in or near the school cafeteria, since every student winds up there at some point during the day. The school library can be another great choice. The lobby or main office is also a prime location. Remember that you’ll need room for all your stock as well as a display area and a space to serve as a counter (a table is fine) for purchases.

Pro tip: Short on space? Use a rolling cart to set up shop anywhere that’s convenient. The cart can be locked up in a supply closet or administrator’s office with the rest of your inventory when not in use.

3. Determine store hours.

What hours will your store be open? Popular times for school stores are lunch times, before and after school, and during school events, like concerts or athletic games. Consider who will need to be available at these times—high school kids may not always need an adult by their sides, but younger kids will definitely need a teacher or parent there when the store is open.

Pro tip: Offer students and parents the chance to place orders in advance via a paper or online form. This gives them more browsing time and speeds up transactions when the store is open.

4. Choose your stock.

SOURCE: Washington Township High School

This is the fun part! Students of any age should definitely be involved here, because they know what is likely to be popular. Items with the school logo are always a big hit—think pencils, folders, notebooks, and T-shirts. If you don’t already have a supplier for these items, there are plenty of sites online that do promotional printing at reasonable prices. Other popular items for a school store include novelty items, like small toys, scented pencils, or colorful erasers; snacks and bottled water; and basic school supplies, like pens and crayons.

Pro tip: Try selling gift certificates—parents can buy them for their kids, or teachers can offer them as rewards for good work.

5. Gather other supplies.

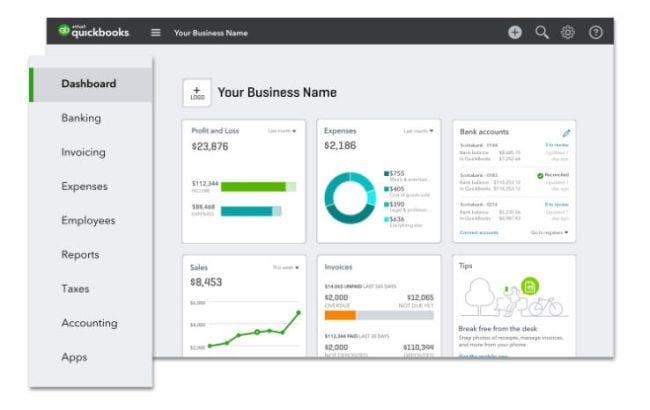

Other school-store supplies you might need include calculators, signage, and shelving. You’ll need a cash box that locks and some small bills and change to get things started. Will you issue receipts? You’ll need a receipt book and pens. Remember to get an account and inventory ledger, too, or use QuickBooks Online —it’s free for teachers and students (more on that below).

Pro tip: Give your school-store staff name tags or even an official T-shirt or badge to wear when they’re on the job.

6. Price the items.

First things first: It’s entirely okay for your school store to make a profit. In fact, that makes it a better learning experience for the students involved! Raise money for something your school needs or plan to donate proceeds to charity. Ask kids to help determine the prices for items; understanding how market prices and markups work is a great entry into the world of business.

Pro tip: Try to have items at a variety of prices, but remember that you’ll need to have the correct change on hand if you price things at a nickel, dime, or quarter.

7. Set up a financial management system.

Calling all future entrepreneurs and accountants! This is where math and business skills really come into play. Teach students the importance of financial management as they keep track of inventory and sales and then balance the books at the end of the month. You can go the old-fashioned paper ledger route, but students will benefit more from learning how to use accounting software. QuickBooks Online is popular with small business owners everywhere, and your students and school can receive free licenses to use the program. These are real-world skills students will appreciate now and down the line.

Pro tip: New to QuickBooks? With online courses and tutorials , the program is easy to learn for students and teachers alike. Plus, educators who register with Intuit Education can access additional free curriculum plus one-on-one guidance from the Intuit Education team.

8. Staff your store.

Try to have your school store staffed by students when possible, with adults there to oversee and guide when needed. Handling money, making change, serving customers, keeping track of sales … these are all valuable skills that students can learn, even in elementary school. Rotate students through different jobs (front-line sales, inventory and bookkeeping, and so on) so they have a chance to build a variety of competencies. Appoint older students as assistant managers and have them help create and maintain the school-store staff schedules.

Pro tip: Have older students apply for the jobs, giving them résumé and interview practice.

9. Advertise your store.

This is another great cross-curricular learning activity. Have students write persuasive ads or commercials in English class. Then get the art students to design posters to post around school. Bring in the drama students to act in the commercials then play the ads during morning announcements or school news reports.

Pro tip: Don’t forget parents—place ads in school newsletters and on the school website, too.

10. Open the doors!

You’re ready to go! As with any small business, expect a few bumps along the road as you get started. Meet regularly with the student and adult staff to talk about what’s going well and what might need to be changed. Remember to be flexible as you tweak the process for your school’s needs.

Pro tip: Each quarter or semester, publicly announce profits for the store and share what those profits are being used for. This gives the whole school a sense of ownership and pride.

Copyright © 2024. All rights reserved. 5335 Gate Parkway, Jacksonville, FL 32256

Start a School Supply Store

Rekindle Your Inner Child: Dive into the World of a School Supply Store

SCHOOL SUPPLY STORE

Related business ideas, discover your perfect domain, school supply store mini business plan, expected percent margin:, earnings expectations:, required actions to achieve these numbers:, inventory management:, marketing and customer acquisition:, sales and customer service:, cost control:, business operations:, not what you had in mind here are more ideas, grab your business website name, step 1: determine if starting a school supply store is the right endeavor, breakdown of startup expenses, breakdown of ongoing expenses, examples of ways to make money, step 2: name the business, step 3: obtain licenses and permits, apply for necessary licenses and permits, maintain licenses and permits, seek professional assistance, step 4: find a location, researching the local market, negotiating a lease, securing the location, step 5: create a business plan, step 6: secure financing, cost of financing, other considerations, step 7: purchase supplies, tips on what supplies to purchase, step 8: market the business, step 9: open the store, explore more categories, take the next steps.

ShopShipShake Official Website

Bussines service or coronavirus bulk supplies buy directly from china factory.

Start a school supply store by following these 10 steps:

Step 1: plan your business.

A clear plan is essential for success as an entrepreneur. It will help you map out the specifics of your business and discover some unknowns. A few important topics to consider are:

- What are the startup and ongoing costs?

- Who is your target market?

How much can you charge customers?

What will you name your business.

Luckily we have done a lot of this research for you.

What are the costs involved in opening a school supply store?

A store space must be rented or purchased. Alternatively, you can launch the business online in the form of a website. If you take the online route, you must pay for the domain name and website maintenance. School supplies ranging from staplers to paper, book covers, pencils, pens, markers, binders, and beyond are necessary. Budget money for marketing along with a website, point-of-sale systems, retail display fixtures, inventory tracking software, a business license/permit, insurance, and labor. A handful of laborers will be necessary at the company’s launch. Laborers include cashiers and those who stock the shelves. You can add more people to the payroll as the business grows.

What are the ongoing expenses for a school supply store?

Ongoing expenses include store rent, employee wages, supplies, insurance, utilities, high-speed internet, and marketing. If you opt to rent your store rather than purchase the site where it will operate, you will likely spend between $700 and $1,500 or more per month in rent. The exact figure hinges on the location of your store and its size. Most employees will earn $8 to $12 per hour. If you hire a marketing professional, store manager, or accountant, they will earn a salary in the range of $30,000 to $50,000 or more. The cost of supplies hinges on the size of your store and the number of customers you attract. Budget at least a thousand dollars per month for supplies and adjust the figure accordingly as time progresses. Budget at least a couple hundred dollars per month for utilities including high-speed internet. Allocate at least $200 or more per month for marketing efforts.

Who is the target market?

The preferred client is a parent with multiple school-age youngsters. In some instances, teachers shop for classroom supplies on their own. Both of these customer types are inclined to spend a significant amount of money at your school supply store business.

How does a school supply store make money?

The business makes money by selling school supplies to students, parents of students, teachers, and schools.

Your school supplies will sell at a wide range of prices. Something as simple as a bookmark will sell for as little as fifty cents. A fancy binder portfolio will cost upwards of $30. However, most school supplies fall in the price range of a couple of dollars to $10.

How much profit can a school supply store make?

A school supply store has the potential to earn a profit of $20,000 to $50,000 or more in the first year. Grow the business, add another location, and profits can double in the ensuing year(s). Develop the business across the region and it is possible to earn hundreds of thousands of dollars or even a profit in the million-dollar range.

How can you make your business more profitable?

You can branch out by selling academic texts, backpacks, and toys like fidget spinners. Consider offering sales through your website. Customers can either pick up their online orders in-person at the brick-and-mortar location or you can deliver the items to the local purchaser. You can also try to sell office supplies along with holiday and party items to keep your store busy during the months in which school is not in session.

Choosing the right name is important and challenging. If you don’t already have a name in mind, visit our How to Name a Business guide or get help brainstorming a name with our School Supply Store Name Generator

If you operate a sole proprietorship , you might want to operate under a business name other than your own name. Visit our DBA guide to learn more.

When registering a business name , we recommend researching your business name by checking:

- Your state’s business records

- Federal and state trademark records

- Social media platforms

- Web domain availability .

It’s very important to secure your domain name before someone else does.

STEP 2: Form a legal entity

The most common business structure types are the sole proprietorship , partnership , limited liability company (LLC) , and corporation .

Establishing a legal business entity such as an LLC or corporation protects you from being held personally liable if your school supply store is issued.

STEP 3: Register for taxes

You will need to register for a variety of state and federal taxes before you can open for business.

In order to register for taxes, you will need to apply for an EIN. It’s really easy and free!

Learn how to get an EIN in our What is an EIN guide or find your existing EIN using our EIN lookup guide.

Small Business Taxes

Depending on which business structure you choose, you might have different options for how your business will be taxed. For example, some LLCs could benefit from being taxed as an S corporation (S corp).

You can learn more about small business taxes in these guides:

- Sole Proprietorship vs LLC

- LLC vs Corporation

- LLC vs S Corp

- How to Start an S Corp

There are specific state taxes that might apply to your business. Learn more about state sales tax and franchise taxes in our state sales tax guides.

STEP 4: Open a business bank account & credit card

Using dedicated business banking and credit accounts is essential for personal asset protection.

When your personal and business accounts are mixed, your personal assets (your home, car, and other valuables) are at risk in the event your business is sued. In business law, this is referred to as piercing your corporate veil .

Additionally, learning how to build business credit can help you get credit cards and another financing in your business’s name (instead of yours), better interest rates, higher lines of credit, and more.

Open a business bank account

- This separates your personal assets from your company’s assets, which is necessary for personal asset protection.

- It also makes accounting and tax filing easier.

STEP 5: Set up business accounting

Recording your various expenses and sources of income is critical to understanding the financial performance of your business. Keeping accurate and detailed accounts also greatly simplifies your annual tax filing.

STEP 6: Obtain necessary permits and licenses

Failure to acquire necessary permits and licenses can result in hefty fines, or even cause your business to be shut down.

State & Local Business Licensing Requirements

Certain state permits and licenses may be needed to operate a school supply store. Learn more about licensing requirements in your state by visiting SBA’s reference to state licenses and permits .

Most businesses are required to collect sales tax on the goods or services they provide. To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses .

For more information about local licenses and permits:

- Check with your town, city or county clerk’s office

- Get assistance from one of the local associations listed in US Small Business Associations directory of local business resources .

Certificate of Occupancy

A school supply store is generally run out of a storefront. Businesses operating out of a physical location typically require a Certificate of Occupancy (CO). A CO confirms that all building codes, zoning laws and government regulations have been met.

- It is generally the landlord’s responsibility to obtain a CO.

- Before leasing, confirm that your landlord has or can obtain a valid CO that is applicable to a school supply store.

- After a major renovation, a new CO often needs to be issued. If your place of business will be renovated before opening, it is recommended to include language in your lease agreement stating that lease payments will not commence until a valid CO is issued.

- You will be responsible for obtaining a valid CO from a local government authority.

- Review all building codes and zoning requirements for your business’ location to ensure your school supply store will be in compliance and able to obtain a CO.

STEP 7: Get business insurance

Just as with licenses and permits, your business needs insurance in order to operate safely and lawfully. Business Insurance protects your company’s financial wellbeing in the event of a covered loss.

There are several types of insurance policies created for different types of businesses with different risks. If you’re unsure of the types of risks that your business may face, begin with General Liability Insurance . This is the most common coverage that small businesses need, so it’s a great place to start for your business.

Learn more about General Liability Insurance .

Another notable insurance policy that many businesses need is Workers’ Compensation Insurance . If your business will have employees, it’s a good chance that your state will require you to carry Workers’ Compensation Coverage.

STEP 8: Define your brand

Your brand is what your company stands for, as well as how your business is perceived by the public. A strong brand will help your business stand out from competitors.

If you aren’t feeling confident about designing your small business logo, then check out our Design Guides for Beginners, we’ll give you helpful tips and advice for creating the best unique logo for your business.

Step9: The True Flame Logo

Recommended: Get a logo using Truic’s free logo Generator no email or sign up required, or use a Premium Logo Maker.

If you already have a logo, you can also add it to a QR code with our Free QR Code Generator. Choose from 13 QR code types to create a code for your business cards and publications, or to help spread awareness for your new website.

Step10 How to promote & market a school supply store

Market your school supply store across an array of mediums. Advertise in the local paper and on local radio. It is also advisable to build a highly polished, easy-to-use website that appeals to youngsters, parents, and teachers alike. Optimize all of your online content for search engines (SEO). This means the website should be laden with keywords and key phrases pertaining to your locale, your inventory, and your customers. The website should also feature a regularly updated blog and links to your social media accounts. Update your social media accounts several times per week with information about sales, new inventory, special offers, and links to information that relates to academics.

How to keep customers coming back The best way to attract customers is to position the business by several schools, universities, malls, and other businesses/organizations that attract youngsters. If your store is located far away from prospective customers, it will prove awfully difficult to attract a steady stream of business. Once you pinpoint the perfect location, get your name out there through a wide-ranging marketing push. Advertise in the local paper, on local radio, in flyers, on billboards, and on the web. In terms of retaining customers, make sure your inventory is high-quality and your prices are competitive with other local school supplies stores. Make sure you have a wide array of supplies that appeal to grade school students, junior high school students, and university students.

Wrapping up

We at ShopShipShake have been working with businesses like yours with fulfilling experiences. We offer one-stop services, including an efficient supply chain, over 10 thousand of China’s suppliers, and more. With a successful track record of over 20,000 clients, we are sure to deliver your orders requirements. Let’s get in touch to build, sustain, and grow your businesses.

If you would like to know more details about us, please contact with us:

www.shopshipshake.co.za

If you are interested in cooperating with us. Please register on:

https://bit.ly/3ks0m1M

Discover more from ShopShipShake Official Website

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

IMAGES

COMMENTS

Marketing promotion expenses for the grand opening of Regina Trent® School Supplies Company, LLC in the amount of $3,500 and as well as flyer printing (2,000 flyers at $0.04 per copy) for the total amount of $3,580. The cost for hiring business consultant - $2,500.

Plan your School Supply Store. Form your School Supply Store into a Legal Entity. Register your School Supply Store for Taxes. Open a Business Bank Account & Credit Card. Set up Accounting for your School Supply Store. Get the Necessary Permits & Licenses for your School Supply Store. Get School Supply Store Insurance.

Think of something that your customers will value. Maybe lower price, better customer service, convenience, etc. These are important because they will set you apart from your competitors. 3. Order From Direct Suppliers. Often, pricing and variety are keys to a successful school and office supplies store.

You'll need a receipt book and pens. Remember to get an account and inventory ledger, too, or use QuickBooks Online —it's free for teachers and students (more on that below). Pro tip: Give your school-store staff name tags or even an official T-shirt or badge to wear when they're on the job. 6. Price the items.

In a School Supply Store business plan, the following financial information should be included: 1. **Startup Costs**: Detail the initial expenses required to launch the school supply store, such as leasing a retail space, purchasing inventory, equipment, furniture, signage, licenses, permits, and any other necessary items. ...

The first step in starting a student-run school store is to get approval from the school's administration. They'll have to sign off on things like an initial budget, location, and operating hours, so getting their official buy-in in the beginning is important. Have the students involved in the store's planning to draw up a business plan ...

Creating a Business Plan for a School Supplies Retailer. A common mistake for an entrepreneur is to not create a business plan. The key benefit of writing a business plan is that it establishes both a framework and a roadmap for your business. If you don't have a business plan, your leadership will be handicapped, choosing short-term ...

Step 3: Obtain Licenses and Permits. The third step in starting a school supply store is to obtain all necessary licenses and permits. It is important to research the types of licenses and permits that are required for a business of this type. Depending on the location, the business may need to obtain a business license, a seller's permit, a ...

STEP 2: Form a legal entity. The most common business structure types are the sole proprietorship, partnership, limited liability company (LLC), and corporation. Establishing a legal business entity such as an LLC or corporation protects you from being held personally liable if your school supply store is issued.

Global Market Size for School Supplies The school supplies industry is a lucrative market that has seen significant growth in recent years. According to a report by Grand View Research, the global school supplies market size was valued at $19.4 billion in 2019 and is projected to reach $24.7 billion by 2027, growing at a compound annual growth rate (CAGR) of 3.1% during the forecast period.

In a School Supply Store business plan, several key financial information should be included to provide a comprehensive understanding of the financial aspects of the business. These may include: 1. Start-up costs: Detail the initial expenses required to establish the School Supply Store. This may include costs for leasing or purchasing a ...

Before opening your teacher store, you will want to consider your business plan and ensure you have adequate financing. You will need to ascertain what support your teachers and students require and if you have enough teachers in your immediate area to supply. Check our office locations, apply a sensible budget and line up a reliable wholesale ...

1. Develop a Plan. Start by creating a business plan. Better yet, have your school store manager create one. It can be simple or extravagant. You'll want to calculate costs and potential profits, and outline a general plan of action. 2. Location.

It's easy to start selling school supplies through your own online store, whether you're looking to sell backpacks, pencils or notebooks, or selling specific supplies and textbooks for college and university classes. Shopify online stores allow you to set up your store in minutes, with more than 80 mobile-friendly website templates — no ...

Many private-independent school administrators have questions when it comes to running a successful school store. To provide assistance, Jerry Chambers, BCP-E, ISM Consultant, and the Chief Financial Officer at The First Academy, recently hosted a webinar titled "10 Things to Know to Start a Successful School Store."

In 2020, the average back-to-school spending hovered around $727.However, it was a drop from $919 recorded in 2019, caused by the pandemic. Despite the decrease, that shouldn't discourage you from starting a school supply business if you want to. The most important thing is to gather as much information as possible to get the supply store running.

How to Set Up a School and Office Supplies Store A school and office supplies store is almost as stable as the food business, because students and offices will continue to consume needed supplies even if there is a recession. Even better is that the products sold are non-perishable. Below are some of the important things to note if you plan to ...

Head Shop Business Plan [Sample Template] Simply put, a stationery store and office supplies business is a place where books, magazines, newspapers, text books, writing pads, greeting cards/postcards and stationery are retailed. Some book stores even go ahead to secure license to operate a mobile money center or a money transfer center.

Office desk sets with chairs and assorted supplies (6) Workstations and a central file server, two laser printers, and Internet connection (6) Copier, fax machine. Assorted pieces of office furniture. Assorted shipping material. Unit phone system with answer service (7) Shelving units for storage. Used fork lift.

Demand \ Supply Gap A 17 Market School and Office Supplies. 20 - B 15 Mongolian Company. 30 -14. C 13 13. D 17 17 E 15 15. F 6 6. TOTAL 85 50 35. Table 5. Shows gap between demand and supply. Competitors. The proponents has identified the following : MS'C Paper Supply , BEST , Gaisano , Robinson CNC, as the competitors of the product.

Showcase your school supplies with professionally edited photos or build customer loyalty with rewards programs. With over 6000 options in the Shopify App Store, you can customize your store experience and test for success.