Launching soon – Support us on Product Hunt 🐱 and get 50% off your first month! Get 50% Off →

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks (Coming soon...) Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

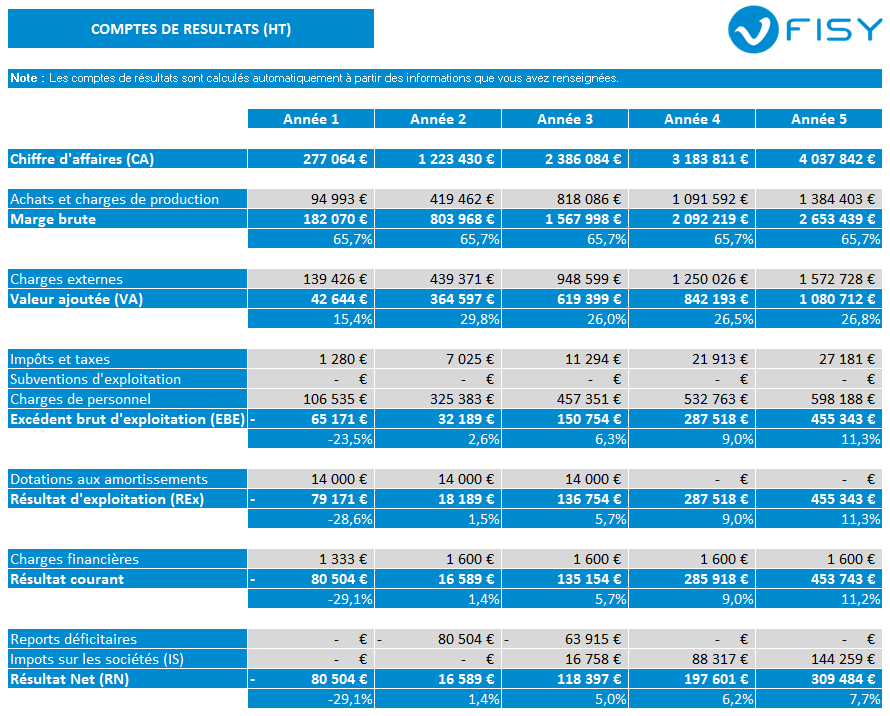

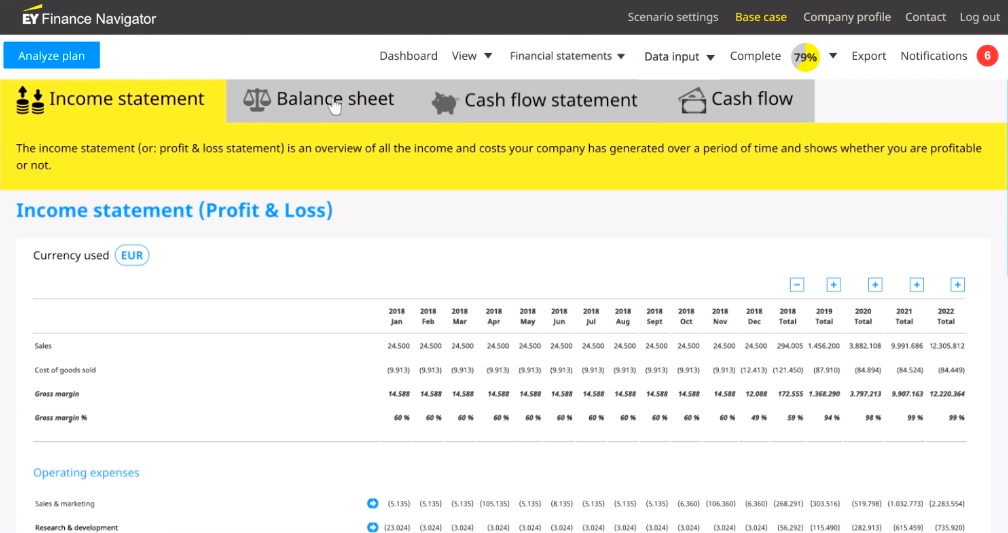

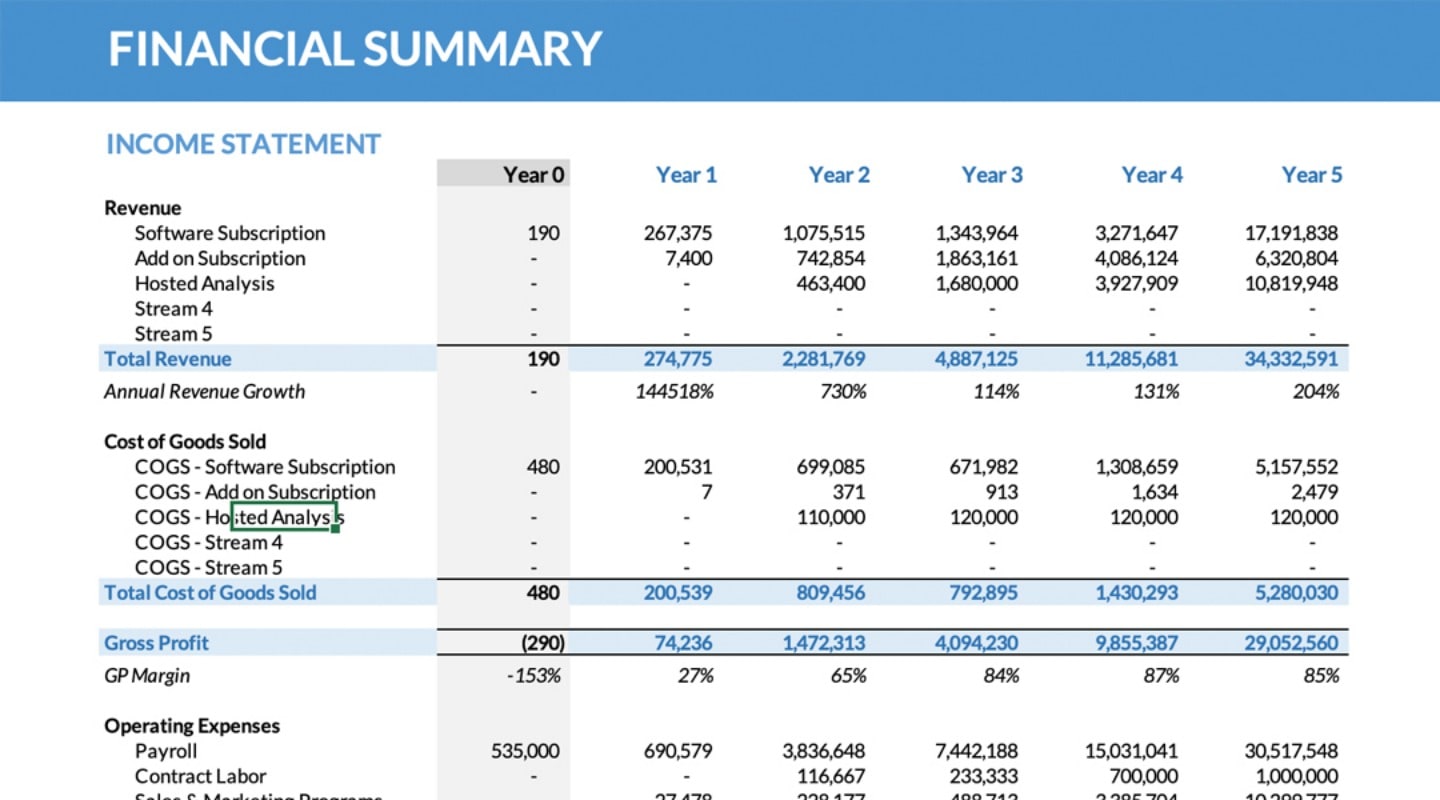

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

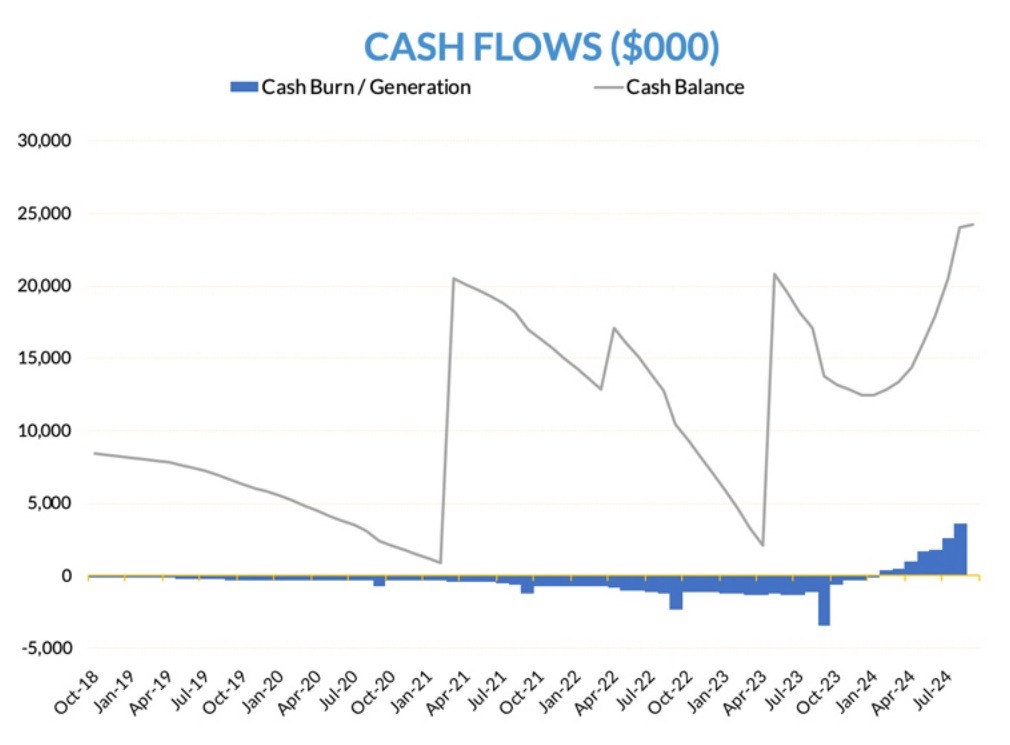

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

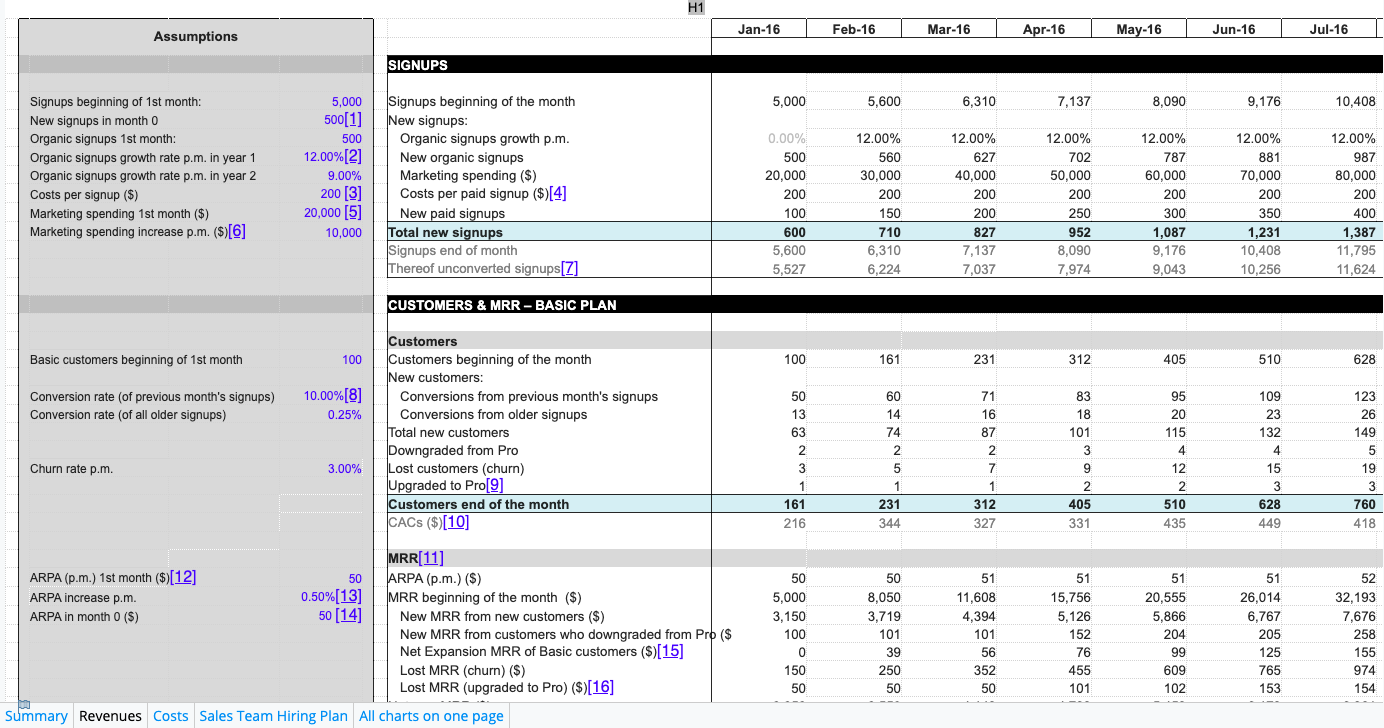

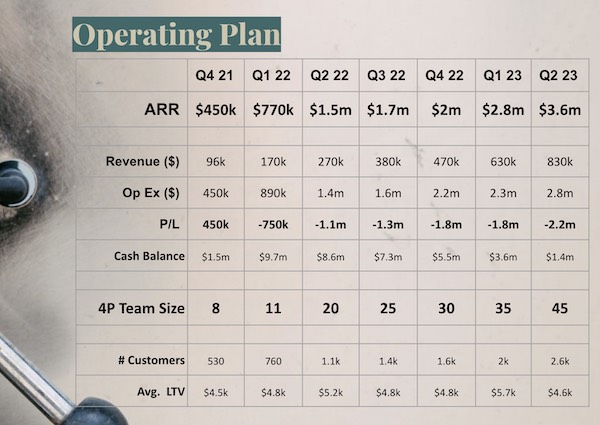

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

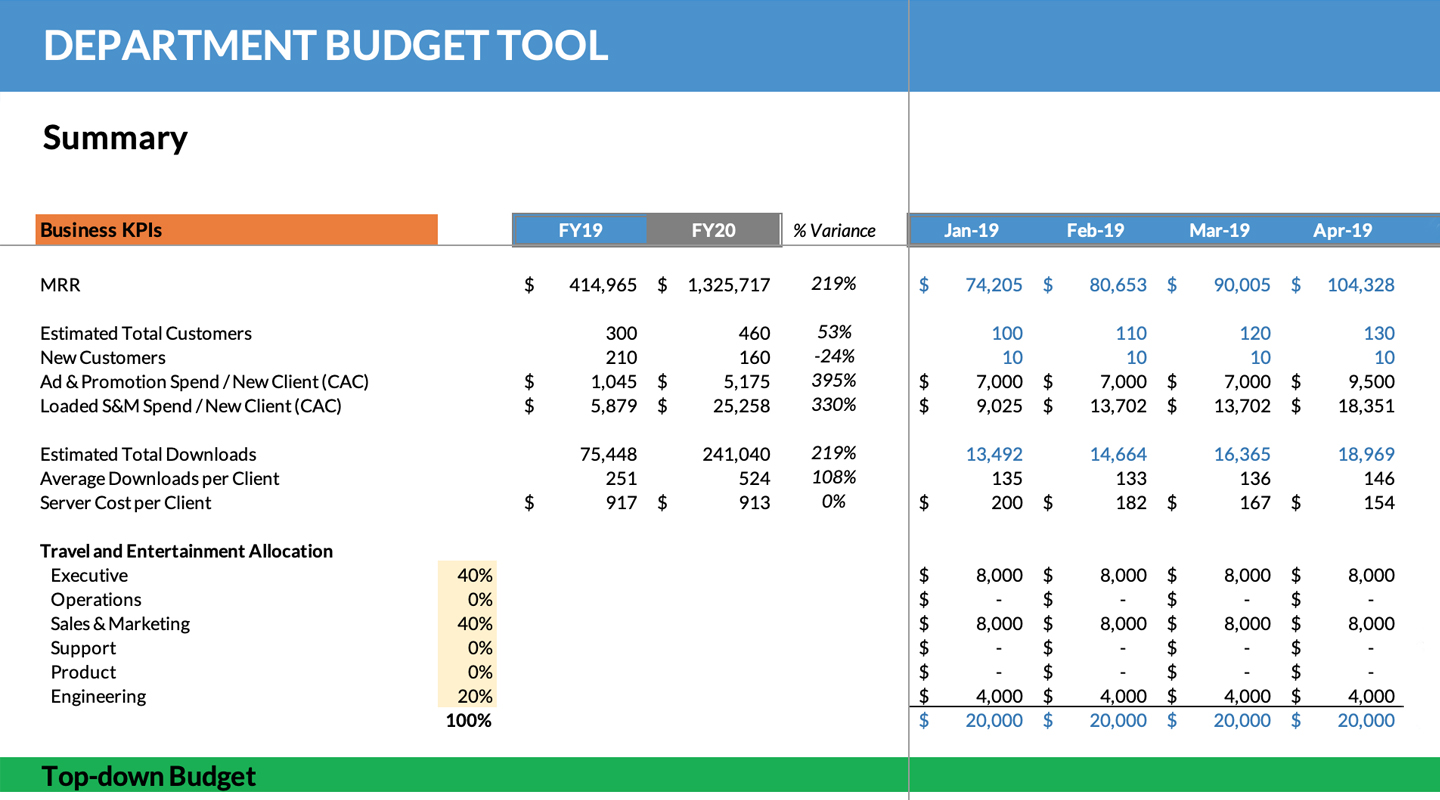

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

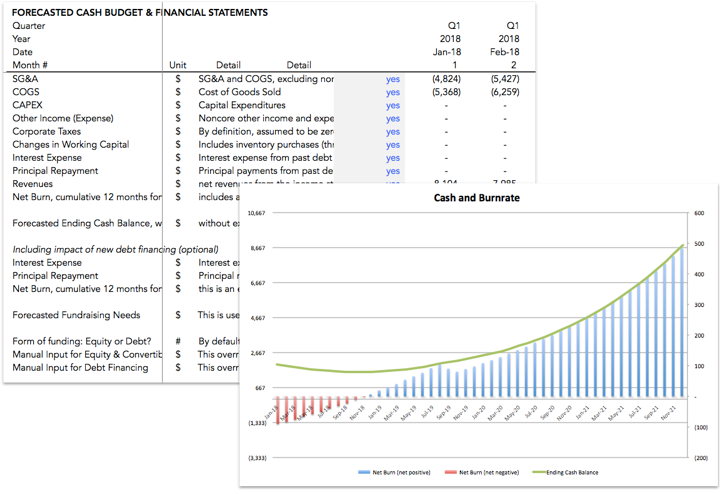

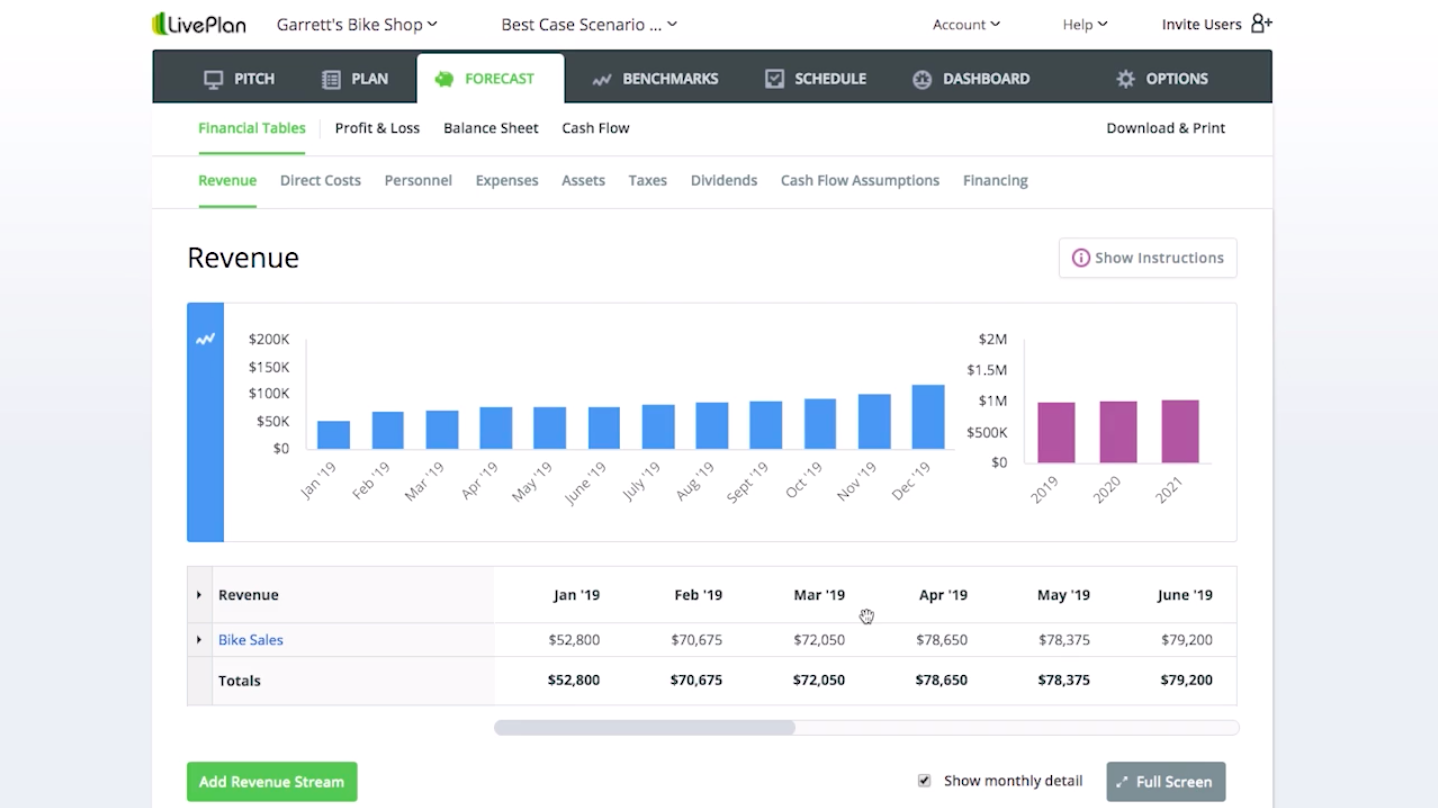

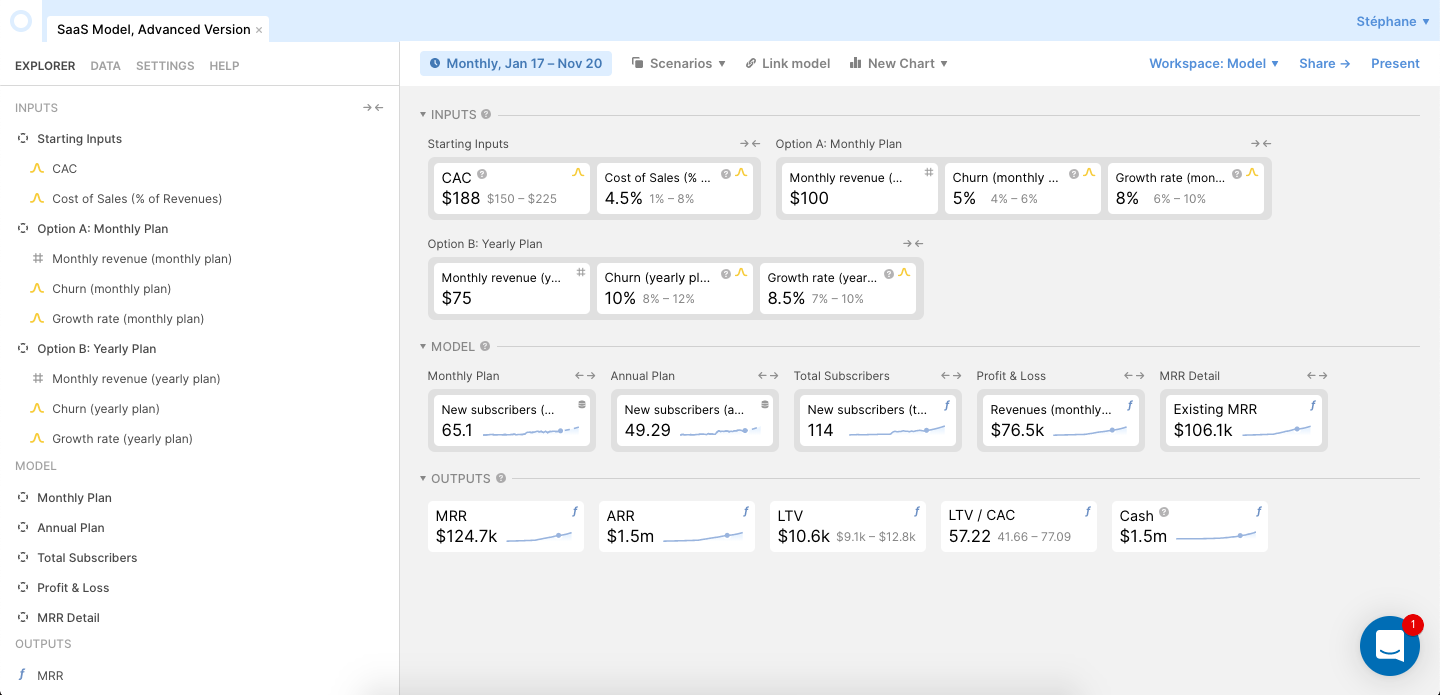

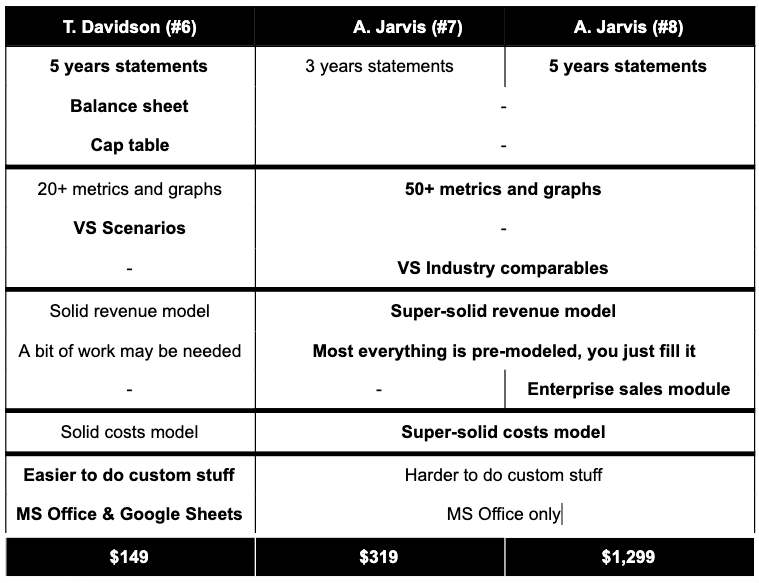

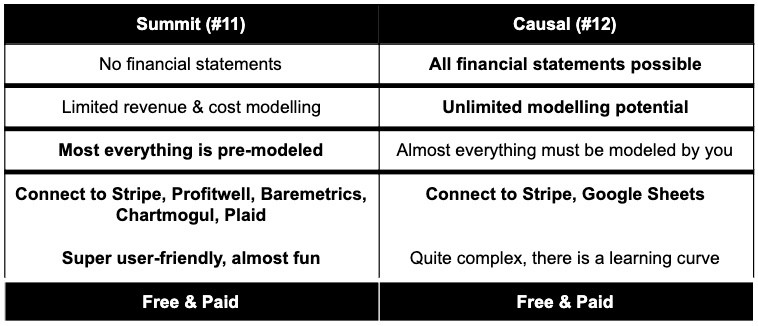

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

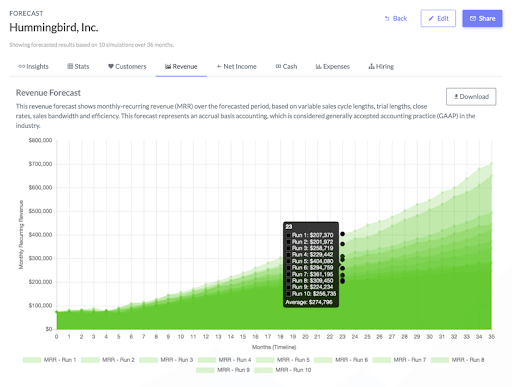

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

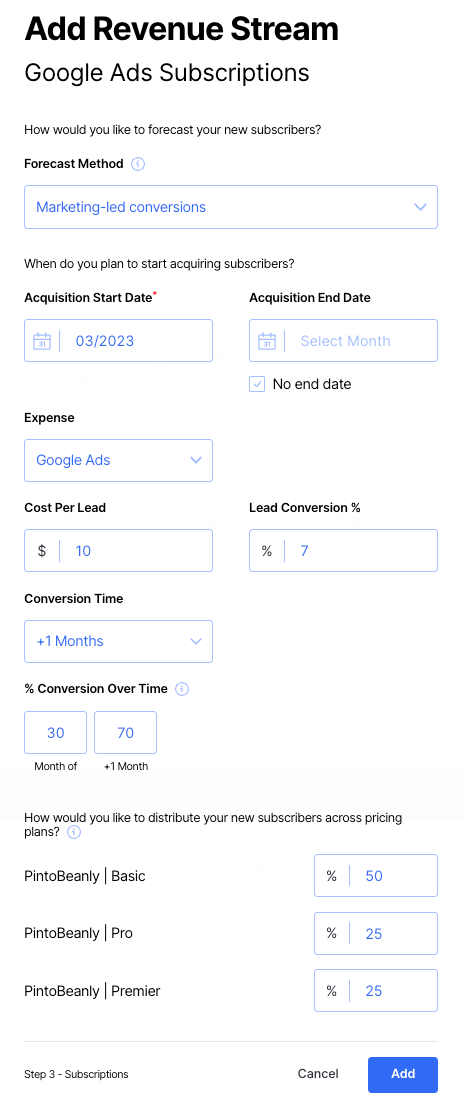

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

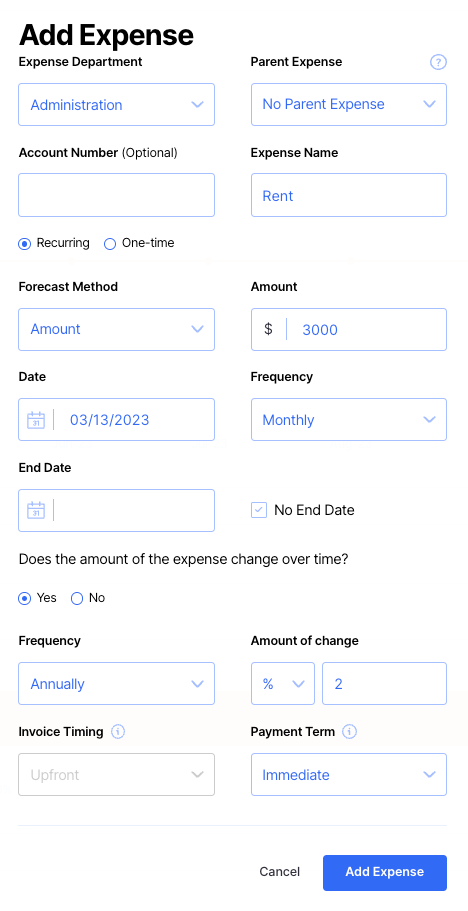

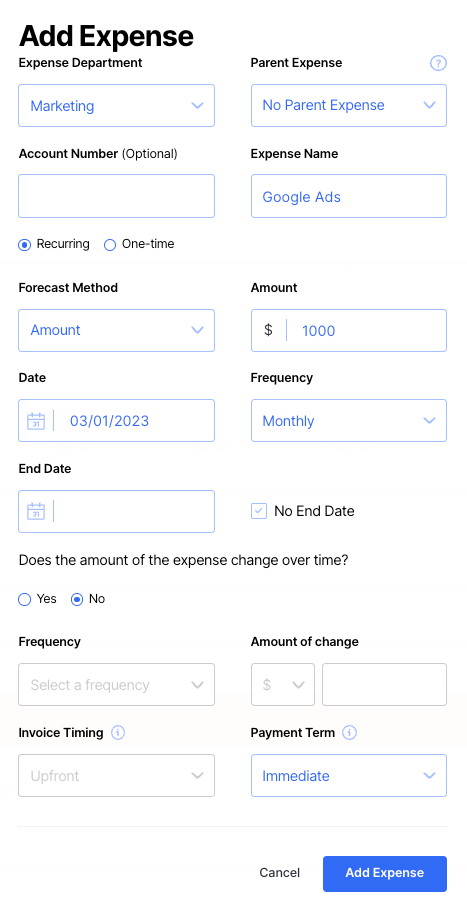

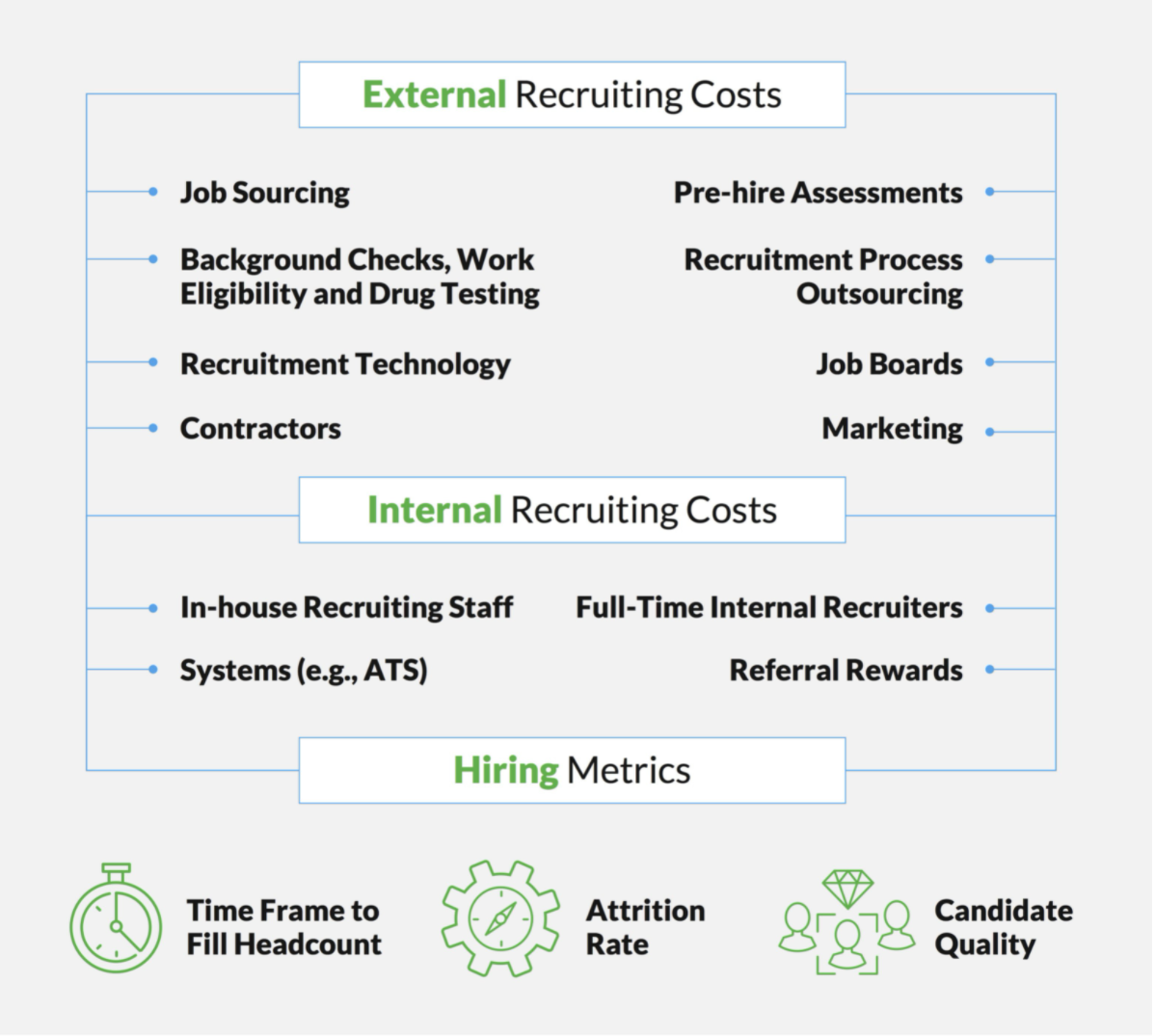

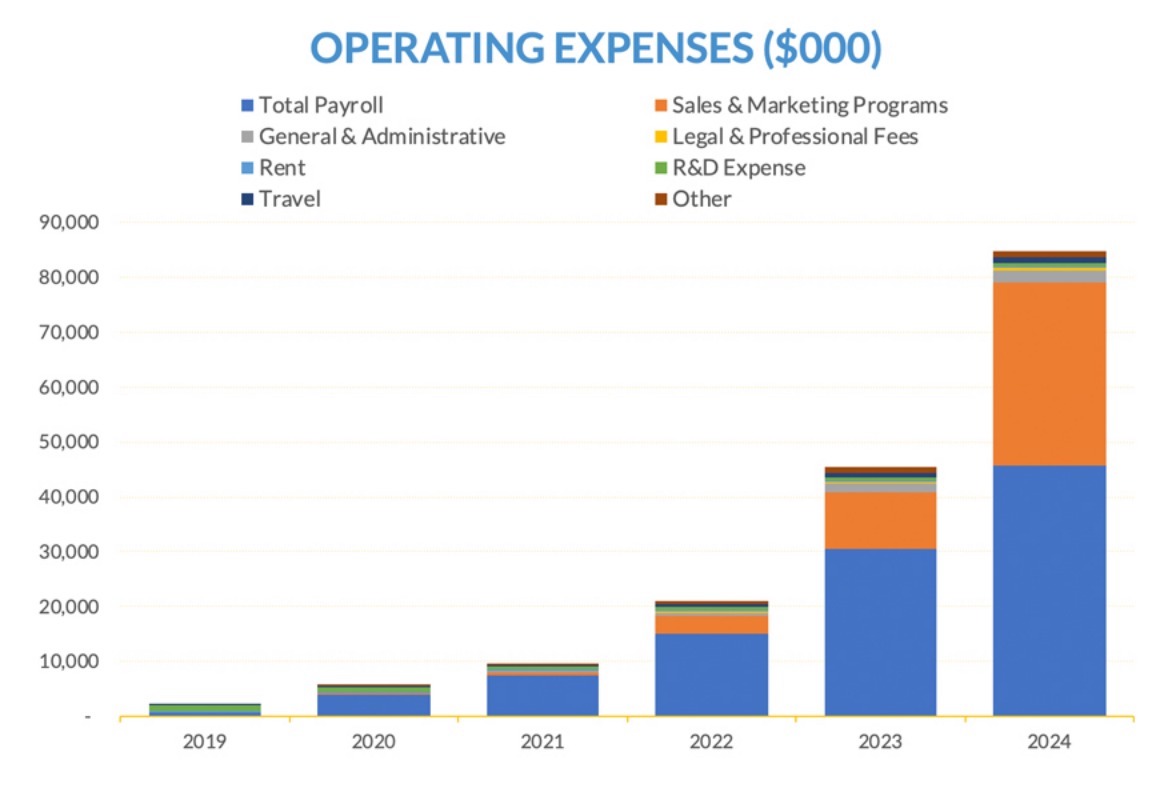

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

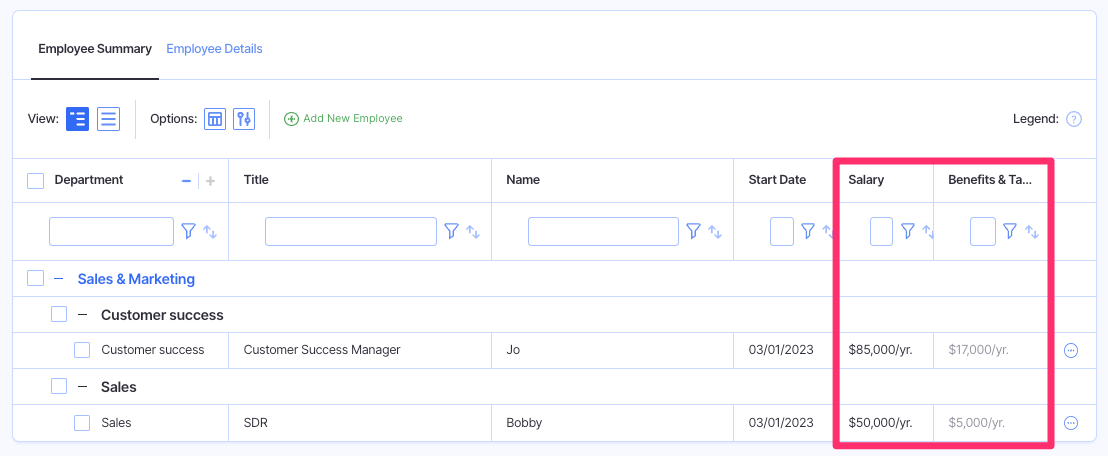

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

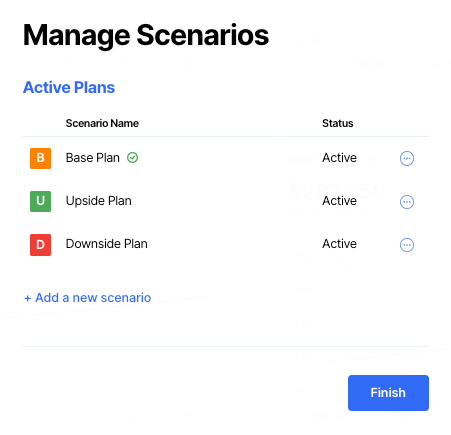

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

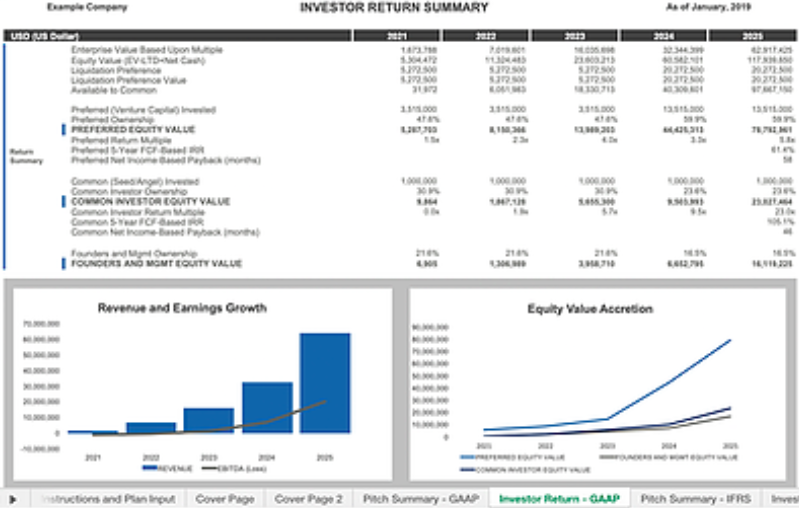

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

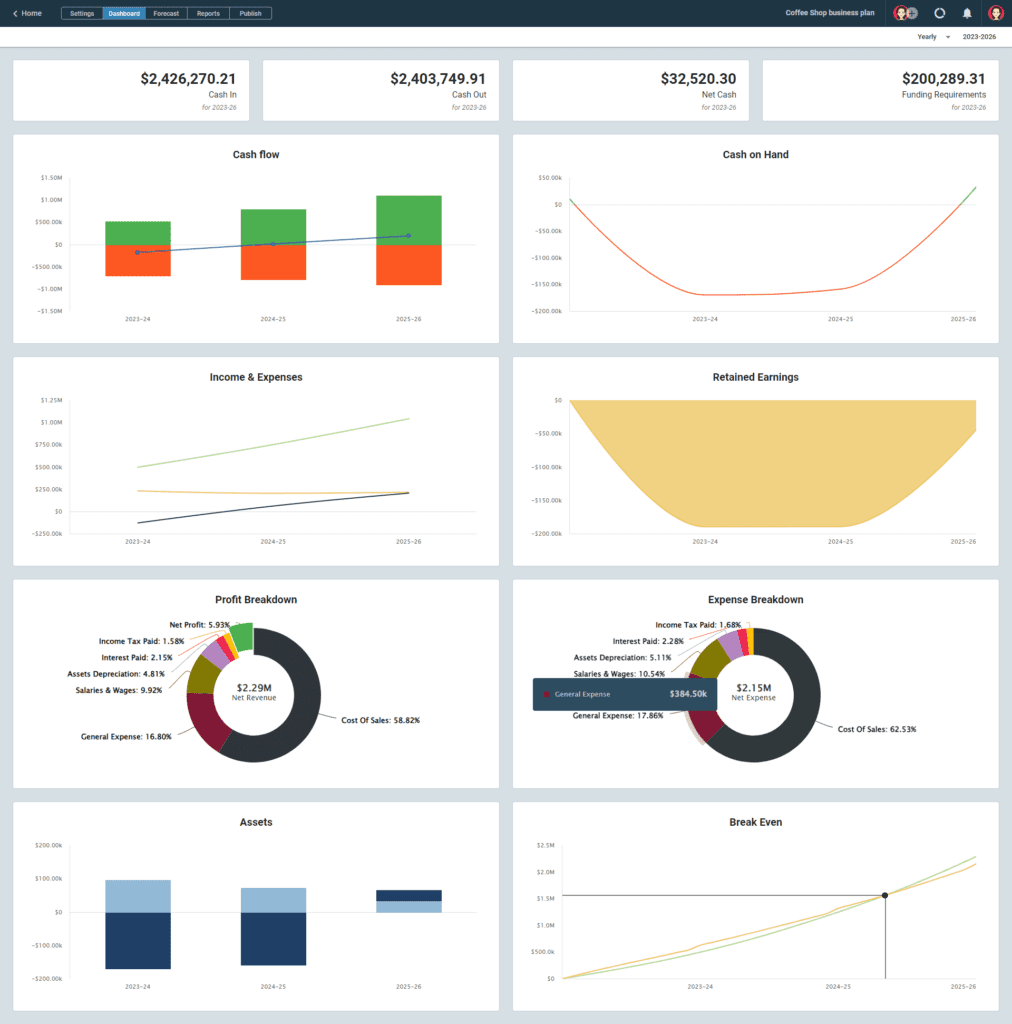

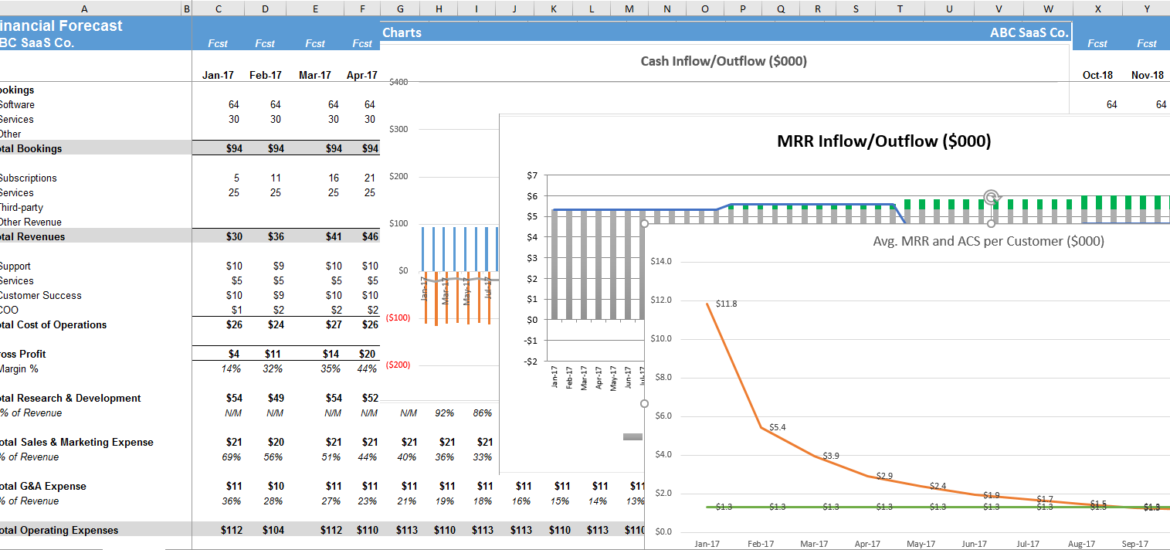

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

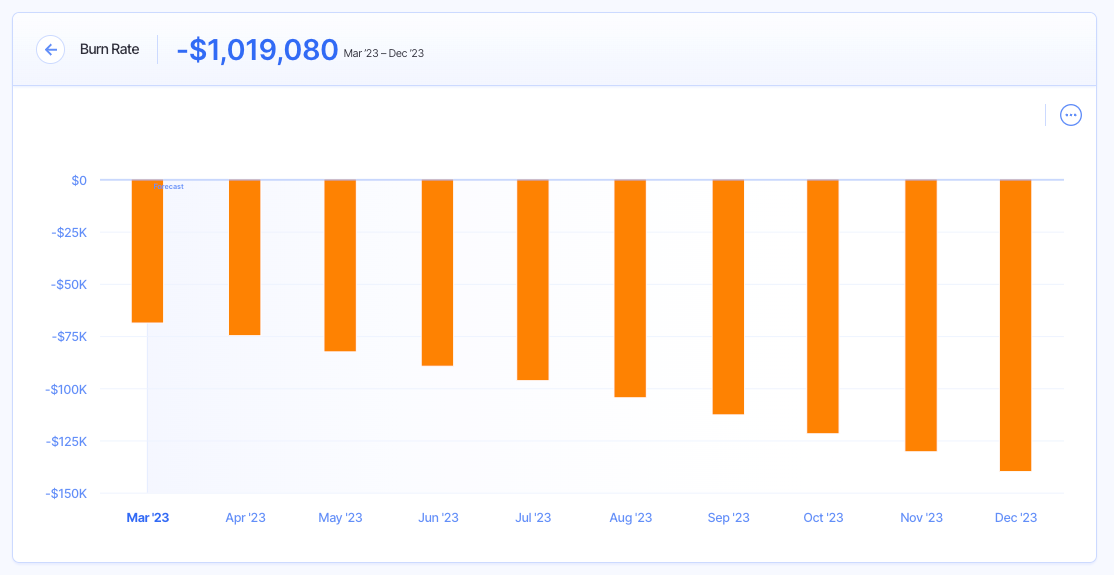

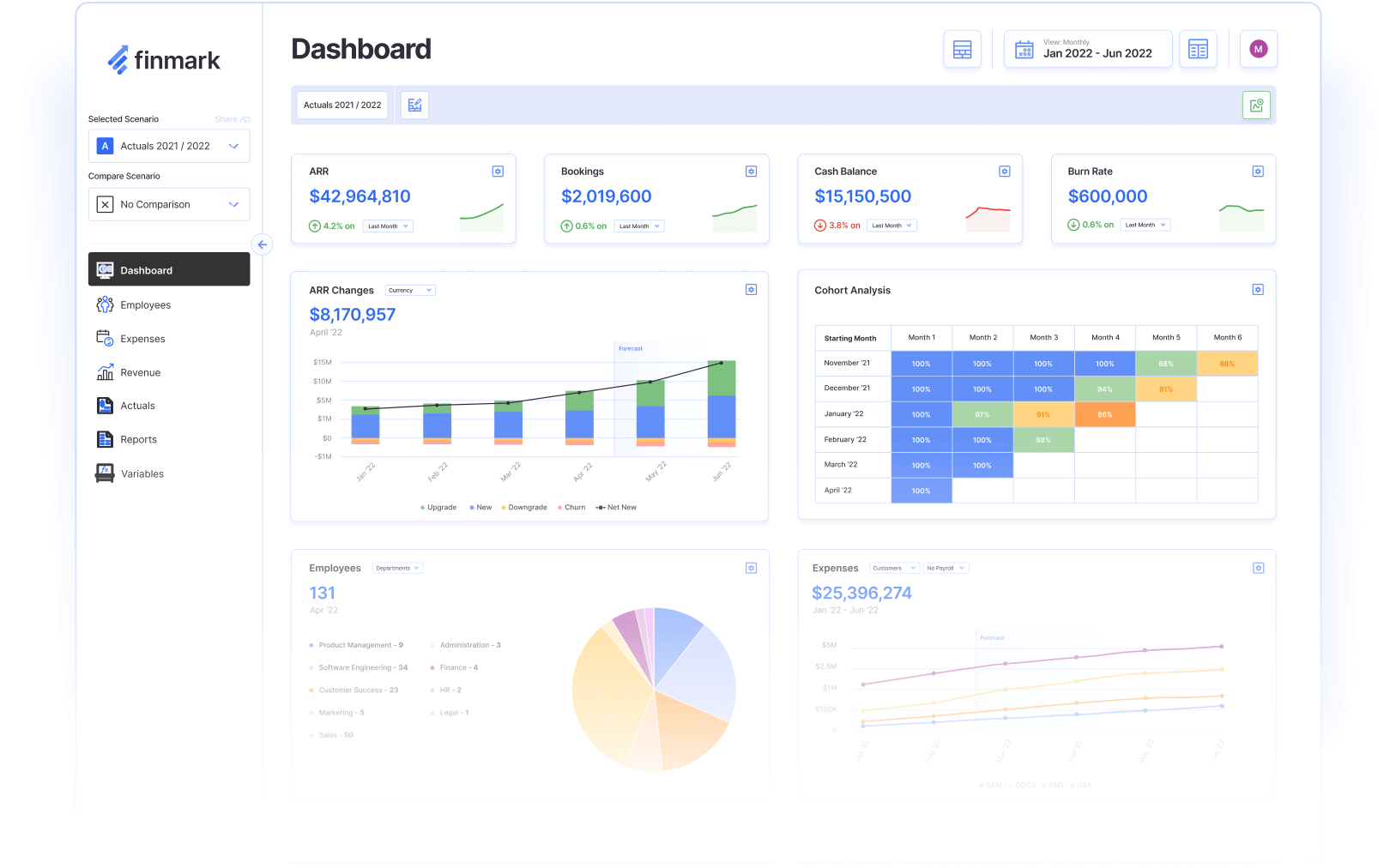

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

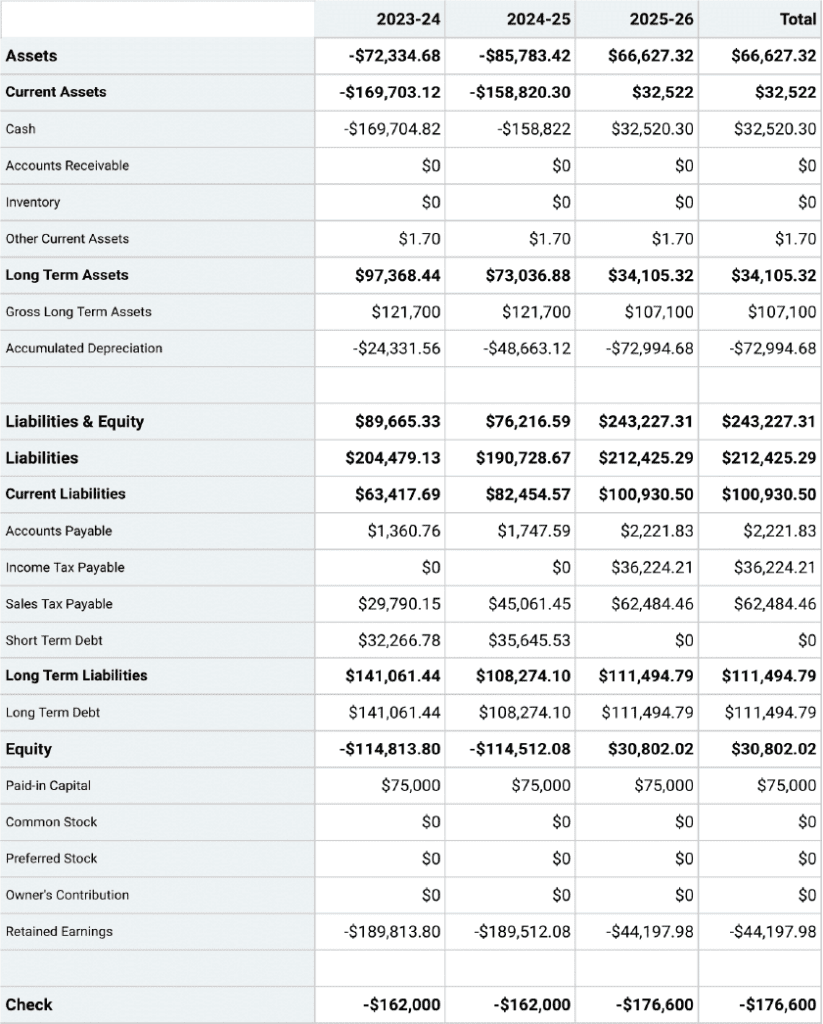

Projected Balance Sheet

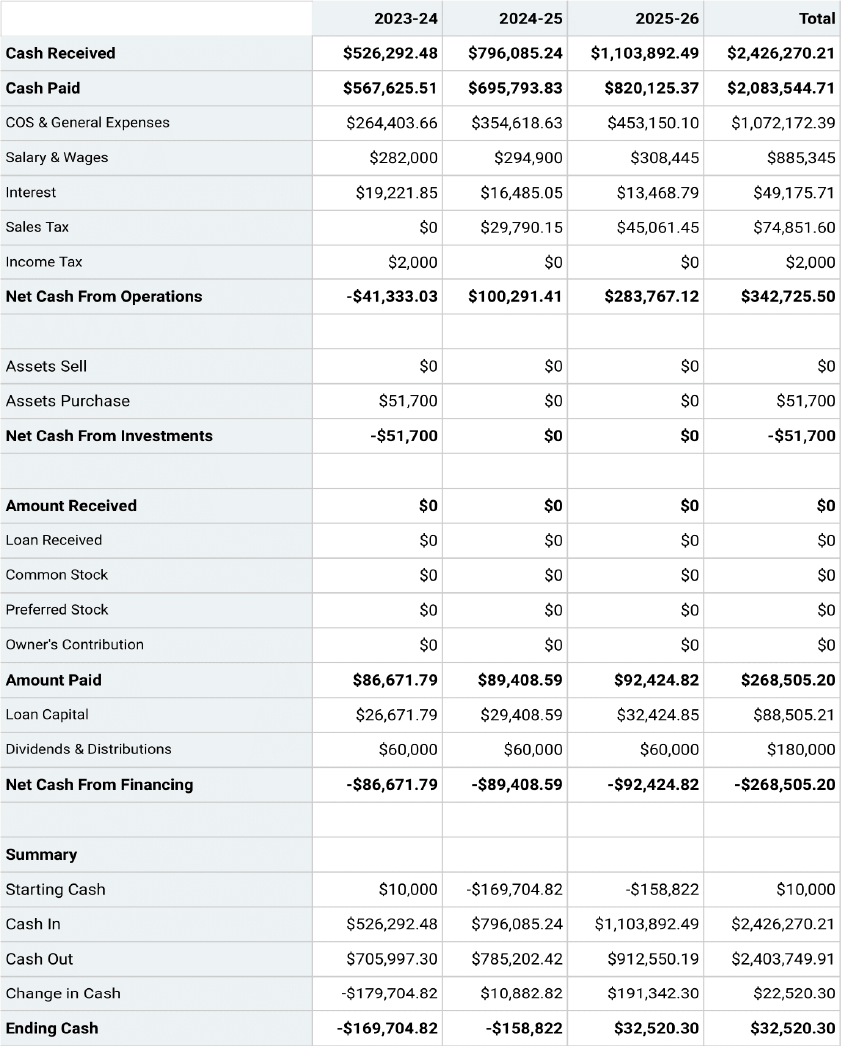

Projected Cash-Flow Statement

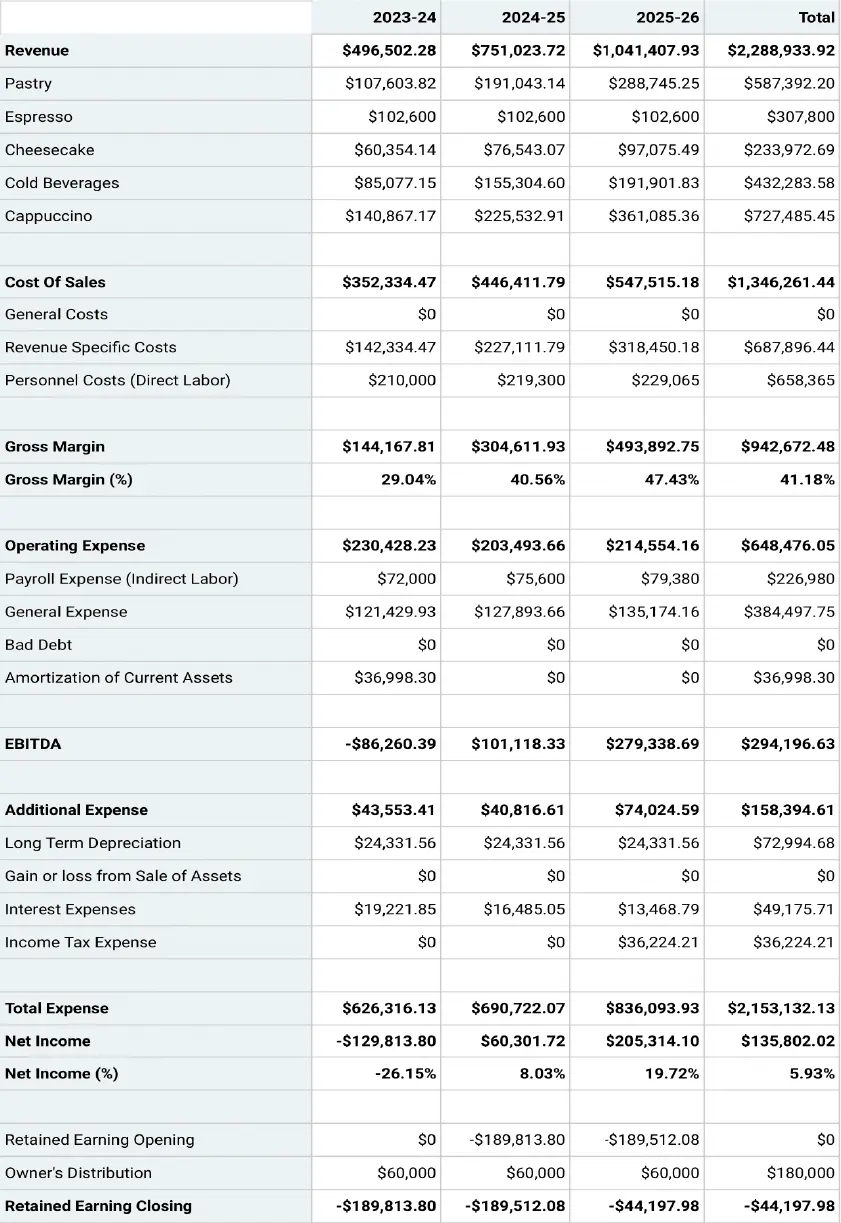

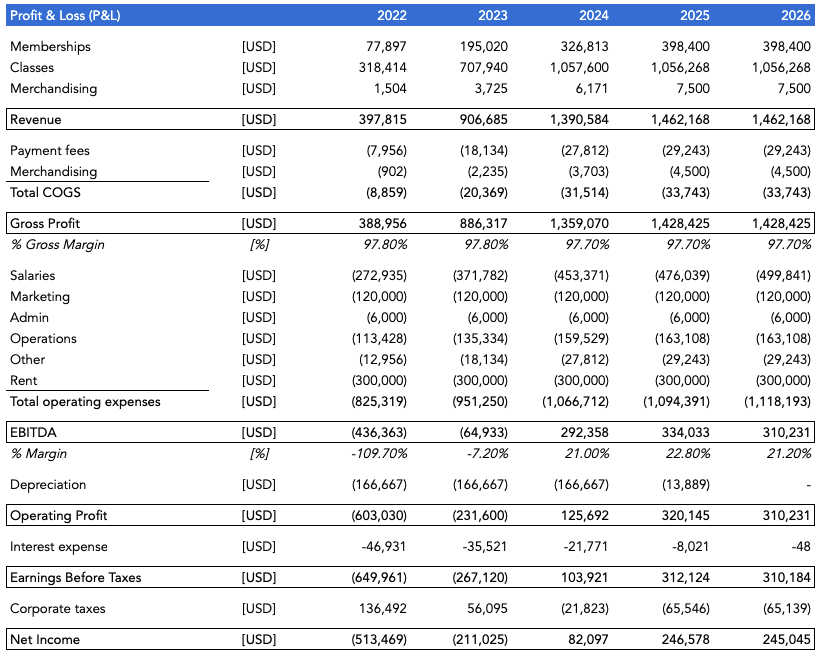

Projected Profit & Loss Statement

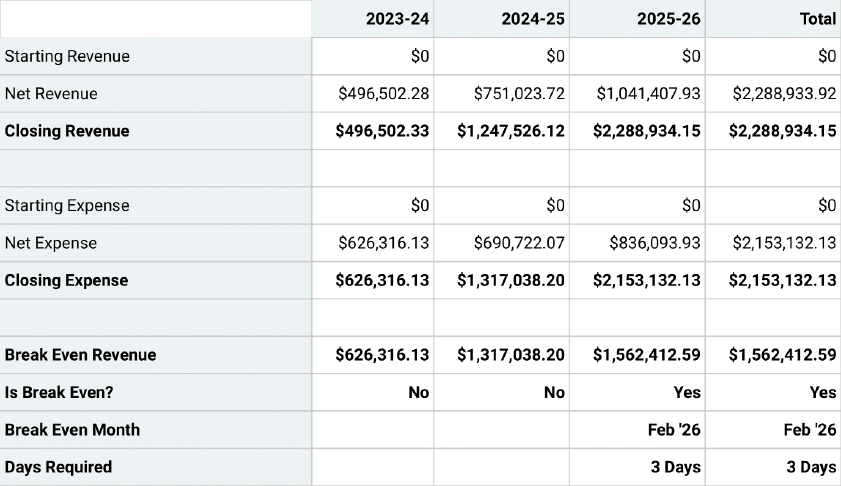

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

4 Key Financial Statements For Your Startup Business Plan

- September 12, 2022

- Fundraising

If you’re preparing a business plan for your startup, chances are that investors (or a bank) have also asked you to produce financial projections for your business. That’s absolutely normal: any startup business plan should at least include forecasts of the 3 financial statements.

The financial projections need to be presented clearly with charts and tables so potential investors understand where you are going, and how much money you need to get there .

In this article we explain you what are the 4 financial statements you should include in the business plan for your startup. Let’s dive in!

Financial Statement #1: Profit & Loss

The profit and loss (P&L) , also referred to as “income statement”, is a summary of all your revenues and expenses over a given time period .

By subtracting expenses from revenues, it gives a clear picture of whether your business is profitable, or loss-making. With the balance sheet and the cash flow statement, it is one of the 3 consolidated financial statements every startup must produce every fiscal year .

Most small businesses produce a P&L on a yearly basis with the help of their accountant. Yet it is good practice to keep track of all revenues and expenses on a monthly or quarterly basis as part of your budget instead.

When projecting your financials as part of your business plan, you must do so on a monthly basis. Usually, most startups project 3 years hence 36 months. If you have some historical performance (for instance you started your business 2 years ago), project 5 years instead.

Expert-built financial model templates for tech startups

Financial Statement #2: Cash Flow

Whilst your P&L includes all your business’ revenues and expenses in a given period, the cash flow statement records all cash inflows and outflows over that same period.

Some expenses are not necessarily recorded in your P&L but should be included in your cash flow statement instead. Why is that? There are 2 main reasons:

- Your P&L shows a picture of all the revenues you generated over a given period as well as the expenses you incurred to generate these revenues . If you sell $100 worth of products in July 2021 and incurred $50 cost to source them from your supplier, your P&L shows $100 revenues minus $50 expenses for that month. But what about if you bought a $15,000 car to deliver these products to your customers? The $15,000 should not be recorded as an expense in your P&L, but a cash outflow instead. Indeed, the car will help you generate revenues, say over the next 5 years, not just in July 2021

- Some expenses in your P&L are not necessarily cash outflows. Think depreciation and amortization expenses for instance: they are pure artificial expenses and aren’t really “spent”. As such, whilst your P&L might include a $100 depreciation expense, your cash flow remains the same.

Financial Statement #3: Balance Sheet

Whilst the P&L and cash flow statement are a summary of your financial performance over a given time period, the balance sheet is a picture of your financials at a given time.

The balance sheet lists all your business’ assets and liabilities at a given time (at end of year for instance). As such, it includes things such as:

- Assets: patents, buildings, equipments, customer receivables, tax credits etc. Assets can be either tangible (e.g. buildings) or intangible (e.g. customer receivables ).

- Liabilities: debt, suppliers payables, etc.

- Equity : the paid-in capital invested to date in the company (from you and any other potential investors). Equity also includes the cumulative result of your P&L: the sum of your profits and losses to date

Whilst P&L and cash flow statement are fairly simple to build when preparing your business plan, you might need help for your balance sheet.

Financial Statement #4: Use of Funds

The use of funds is not a mandatory financial statement your accountant will need to prepare every year. Instead, you shall include it in your startup business plan, along with the 3 key financial statements.

Indeed, the use of funds tells investors where you will spend your money over a given time frame. For instance, if you are raising $500k to open a retail shop, you might need $250k for the first year lease and another $250k for the inventory.

Use of funds should not be an invention from you: instead it is the direct result of your cash flow statement . If you are raising for your first year of business, and your projected cash flow statement result in a $500k loss (including all revenues and expenses), you will need to raise $500k.

For instance, using the example above, if you need $500k over the next 12 months, raise $600k or so instead. Indeed, better be on the safe side in case things do not go as expected!

Related Posts

Pro One Janitorial Franchise Costs $9K – $76K (2024 Fees & Profits)

- July 5, 2024

Dance Studio Business Plan PDF Example

- June 17, 2024

- Business Plan

Carpet and Upholstery Cleaning Business Plan PDF Example

Privacy overview.

| Cookie | Duration | Description |

|---|---|---|

| BIGipServerwww_ou_edu_cms_servers | session | This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| language | session | This cookie is used to store the language preference of the user. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_QP2X5FY328 | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-189374473-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| browser_id | 5 years | This cookie is used for identifying the visitor browser on re-visit to the website. |

| WMF-Last-Access | 1 month 18 hours 11 minutes | This cookie is used to calculate unique devices accessing the website. |

Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

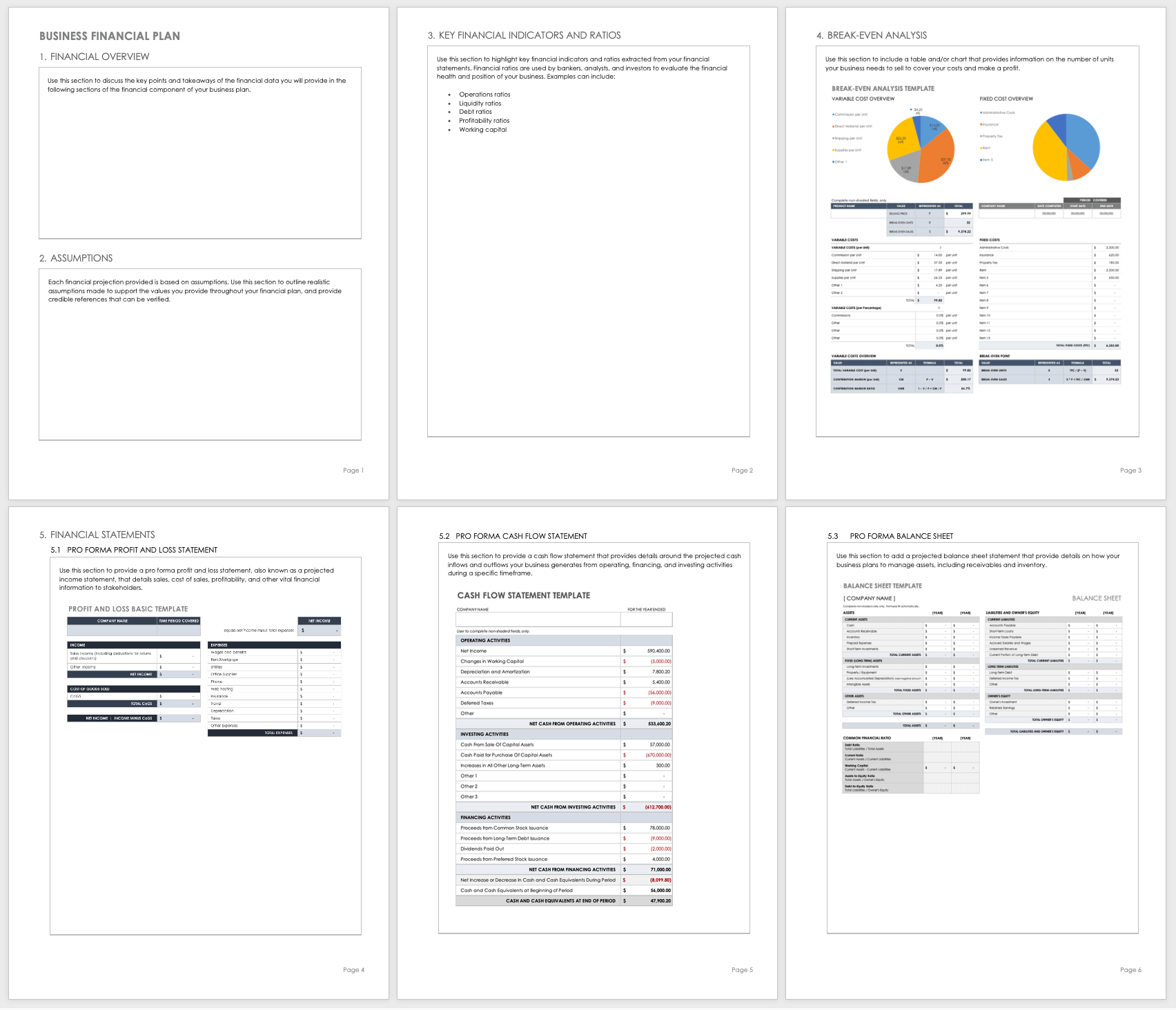

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

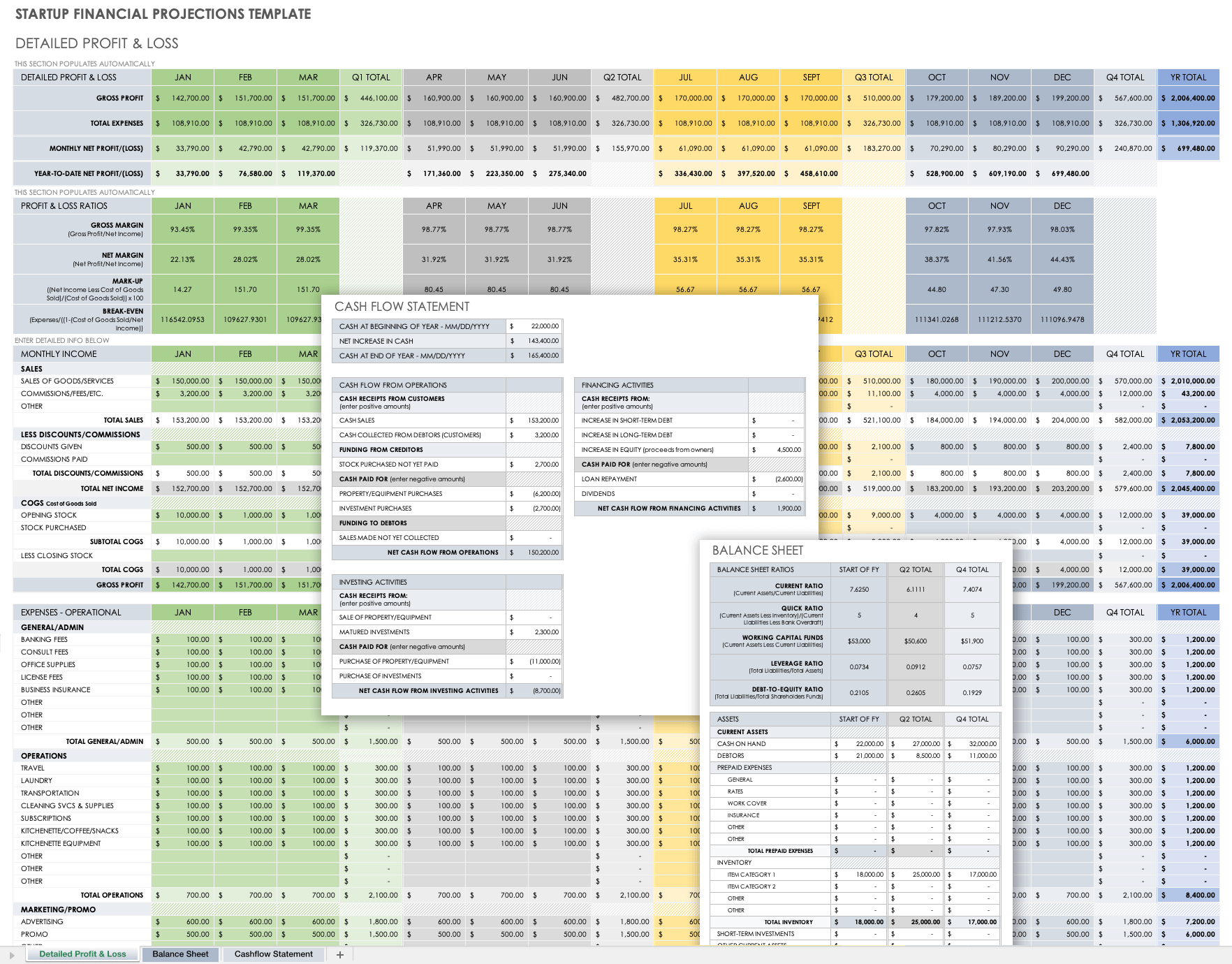

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

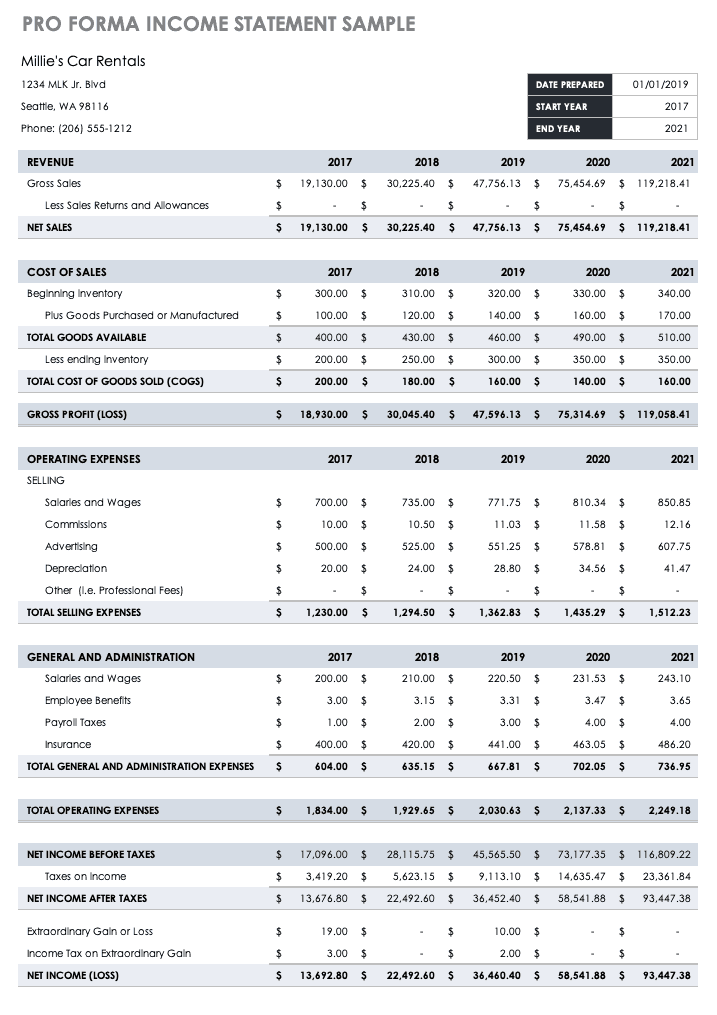

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

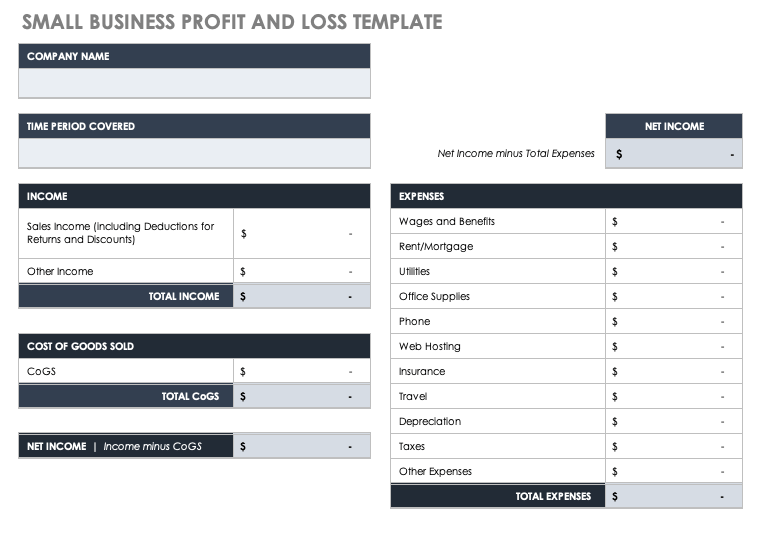

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

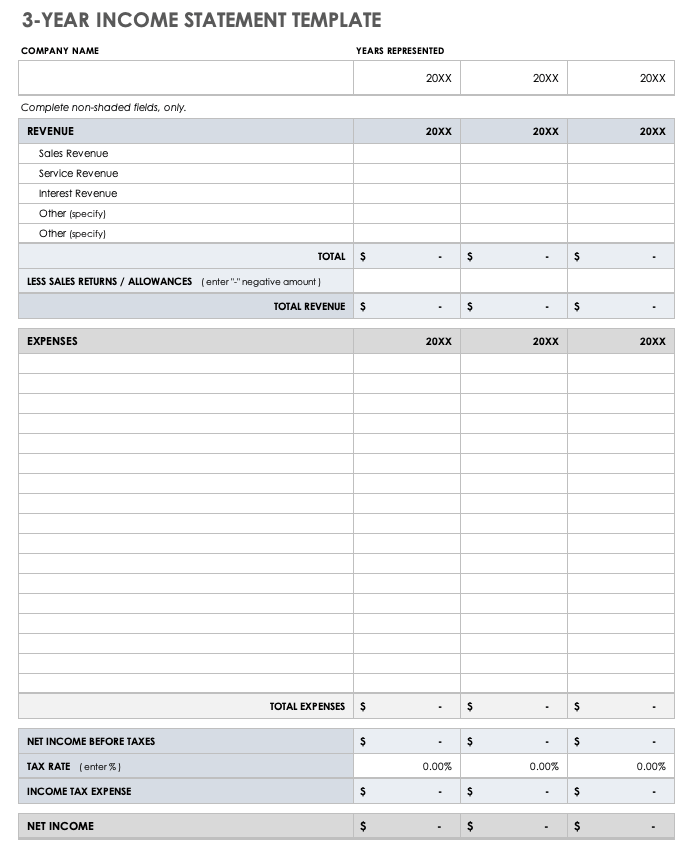

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

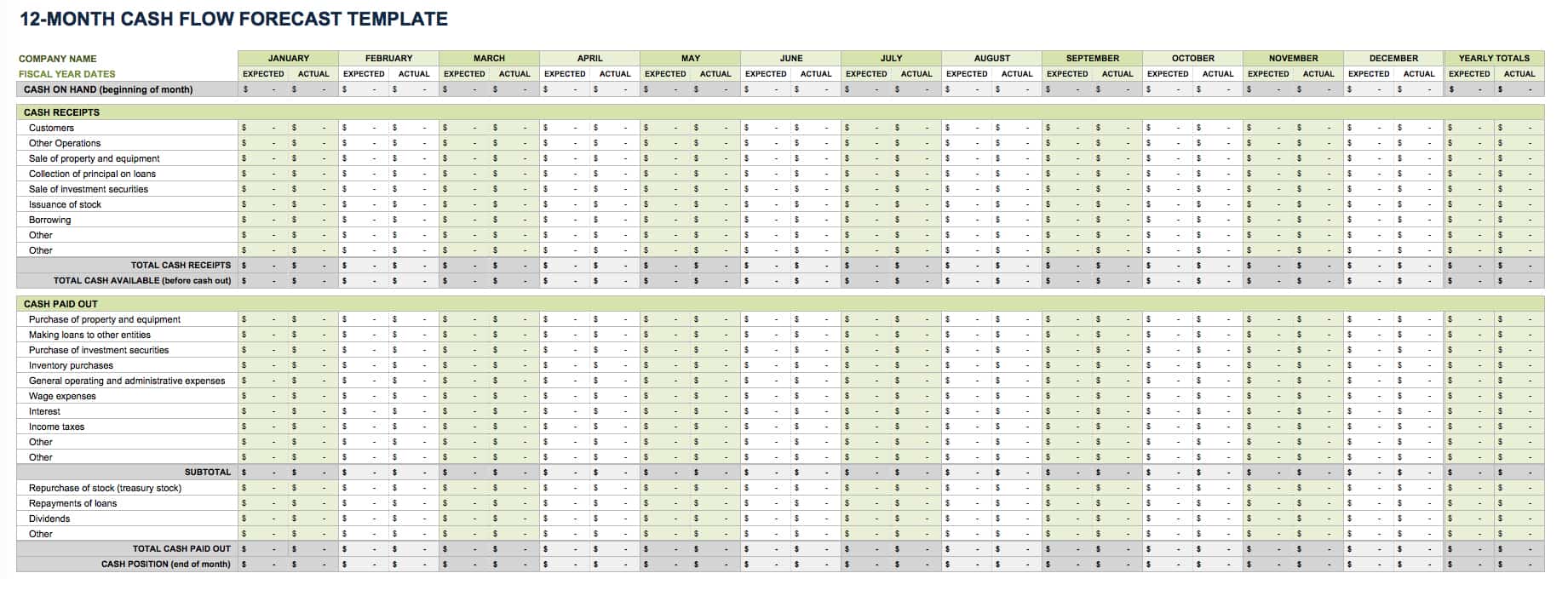

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

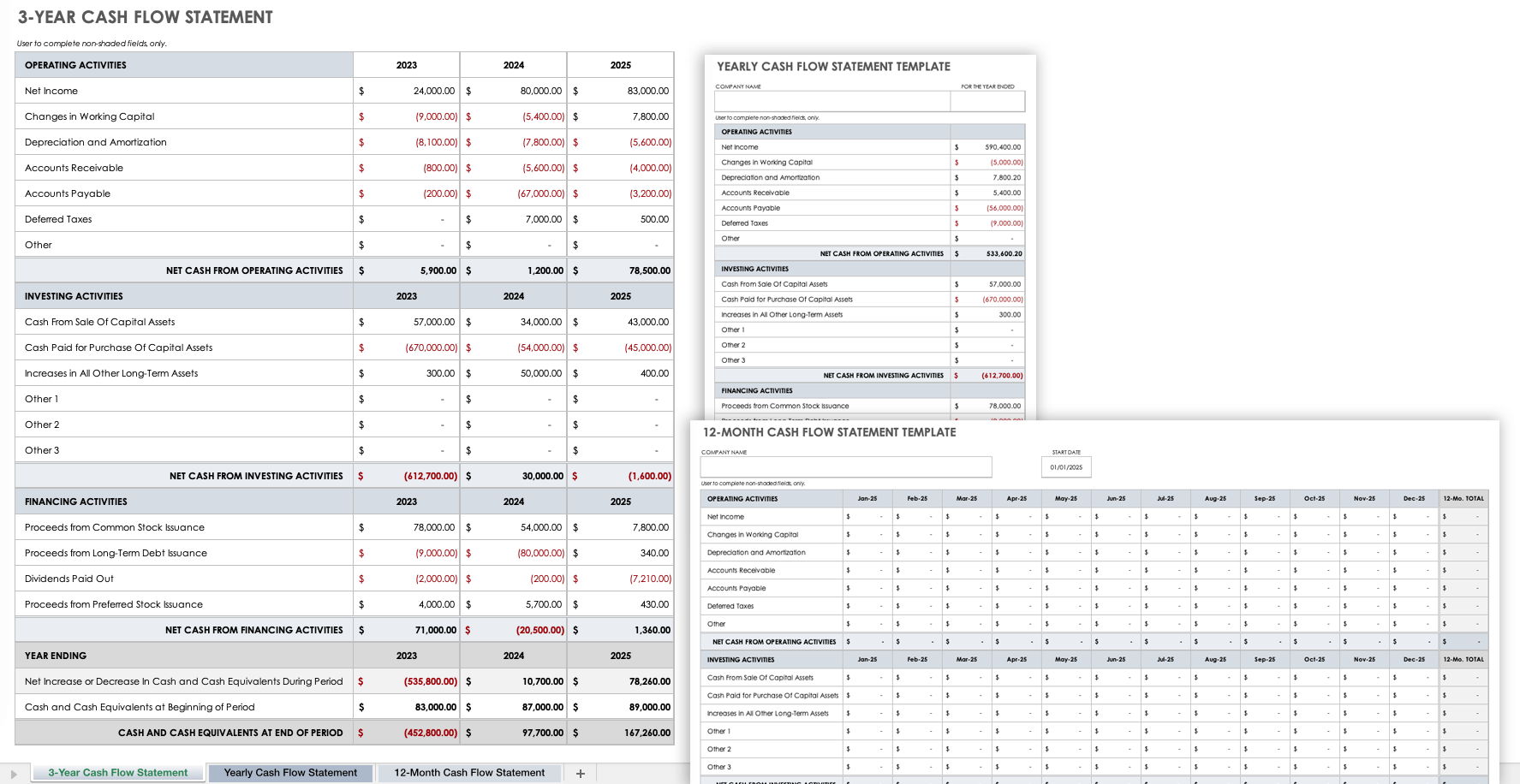

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

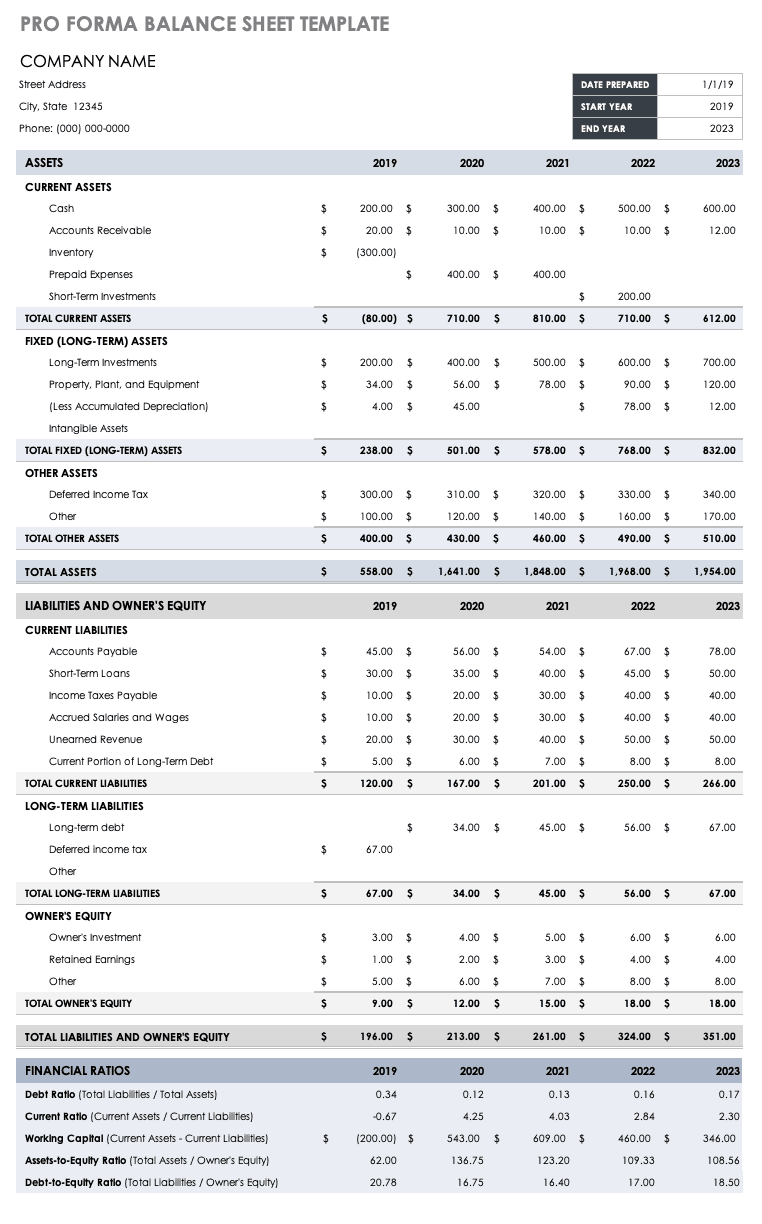

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

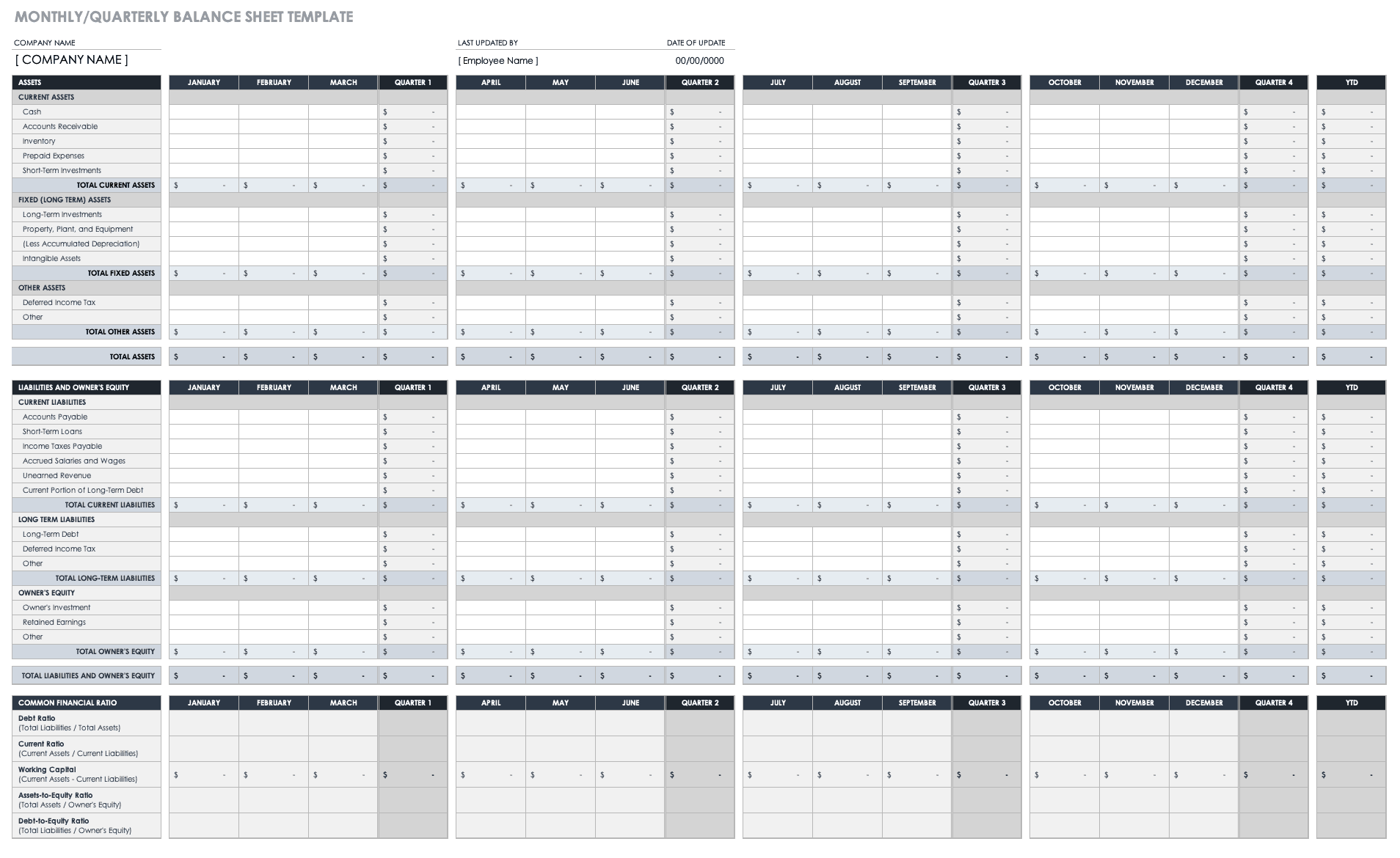

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

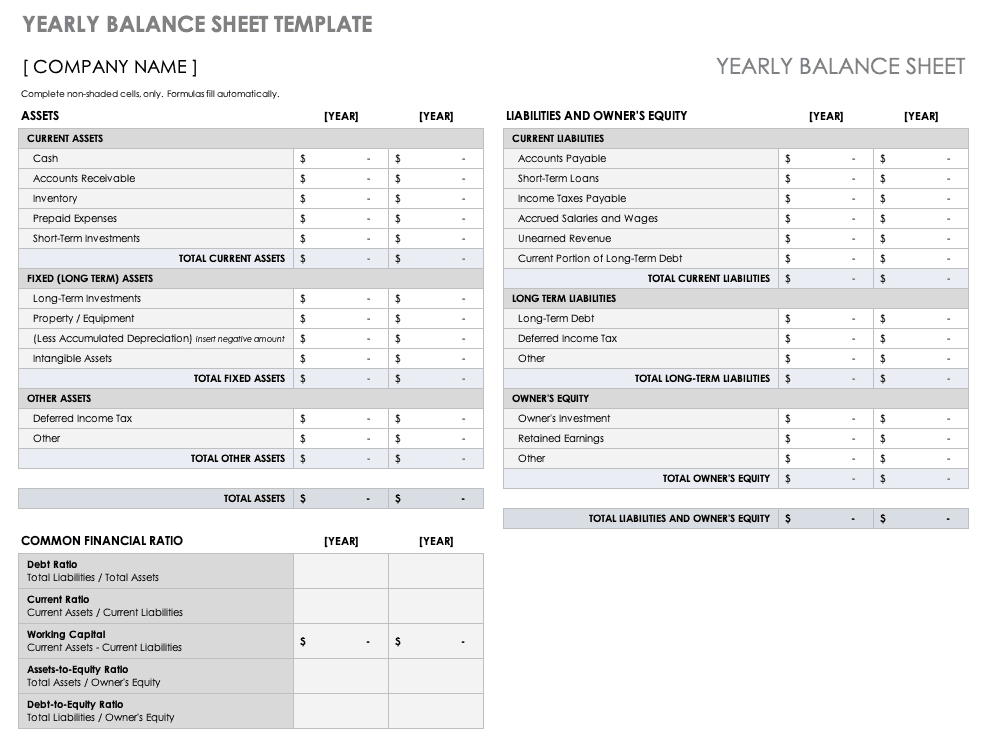

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

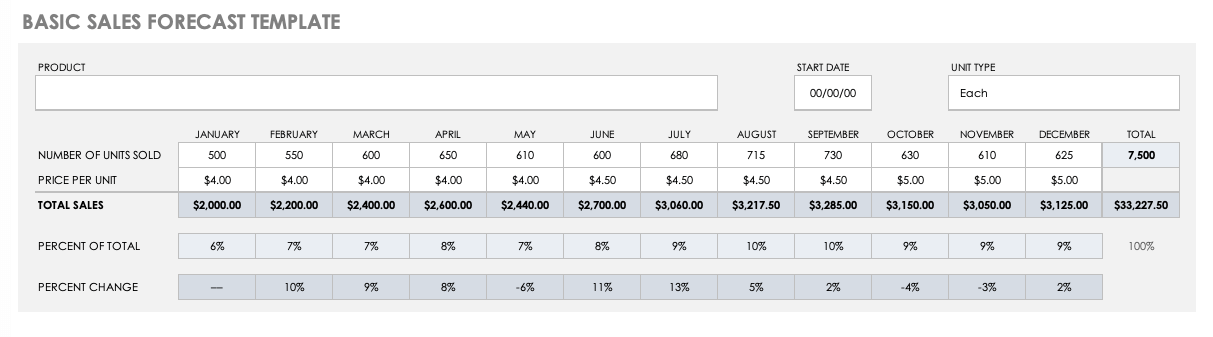

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

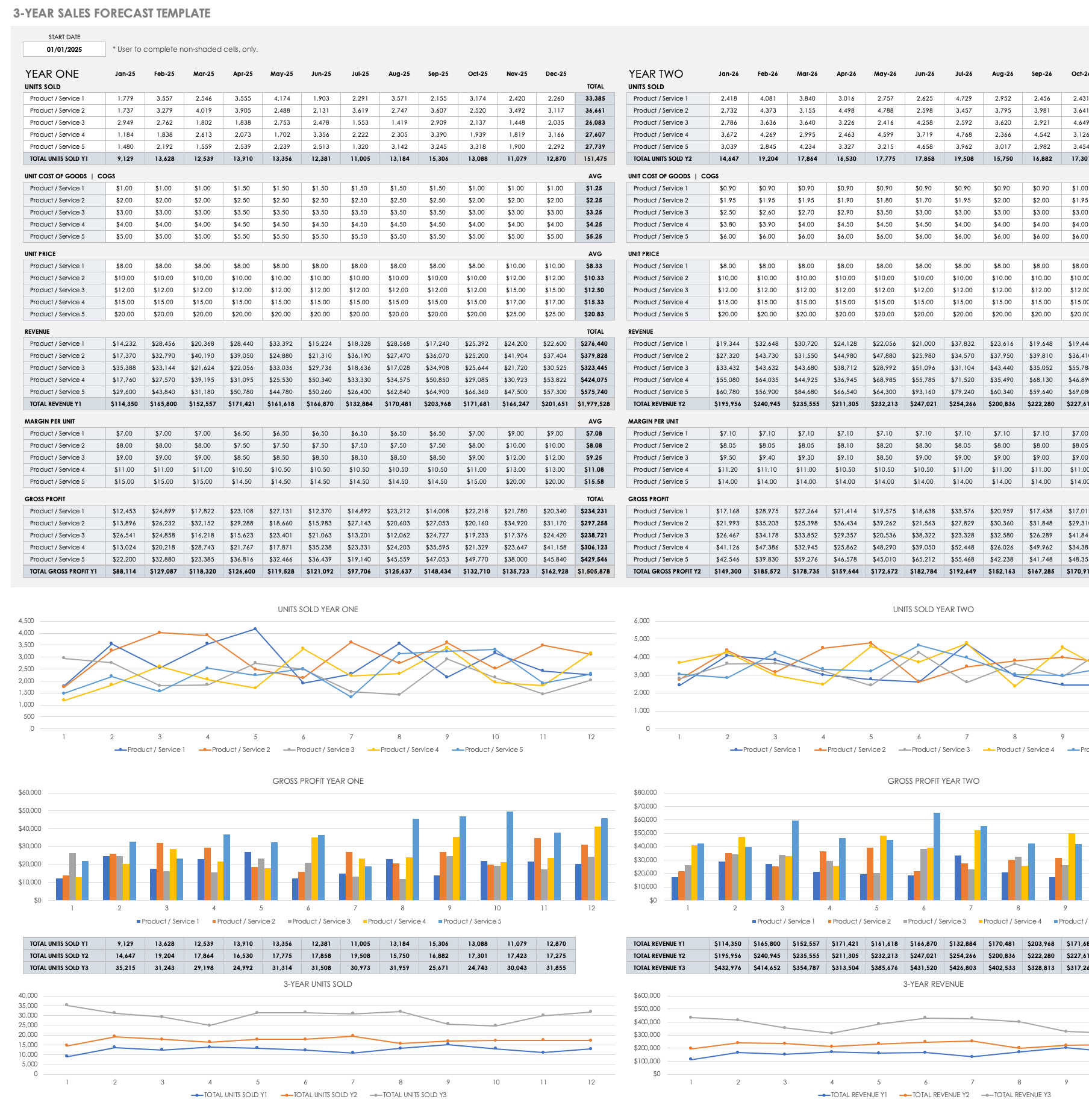

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

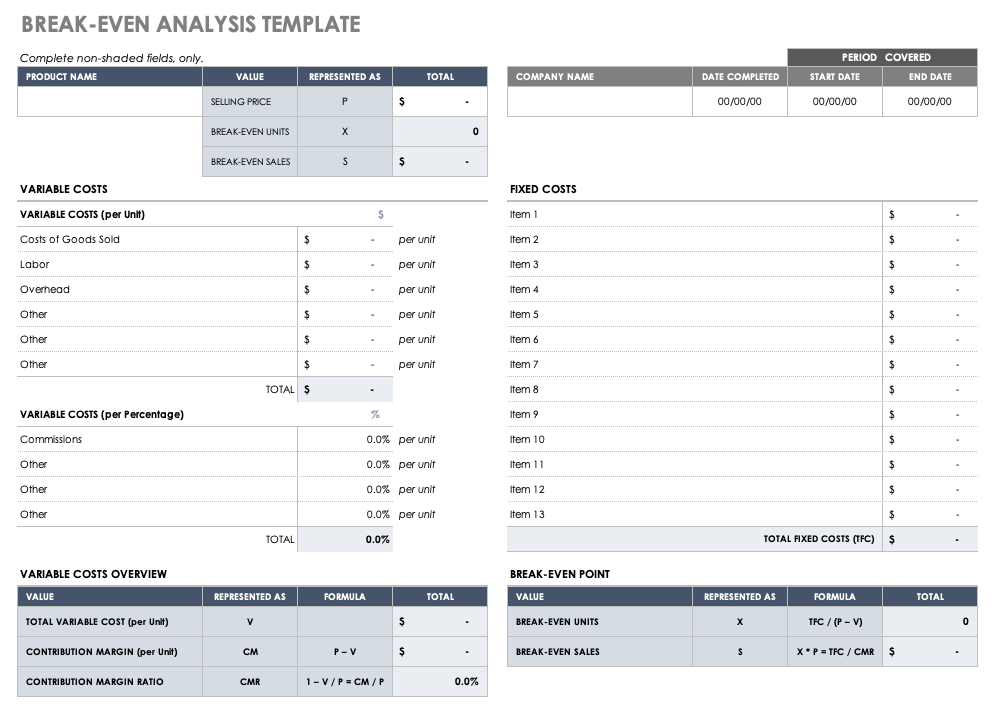

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

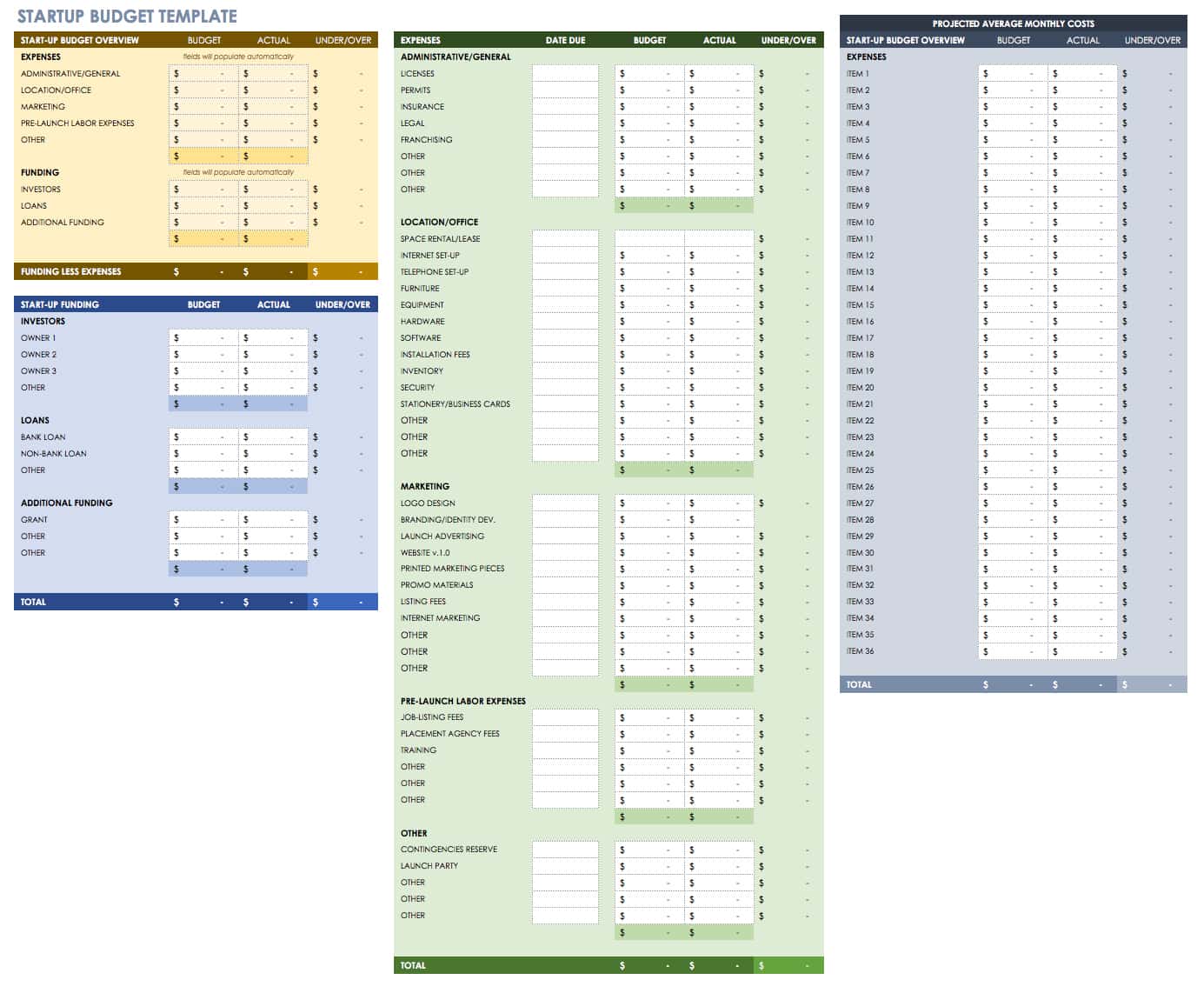

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

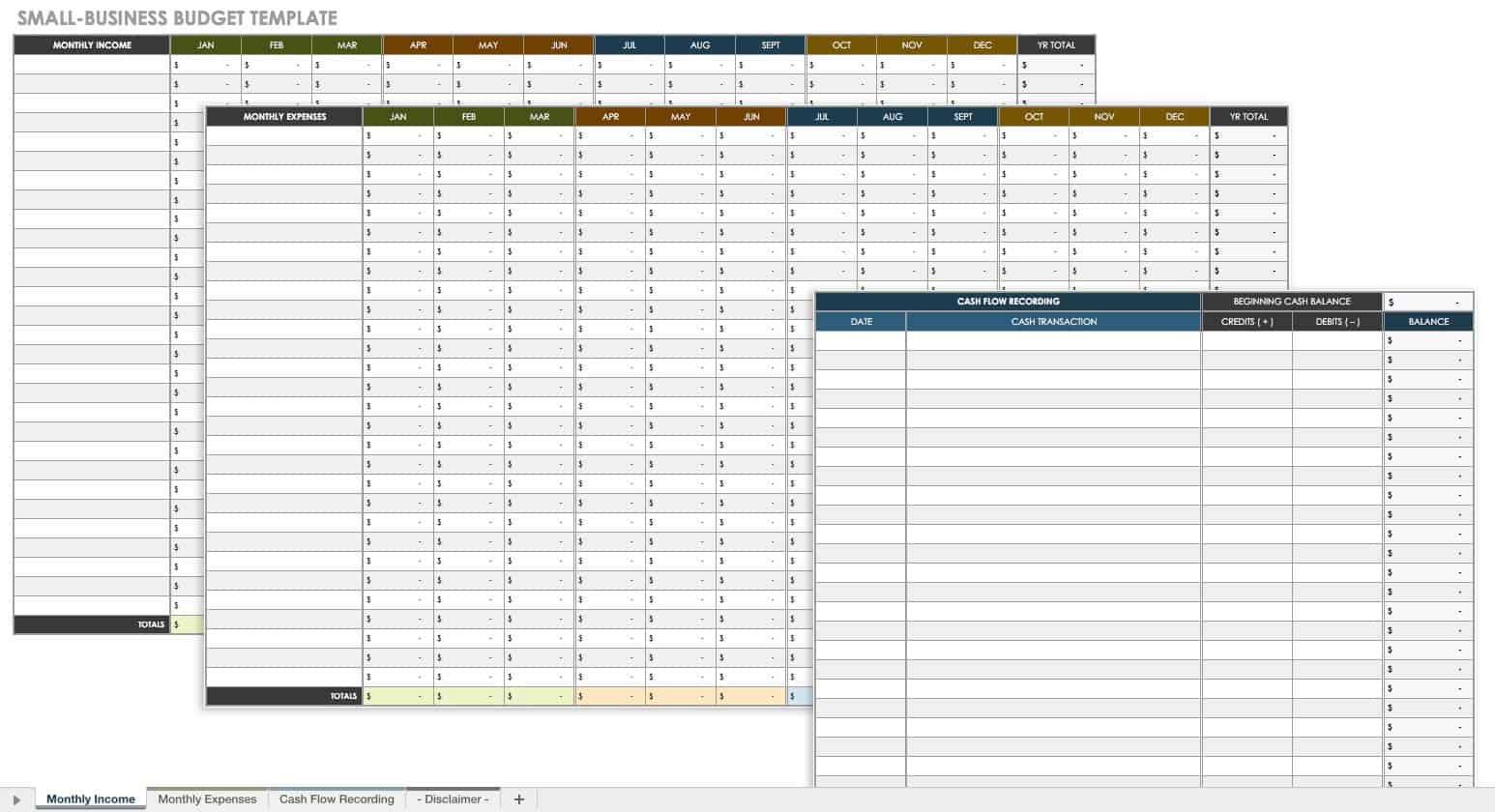

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

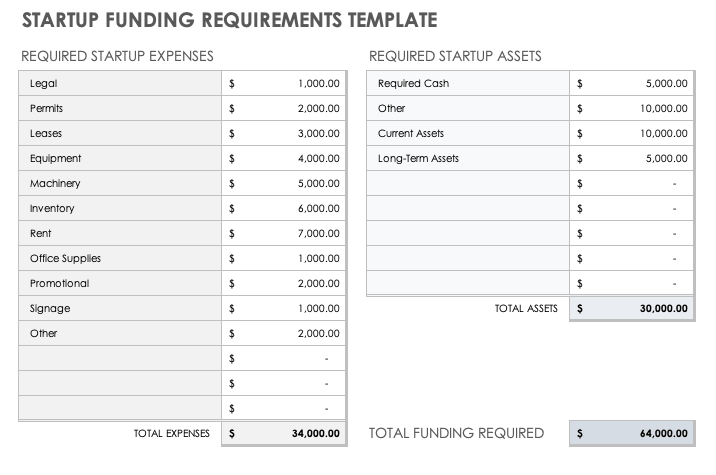

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

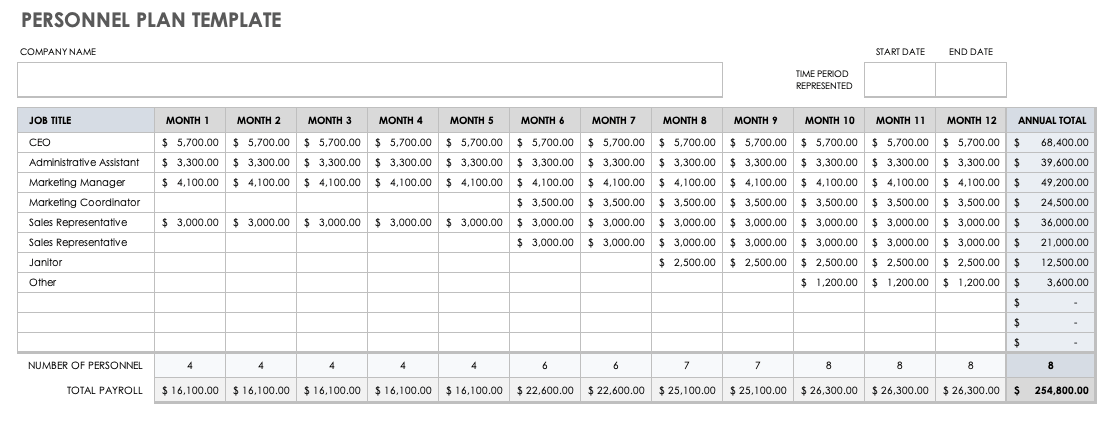

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

No products in the cart.

Crafting Your Business Plan Financials: A Step-by-Step Guide

This guide is my way of taking you by the hand (figuratively, of course) and walking you through the process of building your business plan financials. Whether you’re scribbling your first ever business plan on a napkin or revisiting an existing one to adapt to the ever-evolving market landscape, this guide is for you.

We’ll dive into the nitty-gritty of financial statements without drowning in complexity, break down projections into bite-sized, manageable pieces, and maybe, just maybe, have a bit of fun along the way.

So, if you’re ready to tackle this beast with a blend of expertise, relatability, and a dash of humor, let’s get started. Together, we’ll demystify the world of business plan financials and empower you to take the reins of your financial future with confidence.

Key Takeaways

- Building business plan financials involves forecasting the three financial statements : income statement , balance sheet, and cash flow statement.

- Financial projections should be based on market research and industry trends, as well as your unique business model and goals.

- Business plan financials are essential in securing funding, guiding decision-making, setting benchmarks, managing cash flow , and identifying risks and opportunities.

Understanding the Basics of Business Plan Financials

Diving into the world of business plan financials can feel a bit like stepping onto a dance floor for the first time. You know you need to move, but figuring out how to not step on your own feet (or anyone else’s) is the real challenge.

So, let’s break down the dance floor, shall we? Picture your business plan’s financial section as a trio of critical financial statements performing the most pivotal routine of the night, consisting of the Income Statement, the Balance Sheet, and the Cash Flow Statement.

- The Income Statement : Also known as the profit and loss statement , this is your financial performance’s highlight reel over a specific period. It tells you whether your business is hitting the high notes or if it’s time to change the tune. By tracking revenues, costs, and expenses, the Income Statement gives you a clear picture of your net profit or loss. Think of it as your business’s scorecard, showing you if you’re leading the dance or stepping on toes.

- The Balance Sheet : Imagine this as a snapshot capturing a moment in your business’s dance routine. It’s all about balance (hence the name). On one side, you have your assets—everything your business owns. On the other, liabilities and equity—everything your business owes plus the ownership interest. The Balance Sheet tells you exactly where you stand at any given moment, making sure you’re poised and ready for the next move.

- The Cash Flow Statement : If the Income Statement is about the performance and the Balance Sheet is about the pose, then the Cash Flow Statement is all about the movement. It tracks the cash coming in and going out of your business. This statement is your choreography, showing you if you’ve got the liquidity to keep dancing or if you’re about to trip over a lack of cash.

Why Do You Need Business Plan Financials?

Let’s dive into the different uses for those business plan financials, shall we?

Securing Funding : This one’s pretty straightforward. When you’re pitching to investors or applying for a loan, your financials are the proof in the pudding. They show that you’re not just all talk—you’ve got a plan that’s expected to bring in real money.

Guiding Decision-Making : Your financials are a compass in the wild terrain of business decisions. Want to know if you can afford to increase operating expenses, launch a new product, or expand into a new market? Your financials hold the answers.

Setting Benchmarks : Without benchmarks, how do you measure success? Your financials set clear goals for revenue, profit margins, and growth trajectories.

Cash Flow Management : Ah, cash flow projection —the lifeblood of any business. Your financials help you predict when money will be coming in and going out, ensuring you have enough cash on hand to keep the lights on.

Identifying Risks and Opportunities : By analyzing your financials, you can spot potential risks and opportunities before they become glaring issues or missed chances.

Step 1: Laying the Groundwork with Market Research

Understanding your market is akin to understanding the latest viral dance craze. You need to know who’s dancing, why they’re dancing, and what moves are most popular. In business terms, this means getting to grips with who your customers are, what needs or desires they have, and how your product or service fits into that picture. This is where market research comes into play.

How to Gather Data for Market Research:

- Start with Secondary Research : This is like the pre-party research before you hit the dance floor. Look into existing studies, industry reports, and market analysis that give you a bird’s-eye view of your sector. It’s cheaper (often free), quicker, and a great way to start outlining your market landscape. Websites like Statista and Pew Research are a great resource for secondary research.

- Dive into Primary Research : Now, it’s time to mingle at the party yourself. Surveys, interviews, and focus groups with potential customers will give you insights straight from the horse’s mouth. Yes, it’s more time-consuming and can be costlier, but the firsthand data you gather is worth its weight in gold.

- Analyze Your Competitors : Think of this as knowing who else is on the dance floor with you. Understanding their moves can help you find your unique rhythm. Look at their offerings, pricing strategies, and customer feedback. What are they doing well? Where are they stumbling? This insight is invaluable.

My Experience With Market Research

Let me take you back to the early days of my own business venture, when the concept of “market research” was as foreign to me as quantum physics. My team and I were launching a new financial tool designed to simplify budgeting for freelancers—a noble cause, but we were shooting in the dark with our sales forecast .

So, we hit the books (and the streets) for some hardcore market research. We surveyed freelancers about their budgeting woes, dove into forums where they vented their frustrations, and analyzed competitors who were only partially addressing these pain points. What we found was a goldmine of information that not only validated our product idea but also helped us pinpoint exactly how to position our tool in the market.

Armed with this data, we crafted our revenue projections not on wishful thinking but on solid, research-backed insights. And guess what? Our initial sales outperformed our projections by 20%. It was a clear testament to the power of laying the groundwork with thorough market research.

Step 2: Crafting Your Income Statement

Crafting your profit and loss statement is akin to writing the script for the blockbuster movie of your business’s financial performance. It’s where the rubber meets the road of financial statements, blending the drama of revenue streams with the gritty realism of expenses, all leading up to that climactic figure: your net income.

Breaking Down Revenue Streams

Let’s start our financial projections by casting our stars: the revenue streams. Identifying and projecting these is like mapping out the plot points of our story. For my own venture, it was a mix of predictable box office hits (fixed revenue from long-term contracts) and surprise indie darlings (variable sales from new markets).

The key here is diversity; relying on a single revenue stream is like betting your entire budget on a rookie director. Exciting, sure, but risky. By understanding and forecasting different sources of income, you’re setting the stage for a financial narrative that holds up against unexpected twists.

Fixed vs. Variable Expenses: The Supporting Cast

Next up, we have our supporting characters: fixed and variable costs. Fixed expenses are those steadfast sidekicks that stick with you through thick and thin—rent, salaries, and subscriptions.

They’re your base crew, essential but predictable. Variable expenses, on the other hand, are like those special effects in big action sequences—they fluctuate depending on the production’s scale (or, in our case, the business operations). Materials cost, commission fees, and shipping charges can vary, adding dynamism and a bit of unpredictability to our financial plot.

EBITDA, and Why It’s Your Friend

Now, let’s talk about a concept that might sound like the latest tech gadget but is actually one of your best allies: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Imagine EBITDA as that veteran actor who brings depth and credibility to your movie.

It shows you how well your business is performing without getting bogged down by tax structures, financing decisions, or how much you’ve spent on those fancy ergonomic office chairs.

It is also a critical part of break even analysis. Break even analysis is like the climax of our financial story—it shows the point where your revenue and expenses are equal. It helps you determine how much you need to sell or how to adjust your costs to reach profitability.

Step 3: Building Your Balance Sheet

Think of your balance sheet as the ultimate snapshot of your business’s financial stability at any given moment. It’s like taking a selfie with your assets, liabilities, and equity—everything has to look just right.

Assets, Liabilities, and Equity: What Goes Where?

Imagine your business’s finances as a giant storage unit (stay with me here). On one side, you’ve got your assets—everything you own that has value. This includes cash in the bank, inventory, equipment, and even amounts owed to you by customers (receivables). These are like the treasures you’ve stored away, everything from the antique lamp (cash) to the boxes of unsold novels you swear will be collector’s items one day (inventory).

On the opposite side are your liabilities. Think of these as the IOUs taped to the door by your friends who’ve borrowed your stuff. These could be loans you need to pay back, money you owe to suppliers, or rent for the space your business occupies.

Balancing these two sides is your equity , which is essentially the net worth of your business. If you were to liquidate everything today—sell off all your treasures and pay back your friends—whatever cash you’re left holding is your equity. It’s what you truly “own” outright.

Maintaining a Healthy Balance Sheet Over Time

Here’s where things get personal. In the early days of my venture, our balance sheet was, to put it mildly, a bit of a fixer-upper. Our assets were like mismatched socks—present, but not exactly optimized. Meanwhile, our liabilities were like laundry piles—growing faster than we could manage. The turning point came when we started treating our balance sheet like our business’s health checkup, regularly reviewing and adjusting our financial strategies to ensure everything remained in healthy proportion.

We focused on bolstering our assets, not just by increasing sales but also by managing our receivables more effectively and making smart choices about what equipment to purchase or lease. Simultaneously, we worked on trimming down our liabilities, negotiating better terms with suppliers, and restructuring debt to more manageable levels.

Step 4: Forecasting Cash Flow

Forecasting cash flow—it’s like checking the weather before you head out on a road trip. You wouldn’t want to get caught in a storm without an umbrella, right? Similarly, in the world of finance and accounting, especially for us millennials hustling through our careers, understanding the ins and outs of cash flow is crucial for navigating the unpredictable journey of business operations without getting soaked.

Why Cash Flow is Your Business’s Weather Forecast

Cash flow is essentially the heartbeat of your business’s financial health—tracking the inflow and outflow of money. It’s what keeps the lights on, from paying your awesome team to ensuring the coffee machine (aka the real MVP) is always running. Without a keen eye on cash flow, even the most profitable business can find itself in a pinch when bills come due. It’s about timing, and just like you can’t download more time, you can’t magically create cash when you need it—unless you’ve planned ahead.

Step-by-Step Method for Creating a Cash Flow Forecast

- Start with the Basics : Gather data on all your cash inflows, like sales or accounts receivable , and outflows, including expenses, payroll, and loan payments. Think of it as setting up your playlist before the trip begins.

- Choose Your Time Frame : Decide if you’re mapping out the next month, quarter, or year. This is like deciding whether you’re road-tripping to the next town over or cross-country.

- Use Historical Data : Look back at past months or years to guide your predictions. It’s like knowing there’s always traffic at rush hour and planning your departure time accordingly.

- Factor in Seasonality : Just like packing an extra sweater for a chilly evening, remember that some months may have higher expenses or lower sales. Plan for these fluctuations.

- Keep It Updated : Your cash flow forecast isn’t a set-it-and-forget-it road map. Update it regularly with actual figures to stay on course. This is like checking your GPS for traffic updates in real-time.

My Great Cash Flow Mishap

Early in my career, I experienced what I affectionately call “The Great Cash Flow Mishap.” We were flying high, sales were up, and in my mind, we were invincible. I overlooked the importance of forecasting cash flow because, hey, money was coming in, right? Wrong. Sales being up didn’t mean cash in hand, thanks to generous payment terms we’d extended. When a large expense bill came due, we found ourselves in a financial thunderstorm without an umbrella.

It was a wake-up call. We scrambled, made it through, but learned a valuable lesson in the process: cash flow forecasting isn’t just a nice-to-have; it’s essential. It’s the difference between sailing smoothly and getting caught in a downpour. Since then, I’ve treated cash flow forecasting like my financial weather app, always checking it to ensure we’re prepared for whatever financial weather lies ahead.

Step 5: Bringing It All Together for Financial Analysis

So, you’ve danced through the steps of laying down your financial groundwork, from market research all the way to cash flow forecasting. Now, it’s time for what I like to call the “big reveal” in our financial saga—financial analysis. Think of it as the season finale where all the plotlines converge, and you finally get to see the full picture of your business’s financial health. Exciting, right?

How to Use Your Financials to Calculate Key Ratios

Financial ratios might sound like something out of a high school math class you’d rather forget, but they’re actually pretty cool once you get to know them. They’re like the secret codes that unlock the mysteries of your business’s financial narrative. Here are a few key players:

- Profit Margin : Sales are great, but what’s left after expenses? This ratio tells you exactly that. It’s like checking how much gas is left in the tank after a long trip.

- Current Ratio : This one measures whether you have enough assets to cover your liabilities. Imagine you’re planning a big party (i.e., a major business move). Do you have enough snacks (assets) for all the guests (liabilities)?

- Debt to Equity Ratio : It shows the balance between the money you’ve borrowed and the money you’ve personally invested in your business. Think of it as the ratio between the contributions to the potluck from you and those from your friends.

Innovative Tools and Techniques for Financial Analysis

Gone are the days of poring over spreadsheets until your eyes cross. Today, we have an arsenal of innovative tools at our disposal that make financial analysis not just bearable but actually kind of fun:

- Cloud-Based Accounting Software : These platforms are like having a financial wizard by your side, automating many of the tedious tasks involved in financial analysis.

- Data Visualization Tools : Imagine turning your financial data into a vibrant art gallery. These tools help you visualize trends, patterns, and anomalies in your data, making complex information digestible at a glance.

- AI and Machine Learning : The new kids on the block, these technologies offer predictive insights based on your financial data, helping you make informed decisions about the future.

Step 6: Planning for the Future: Scenarios and Projections

Planning for the future in the fast-paced world of finance and accounting is a bit like trying to pack for a vacation without knowing the destination. Will it be sunny beaches or snowy mountains? In business, just as in travel, the key to being well-prepared lies in anticipating a range of scenarios. This approach doesn’t just cushion you against the unexpected; it equips you to navigate the twists and turns of the market with confidence and agility.

The Importance of Creating Financial Scenarios

Imagine you’re at a crossroads, each path leading to a different outcome for your business. One might lead to rapid growth if a new product takes off, another to steady progress as you expand your customer base, and yet another to a challenging period if the market takes a downturn. Creating financial scenarios is like mapping out each of these paths in advance, complete with signposts (financial indicators) that help you recognize which path you’re on and what you need to do to stay on course—or change direction if necessary.

This practice isn’t about predicting the future with crystal ball accuracy; it’s about being prepared for whatever comes your way. By considering various “what ifs” and planning for them, you transform uncertainty from a source of anxiety into a strategic advantage.

Practical Advice on Long-Term Financial Planning

- Start with a Solid Foundation : Your current financial statements are the launching pad for any long-term planning. Ensure they’re accurate and up-to-date.

- Identify Key Drivers : Understand what factors most significantly impact your business’s financial health—be it sales volume, pricing strategies, or cost controls—and model your scenarios around these drivers.

- Embrace Technology : Leverage financial planning software that allows you to create and compare different scenarios with ease. These tools can provide invaluable insights and save you a heap of time.

- Regular Reviews : The only constant in business is change. Regularly review and adjust your scenarios and projections to reflect new information and market conditions.

How “Planning for the Worst” Saved My Business

There was a time when my business faced what I fondly refer to as “the perfect storm”—a combination of market downturn, rising costs, and a major client backing out last minute. It was every entrepreneur’s nightmare. But here’s the twist: we weathered the storm, not by luck, but by preparation.

During sunnier days, we’d developed a “worst-case scenario” plan . It felt a bit like rehearsing for a play we never wanted to perform, but when the storm hit, that script became our survival guide. We knew exactly which costs to cut, how to streamline operations, and where we could find alternative revenue streams. It wasn’t easy, but that plan gave us the clarity and confidence to make tough decisions quickly.

That experience taught me a valuable lesson: optimism is a fantastic quality, but it’s preparation that truly makes us resilient. Planning for the worst doesn’t mean expecting it to happen; it means ensuring that no matter what comes your way, you’re ready to face it head-on.

Have any questions? Are there other topics you would like us to cover? Leave a comment below and let us know! Also, remember to subscribe to our Newsletter to receive exclusive financial news in your inbox. Thanks for reading, and happy learning!

Related Posts

- How To Get A Heavy Equipment Loan

- The Ultimate Guide to 50+ Financial Modeling Resources

- Your Flux Analysis Step-By-Step Survival Guide

- How To Do Account Reconciliation Without Pulling Your Hair Out

- Taking Vertical Analysis To The Next Level

- Your Unconventional Guide To Managing Working Capital

FP&A Leader | Digital Finance Advocate | Small Business Founder

Mike Dion brings a wealth of knowledge in business finance to his writing, drawing on his background as a Senior FP&A Leader. Over more than a decade of finance experience, Mike has added tens of millions of dollars to businesses from the Fortune 100 to startups and from Entertainment to Telecom. Mike received his Bachelor of Science in Finance and a Master of International Business from the University of Florida, laying a solid foundation for his career in finance and accounting. His work, featured in leading finance publications such as Seeking Alpha, serves as a resource for industry professionals seeking to navigate the complexities of corporate finance, small business finance, and finance software with ease.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

How to Write the Financial Section of a Business Plan

An outline of your company's growth strategy is essential to a business plan, but it just isn't complete without the numbers to back it up. here's some advice on how to include things like a sales forecast, expense budget, and cash-flow statement..

A business plan is all conceptual until you start filling in the numbers and terms. The sections about your marketing plan and strategy are interesting to read, but they don't mean a thing if you can't justify your business with good figures on the bottom line. You do this in a distinct section of your business plan for financial forecasts and statements. The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Even if you don't need financing, you should compile a financial forecast in order to simply be successful in steering your business. "This is what will tell you whether the business will be viable or whether you are wasting your time and/or money," says Linda Pinson, author of Automate Your Business Plan for Windows (Out of Your Mind 2008) and Anatomy of a Business Plan (Out of Your Mind 2008), who runs a publishing and software business Out of Your Mind and Into the Marketplace . "In many instances, it will tell you that you should not be going into this business." The following will cover what the financial section of a business plan is, what it should include, and how you should use it to not only win financing but to better manage your business.

Dig Deeper: Generating an Accurate Sales Forecast

Editor's Note: Looking for Business Loans for your company? If you would like information to help you choose the one that's right for you, use the questionnaire below to have our partner, BuyerZone, provide you with information for free:

How to Write the Financial Section of a Business Plan: The Purpose of the Financial Section Let's start by explaining what the financial section of a business plan is not. Realize that the financial section is not the same as accounting. Many people get confused about this because the financial projections that you include--profit and loss, balance sheet, and cash flow--look similar to accounting statements your business generates. But accounting looks back in time, starting today and taking a historical view. Business planning or forecasting is a forward-looking view, starting today and going into the future. "You don't do financials in a business plan the same way you calculate the details in your accounting reports," says Tim Berry, president and founder of Palo Alto Software, who blogs at Bplans.com and is writing a book, The Plan-As-You-Go Business Plan. "It's not tax reporting. It's an elaborate educated guess." What this means, says Berry, is that you summarize and aggregate more than you might with accounting, which deals more in detail. "You don't have to imagine all future asset purchases with hypothetical dates and hypothetical depreciation schedules to estimate future depreciation," he says. "You can just guess based on past results. And you don't spend a lot of time on minute details in a financial forecast that depends on an educated guess for sales." The purpose of the financial section of a business plan is two-fold. You're going to need it if you are seeking investment from venture capitalists, angel investors, or even smart family members. They are going to want to see numbers that say your business will grow--and quickly--and that there is an exit strategy for them on the horizon, during which they can make a profit. Any bank or lender will also ask to see these numbers as well to make sure you can repay your loan. But the most important reason to compile this financial forecast is for your own benefit, so you understand how you project your business will do. "This is an ongoing, living document. It should be a guide to running your business," Pinson says. "And at any particular time you feel you need funding or financing, then you are prepared to go with your documents." If there is a rule of thumb when filling in the numbers in the financial section of your business plan, it's this: Be realistic. "There is a tremendous problem with the hockey-stick forecast" that projects growth as steady until it shoots up like the end of a hockey stick, Berry says. "They really aren't credible." Berry, who acts as an angel investor with the Willamette Angel Conference, says that while a startling growth trajectory is something that would-be investors would love to see, it's most often not a believable growth forecast. "Everyone wants to get involved in the next Google or Twitter, but every plan seems to have this hockey stick forecast," he says. "Sales are going along flat, but six months from now there is a huge turn and everything gets amazing, assuming they get the investors' money." The way you come up a credible financial section for your business plan is to demonstrate that it's realistic. One way, Berry says, is to break the figures into components, by sales channel or target market segment, and provide realistic estimates for sales and revenue. "It's not exactly data, because you're still guessing the future. But if you break the guess into component guesses and look at each one individually, it somehow feels better," Berry says. "Nobody wins by overly optimistic or overly pessimistic forecasts."

Dig Deeper: What Angel Investors Look For

How to Write the Financial Section of a Business Plan: The Components of a Financial Section

A financial forecast isn't necessarily compiled in sequence. And you most likely won't present it in the final document in the same sequence you compile the figures and documents. Berry says that it's typical to start in one place and jump back and forth. For example, what you see in the cash-flow plan might mean going back to change estimates for sales and expenses. Still, he says that it's easier to explain in sequence, as long as you understand that you don't start at step one and go to step six without looking back--a lot--in between.

- Start with a sales forecast. Set up a spreadsheet projecting your sales over the course of three years. Set up different sections for different lines of sales and columns for every month for the first year and either on a monthly or quarterly basis for the second and third years. "Ideally you want to project in spreadsheet blocks that include one block for unit sales, one block for pricing, a third block that multiplies units times price to calculate sales, a fourth block that has unit costs, and a fifth that multiplies units times unit cost to calculate cost of sales (also called COGS or direct costs)," Berry says. "Why do you want cost of sales in a sales forecast? Because you want to calculate gross margin. Gross margin is sales less cost of sales, and it's a useful number for comparing with different standard industry ratios." If it's a new product or a new line of business, you have to make an educated guess. The best way to do that, Berry says, is to look at past results.

- Create an expenses budget. You're going to need to understand how much it's going to cost you to actually make the sales you have forecast. Berry likes to differentiate between fixed costs (i.e., rent and payroll) and variable costs (i.e., most advertising and promotional expenses), because it's a good thing for a business to know. "Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Berry says. "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such." Once again, this is a forecast, not accounting, and you're going to have to estimate things like interest and taxes. Berry recommends you go with simple math. He says multiply estimated profits times your best-guess tax percentage rate to estimate taxes. And then multiply your estimated debts balance times an estimated interest rate to estimate interest.

- Develop a cash-flow statement. This is the statement that shows physical dollars moving in and out of the business. "Cash flow is king," Pinson says. You base this partly on your sales forecasts, balance sheet items, and other assumptions. If you are operating an existing business, you should have historical documents, such as profit and loss statements and balance sheets from years past to base these forecasts on. If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months. Pinson says that it's important to understand when compiling this cash-flow projection that you need to choose a realistic ratio for how many of your invoices will be paid in cash, 30 days, 60 days, 90 days and so on. You don't want to be surprised that you only collect 80 percent of your invoices in the first 30 days when you are counting on 100 percent to pay your expenses, she says. Some business planning software programs will have these formulas built in to help you make these projections.

- Income projections. This is your pro forma profit and loss statement, detailing forecasts for your business for the coming three years. Use the numbers that you put in your sales forecast, expense projections, and cash flow statement. "Sales, lest cost of sales, is gross margin," Berry says. "Gross margin, less expenses, interest, and taxes, is net profit."

- Deal with assets and liabilities. You also need a projected balance sheet. You have to deal with assets and liabilities that aren't in the profits and loss statement and project the net worth of your business at the end of the fiscal year. Some of those are obvious and affect you at only the beginning, like startup assets. A lot are not obvious. "Interest is in the profit and loss, but repayment of principle isn't," Berry says. "Taking out a loan, giving out a loan, and inventory show up only in assets--until you pay for them." So the way to compile this is to start with assets, and estimate what you'll have on hand, month by month for cash, accounts receivable (money owed to you), inventory if you have it, and substantial assets like land, buildings, and equipment. Then figure out what you have as liabilities--meaning debts. That's money you owe because you haven't paid bills (which is called accounts payable) and the debts you have because of outstanding loans.