The marketplace for case solutions.

H. J. Heinz: Estimating the Cost of Capital in Uncertain Times – Case Solution

With the ever-changing status of the market conditions and the doubt about where it will lead, H. J. Heinz's internal financial analyst found the need to come up with an estimate of the company's weighted average cost of capital (WACC). This case study analysis provides information not only for Heinz but also for other comparable firms. The study connects the practice of calculating the WACC and at the same time looks into the economic meaning of inputs to the calculation.

Marc Lipson Harvard Business Review ( UV5147-PDF-ENG ) November 08, 2010

Case questions answered:

We have uploaded two case solutions, which both answer the following questions:

- What were the yields on the two representative outstanding H.J. Heinz debt issues as of the end of April 2010? What were they one year earlier?

- What was the WACC for Heinz at the start of the fiscal year 2010? What was the WACC one year earlier?

- What is your best estimate of the WACC for Kraft Foods, Campbell Soup Company, and Del Monte Foods? How do these WACCs influence your thinking about the WACC for Heinz?

Not the questions you were looking for? Submit your own questions & get answers .

H. J. Heinz: Estimating the Cost of Capital in Uncertain Times Case Answers

This case solution includes an Excel file with calculations.

You will receive access to two case study solutions! The second is not yet visible in the preview.

Executive Summary

The central problem, in this case, was the calculation of the weighted average cost of capital for the Heinz Company. There are three main reasons why it was becoming problematic to compute the weighted average cost of capital for the H. J. Heinz Company.

The first reason was the rapid fluctuation of the stock price of the company over the past 2 years. The price had touched the same high level of $ 47 per share in 2010, and there was a huge debate about whether the WACC needs to be updated or not.

Secondly, the interest rates were highly low. The lower interest rates would also reduce the WACC for Heinz Company, and a large number of projects could be then accepted by H. J. Heinz.

Finally, the third issue was that the company was not certain how the consumers would react to this, as the chances of the consumers taking the risks changed because of the changing economic conditions.

Furthermore, the company is also facing stiff competition from three other competitors in the industry which are Kraft Foods, Campbell Soup, and Del Monte Foods. In this case analysis, we have attempted to compute the yields of the short-term and long-term bond issues of the company.

It could be seen that the yields have declined significantly in 2010 from 2009. After this, the weighted average cost of capital has been computed for 2010 and 2009 based on a number of input variables.

It could be seen that the WACC has declined significantly in 2010 as compared to 2009. Finally, the WACCs of all three comparable companies have also been calculated, all of which have higher WACCS than H. J. Heinz.

What were the yields on the two representative outstanding Heinz debt issues as of the end of April 2010? What were they one year earlier?

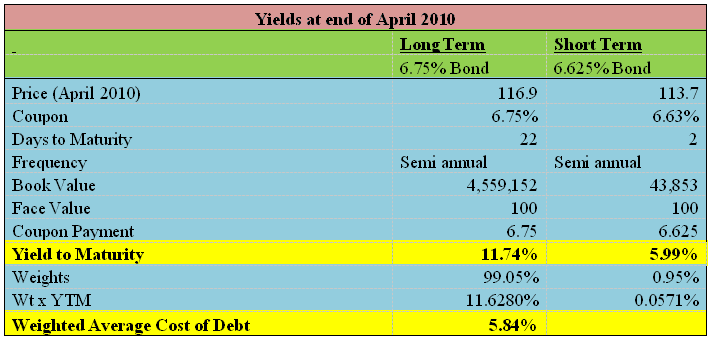

The yields of the two representative outstanding H. J. Heinz debt issues at the end of April 2010 are as follows:

The debt with 22 years to maturity is long-term debt, and the debt with just a maturity period of 2 years is short-term debt. The YTL approximation formulas have been used to compute the yields of the two debt issues at the end of April 2010. The formula used is shown in the Excel spreadsheet.

Similarly, the yields on both of these two representative bonds one year earlier based on the maturity and the book values of short-term and long-term debts in 2009 were as follows…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster! Michael MBA student, Boston

How do I get access?

Upon purchase, you are forwarded to the full solution and also receive access via email.

Is it safe to pay?

Yes! We use Paypal and Stripe as our secure payment providers of choice.

What is Casehero?

We are the marketplace for case solutions - created by students, for students.

- High School

- You don't have any recent items yet.

- You don't have any courses yet.

- You don't have any books yet.

- You don't have any Studylists yet.

- Information

Heinz Case Study

Financial management (fin 6406), florida atlantic university, students also viewed.

- Assignment 10b

- tte hw intro to transportation

- French Culture Quiz Ch 4

- Chapter 5 Assignment - QUESTIONS AND ANSWERS

- PHY 2 lab report 4

Related documents

- Talbot, The Myth of Whiteness in Classical Sculpture The New Yorker

- S13195 024 01511 x - research paper for template 5

- Jeopardy Assignment

- Intro to Hlth care - COursework

- Genetics Assignment-1

Preview text

1 HEINZ CASE STUDY FIN 6046: Corporate Finance Florida Atlantic University October 23, 2018 2 Executive Summary The purpose of the Heinz case study is to analyze the decision making and potential outcomes for the future investments and growth strategies. The specified time period of the case is Heinz experienced topline growth, but operating margins declined because of an increase in Cost of Goods Sold (COGS). These factors led to a lower Return on Assets (ROA) which negatively affected the internal growth rate. In order to support future sales growth, the firm needs to secure external financing. The first step to identify needs for a positive turnaround is to calculate the Weighted Average Cost of Capital (WACC). The WACC determines the appropriate discount rate. According to the Corporate Finance Institute, represents its blended cost of capital across all sources, including common shares, preferred shares, and (N.). The approximate discount rate represents the overall required return on the firm as a whole. It is also necessary to identify the internal and external factors affecting the market value of Heinz equity and debt. We will discuss terms such as risk free rate, market premium, and beta. It is uncommon for consumer goods companies to be impacted volatility of market conditions and the overall economy. Indeed, Heinz is undergoing some transitions such as an increased focus on organic products with higher nutrition value, purchasing decisions, and privatelabel growth (2009 Heinz Annual Report). More significantly, the global economic environment continues to present however, we are uncertain as to why the change in WACC may be occurring when the company reports strong sales during the past three years. Therefore, we will also evaluate the financial health of major competitors Kraft Foods, Campbell Soup Company, and Del Monte Foods to gain a better understanding of WACC industry averages. The case study analysis will address the following metrics during risk free rate, market premium, and yields for outstanding debt the WACC for the company and its and the timespan of infrastructure investments and capital projects. With this information we will have a better understanding of the cost of capital and Return on Equity (ROE). Company Overview Heinz, established in 1869, is recognized as a value stock. The company culture advocates values of ownership, high performance, empowerment, and other philosophies Are Kraft N.). Indeed, these are key principles embodying a successful but to the general consumer, the iconic brands far outweigh the company ideologies. For generations, 4 Officer, reported to shareholders in the 2009 Annual Report: this economy, Heinz continues to connect with consumers. Our Top 15 brands delivered excellent growth in Fiscal 2009 while contributing about of the total This seemingly contradiction is one of the areas we will explore in the case study how Heinz is able to report record sales, profits, and attractive earnings per share for the past three years. Illustrated in the graphic above, operating free cash flow declined from 2008 to 2009 (2009 Heinz Annual Report). The financial calculations included in the case study evaluation will address competitive comparisons such as discount rates and ROA. There is an interesting data point in 2009 Annual Report a graph depicting the cumulative total shareholder return as double the peer group average. Campbell reports a shareholder return versus the Packages Foods Index of (Campbell Soup Company 2009 Annual Report). Another area of interest pertains to a key competitive differentiator. As previously discussed, an important market trend for CPG manufacturers is adapting products and marketing strategies to cater to who seek healthier diets and lifestyle. seems to be ahead of the market in identifying this inflection point in consumer behavior. Heinz continuously scores highly in customer satisfaction and brand recognition. The infographic below shows the leading consumer brands. Although we are curious as to why the Heinz product portfolio is not the illustration shows the product breath and scale of companies in the trillion CPG industry. Figure 2: 10 Companies Control Enormous Number of Consumer 2012.) 5 Financial Introduction The purpose of this introduction is to explain the financial process breakdown. The goal is to estimate the weighted average cost of capital (WACC) for Heinz Company using data from to estimate the future cost of capital as well as in relationship to its industry competitors. In order to understand how WACC is derived, it is important to review the capital budgeting concepts of finance. The sequence of how these concepts affect each other and the goal of WACC is explained below. Capital Budgeting At the foundation of corporate finance is capital budgeting. Capital budgeting involves the purchase of fixed assets and the allocation of funds towards a new and existing projects. Capital budgeting is also referred to as Strategic Asset Allocation since fixed assets are the most important component of corporate finance. Decisions on assets make up the capital budgeting question and decision on project make up the capital budgeting decision. A projects (such as services or product lines) begin with the capital budgeting decision, where launching a new or entering a new market undergoes strategic decision tools. These capital budgeting tools (payback method, net present value, and internal rate of return) will support whether a firm accepts or rejects a new proposal (Corporate Finance, 2018). Further capital budgeting matters involve the capital structure question (how a firm finances its operations) and the working capital question (management of a firms operating activities). At the core of capital budgeting is identifying that an investment today is worth more than the present value of its future cash flows. The value that this creates is the same value that is created for stockholders. Projects with positive net present values allow this to happen. Net Present Value, Cash Flows and Discounting Net present value (NPV) is defined as difference between an market value and its (Corporate Finance, 2018). relationship to capital budgeting means that a positive calculated NPV for a proposal is also a positive value to shareholders (Corporate Finance, 2018). Estimating the NPV involves estimating the value of a project via future cash flows then finding the present value means of 7 (Investopedia, 2018). The cost of equity can be determined two different models: the dividend growth model or the security market line model (SML). The dividend growth model includes cost of equity, price of stock, dividends, growth rate, and required rate of return. The SML model involves a rate, beta variable, and a market risk premium rate. The cost of debt involves the time value of money. Analyzing a present and future values, payments and yield to maturity will generate a cost of debt. Weighted Average Cost of Capital (WACC) The weighted average cost of capital (WACC) is a combination of financing businesses through both debt and equity. Typically, projects are funded using both costs of capital to form a weighted average. The WACC ultimately represents the main obstacle companies must face regarding the that projects generate for the firm and shareholders. We can call this market success. We have analyzed how the value process starts (the methods of capital budgeting) and how it goes through the market risk to end up at a weighted average cost of capital that is used to determine the point where companies generate value. 8 Analysis When determining the YTM for the 2 bonds, the long term rates were selected for this analysis. One of the bonds has over 20 years remaining, rather than taking an average of the short and long term rates we choose the long term as all coupon payments are reinvested at the current yield. Any selection will carry risk and we viewed the short term rate as too reliant on the recent changes in the market for our long term analysis. These bonds give us a baseline for the cost of debt and the proportion of debt that Heinz has long term vs. current debt is to There are two outstanding issues. The debt with 22 years to maturity is a debt and the debt with just a maturity period of 2 years is a debt. The YTL approximation formulas have been used to compute the yields of the two debt issues at the end of April 2010. The formula used is shown in the excel spreadsheet. For 2010, the bond (due has the coupon rate of and the current cost of Future Value is payment is 7 and present value is We have a yield of For 2010, the bond (due has the coupon rate of and the current cost of Future value is PMT is 7 and PV is We have a yield of For 2009, the bond (due has the coupon rate of and the current cost of Future Value is payment is 6 and present value is We have a yield of For 2009, the bond (due has the coupon rate of and the current cost of Future value is PMT is 7 and PV is We have a yield of The Weighted Average Cost of Capital (WACC) is the market value weighted cost of debt and equity, and is calculated as follows: WACC E D ) D D E Market Value of Equity D Market Value of Debt Re Cost of Equity Rd Cost of Debt T Income Tax Rate 10 Appendix 11 13 References not used but reviewed Davidson, Jacob. (2015, March, 25). One image that shows just how insane the Kraft Heinz empire will be. Money. Retrieved from Mondelez International. (2010, February 16). Kraft Foods reports strong earnings and free cash flow for 2009. Retrieved from Reuters. (N.). Profile: Kraft Heinz Co. Retrieved from Wikipedia. (N.). Heinz Tomato Ketchup. Retrieved from

- Multiple Choice

Course : Financial Management (FIN 6406)

University : florida atlantic university, this is a preview.

Access to all documents

Get Unlimited Downloads

Improve your grades

Share your documents to unlock

Get 30 days of free Premium

Why is this page out of focus?

IMAGES