Defining and measuring oligopoly

Concentration ratios

Example of a hypothetical concentration ratio, fixed broadband services, fuel retailing, further examples, the herfindahl – hirschman index (h-h index), key characteristics, interdependence.

- Whether to compete with rivals, or collude with them.

- Whether to raise or lower price, or keep price constant.

- Whether to be the first firm to implement a new strategy, or whether to wait and see what rivals do. The advantages of ‘going first’ or ‘going second’ are respectively called 1st and 2nd-mover advantage. Sometimes it pays to go first because a firm can generate head-start profits. 2nd mover advantage occurs when it pays to wait and see what new strategies are launched by rivals, and then try to improve on them or find ways to undermine them.

Barriers to entry

Natural entry barriers include:, economies of large scale production., ownership or control of a key scarce resource, high set-up costs, high r&d costs, artificial barriers include:, predatory pricing, limit pricing, superior knowledge, predatory acquisition, advertising, a strong brand, loyalty schemes, exclusive contracts, patents and licences, vertical integration, collusive oligopolies, types of collusion, competitive oligopolies, pricing strategies of oligopolies.

- Oligopolists may use predatory pricing to force rivals out of the market. This means keeping price artificially low, and often below the full cost of production.

- They may also operate a limit-pricing strategy to deter entrants, which is also called entry forestalling price .

- Oligopolists may collude with rivals and raise price together, but this may attract new entrants.

- Cost-plus pricing is a straightforward pricing method, where a firm sets a price by calculating average production costs and then adding a fixed mark-up to achieve a desired profit level. Cost-plus pricing is also called rule of thumb pricing.There are different versions of cost-pus pricing, including full cost pricing , where all costs - that is, fixed and variable costs - are calculated, plus a mark up for profits, and contribution pricing , where only variable costs are calculated with precision and the mark-up is a contribution to both fixed costs and profits.

Non-price strategies

- Trying to improve quality and after sales servicing, such as offering extended guarantees.

- Spending on advertising, sponsorship and product placement - also called hidden advertising – is very significant to many oligopolists. The UK's football Premiership has long been sponsored by firms in oligopolies, including Barclays Bank and Carling.

- Sales promotion, such as buy-one-get-one-free (BOGOF), is associated with the large supermarkets, which is a highly oligopolistic market, dominated by three or four large chains.

- Loyalty schemes, which are common in the supermarket sector, such as Sainsbury’s Nectar Card and Tesco’s Club Card .

- How successful is it likely to be?

- Will rivals be able to copy the strategy?

- Will the firms get a 1st - mover advantage?

- How expensive is it to introduce the strategy? If the cost of implementation is greater than the pay-off, clearly it will be rejected.

- How long will it take to work? A strategy that takes five years to generate a pay-off may be rejected in favour of a strategy with a quicker pay-off.

Price stickiness

Kinked demand curve.

Maximising profits

A game theory approach to price stickiness.

- Raise price

- Lower price

- Keep price constant

The Prisoner’s Dilemma

- Higher prices or hidden prices, such as the hidden charges in credit card transactions

- Lower output

- Restricted choice or other limiting conditions associated with the transaction

Examples of Oligopoly

Evaluation of oligopolies, the disadvantages of oligopolies.

- High concentration reduces consumer choice.

- Cartel-like behaviour reduces competition and can lead to higher prices and reduced output.

- Given the lack of competition, oligopolists may be free to engage in the manipulation of consumer decision making. By making decisions more complex - such as financial decisions about mortgages - individual consumers fall back on heuristics and rule of thumb processes, which can lead to decision making bias and irrational behaviour, including making purchases which add no utility or even harm the individual consumer.

- Firms can be prevented from entering a market because of deliberate barriers to entry .

- There is a potential loss of economic welfare.

- Oligopolists may be allocatively and productively inefficient .

The advantages of oligopolies

- Oligopolies may adopt a highly competitive strategy, in which case they can generate similar benefits to more competitive market structures , such as lower prices. Even though there are a few firms, making the market uncompetitive, their behaviour may be highly competitive.

- Oligopolists may be dynamically efficient in terms of innovation and new product and process development. The super-normal profits they generate may be used to innovate, in which case the consumer may gain.

- Price stability may bring advantages to consumers and the macro-economy because it helps consumers plan ahead and stabilises their expenditure, which may help stabilise the trade cycle.

Test your knowledge with a quiz

Press next to launch the quiz, you are allowed two attempts - feedback is provided after each question is attempted..

Game Theory

Monopolistic competition

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

11.2 Oligopoly: Competition Among the Few

Learning objectives.

- Explain the main characteristics of an oligopoly, differentiating it from other types of market structures.

- Explain the measures that are used to determine the degree of concentration in an industry.

- Explain and illustrate the collusion model of oligopoly.

- Discuss how game theory can be used to understand the behavior of firms in an oligopoly.

In July, 2005, General Motors Corporation (GMC) offered “employee discount pricing” to virtually all GMC customers, not just employees and their relatives. This new marketing strategy introduced by GMC obviously affected Ford, Chrysler, Toyota and other automobile and truck manufacturers; Ford matched GMC’s employee-discount plan by offering up to $1,000 to its own employees who convinced friends to purchase its cars and trucks. Ford also offered its customers the same prices paid by its employees. By mid-July, Chrysler indicated that it was looking at many alternatives, but was waiting for GMC to make its next move. Ultimately, Chrysler also offered employee discount pricing.

Toyota had to respond. It quickly developed a new marketing strategy of its own, which included lowering the prices of its cars and offering new financing terms. The responses of Ford, Chrysler, and Toyota to GMC’s pricing strategy obviously affected the outcome of that strategy. Similarly, a decision by Procter & Gamble to lower the price of Crest toothpaste may elicit a response from Colgate-Palmolive, and that response will affect the sales of Crest. In an oligopoly , the fourth and final market structure that we will study, the market is dominated by a few firms, each of which recognizes that its own actions will produce a response from its rivals and that those responses will affect it.

The firms that dominate an oligopoly recognize that they are interdependent: What one firm does affects each of the others. This interdependence stands in sharp contrast to the models of perfect competition and monopolistic competition, where we assume that each firm is so small that it assumes the rest of the market will, in effect, ignore what it does. A perfectly competitive firm responds to the market, not to the actions of any other firm. A monopolistically competitive firm responds to its own demand, not to the actions of specific rivals. These presumptions greatly simplify the analysis of perfect competition and monopolistic competition. We do not have that luxury in oligopoly, where the interdependence of firms is the defining characteristic of the market.

Some oligopoly industries make standardized products: steel, aluminum, wire, and industrial tools. Others make differentiated products: cigarettes, automobiles, computers, ready-to-eat breakfast cereal, and soft drinks.

Measuring Concentration in Oligopoly

Oligopoly means that a few firms dominate an industry. But how many is “a few,” and how large a share of industry output does it take to “dominate” the industry?

Compare, for example, the ready-to-eat breakfast cereal industry and the ice cream industry. The cereal market is dominated by two firms, Kellogg’s and General Mills, which together hold more than half the cereal market. This oligopoly operates in a highly concentrated market. The market for ice cream, where the four largest firms account for just less than a third of output, is much less concentrated.

One way to measure the degree to which output in an industry is concentrated among a few firms is to use a concentration ratio , which reports the percentage of output accounted for by the largest firms in an industry. The higher the concentration ratio, the more the firms in the industry take account of their rivals’ behavior. The lower the concentration ratio, the more the industry reflects the characteristics of monopolistic competition or perfect competition.

The U.S. Census Bureau, based on surveys it conducts of manufacturing firms every five years, reports concentration ratios. These surveys show concentration ratios for the largest 4, 8, 20, and 50 firms in each industry category. Some concentration ratios from the 2002 survey, the latest available, are reported in Table 11.1 “Concentration Ratios and Herfindahl–Hirschman Indexes” . Notice that the four-firm concentration ratio for breakfast cereals is 78%; for ice cream it is 48%.

Table 11.1 Concentration Ratios and Herfindahl–Hirschman Indexes

| Industry | Largest 4 firms | Largest 8 firms | Largest 20 firms | Largest 50 firms | HHI |

|---|---|---|---|---|---|

| Ice cream | 48 | 64 | 82 | 93 | 736 |

| Breakfast cereals | 78 | 91 | 99 | 100 | 2521 |

| Cigarettes | 95 | 99 | 100 | *D | |

| Men’s and boys’ shirts | 38 | 53 | 73 | 89 | 481 |

| Women’s and girls’ blouses and shirts | 21 | 32 | 49 | 70 | 186 |

| Automobiles | 76 | 94 | 99 | 100 | 1911 |

| Sporting and athletic goods | 23 | 32 | 46 | 62 | 182 |

| Dental laboratories | 13 | 18 | 23 | 30 | 54 |

| *D, data withheld by the government to avoid revealing information about specific firms. | |||||

Two measures of industry concentration are reported by the Census Bureau: concentration ratios and the Herfindahl–Hirschman Index (HHI).

Source: Selected statistics from Sector 31: Manufacturing: Subject Series—Concentration Ratios: Share of Value of Shipments Accounted for by the 4, 8, 20, and 50 Largest Companies for Industries: 2002 at http://www.census.gov/epcd/www/concentration.html .

An alternative measure of concentration is found by squaring the percentage share (stated as a whole number) of each firm in an industry, then summing these squared market shares to derive a Herfindahl–Hirschman Index (HHI) . The largest HHI possible is the case of monopoly, where one firm has 100% of the market; the index is 100 2 , or 10,000. An industry with two firms, each with 50% of total output, has an HHI of 5,000 (50 2 + 50 2 ). In an industry with 10,000 firms that have 0.01% of the market each, the HHI is 1. Herfindahl–Hirschman Indexes reported by the Census Bureau are also given in Table 11.1 “Concentration Ratios and Herfindahl–Hirschman Indexes” . Notice that the HHI is 2,521 for breakfast cereals and only 736 for ice cream, suggesting that the ice cream industry is more competitive than the breakfast cereal industry.

In some cases, the census data understate the degree to which a few firms dominate the market. One problem is that industry categories may be too broad to capture significant cases of industry dominance. The sporting goods industry, for example, appears to be highly competitive if we look just at measures of concentration, but markets for individual goods, such as golf clubs, running shoes, and tennis rackets, tend to be dominated by a few firms. Further, the data reflect shares of the national market. A tendency for regional domination does not show up. For example, the concrete industry appears to be highly competitive. But concrete is produced in local markets—it is too expensive to ship it very far—and many of these local markets are dominated by a handful of firms.

The census data can also overstate the degree of actual concentration. The “automobiles” category, for example, has a four-firm concentration ratio that suggests the industry is strongly dominated by four large firms (in fact, U.S. production is dominated by three: General Motors, Ford, and Chrysler). Those firms hardly account for all car sales in the United States, however, as other foreign producers have captured a large portion of the domestic market. Including those foreign competitors suggests a far less concentrated industry than the census data imply.

The Collusion Model

There is no single model of profit-maximizing oligopoly behavior that corresponds to economists’ models of perfect competition, monopoly, and monopolistic competition. Uncertainty about the interaction of rival firms makes specification of a single model of oligopoly impossible. Instead, economists have devised a variety of models that deal with the uncertain nature of rivals’ responses in different ways. In this section we review one type of oligopoly model, the collusion model. After examining this traditional approach to the analysis of oligopoly behavior, we shall turn to another method of examining oligopolistic interaction: game theory.

Firms in any industry could achieve the maximum profit attainable if they all agreed to select the monopoly price and output and to share the profits. One approach to the analysis of oligopoly is to assume that firms in the industry collude, selecting the monopoly solution.

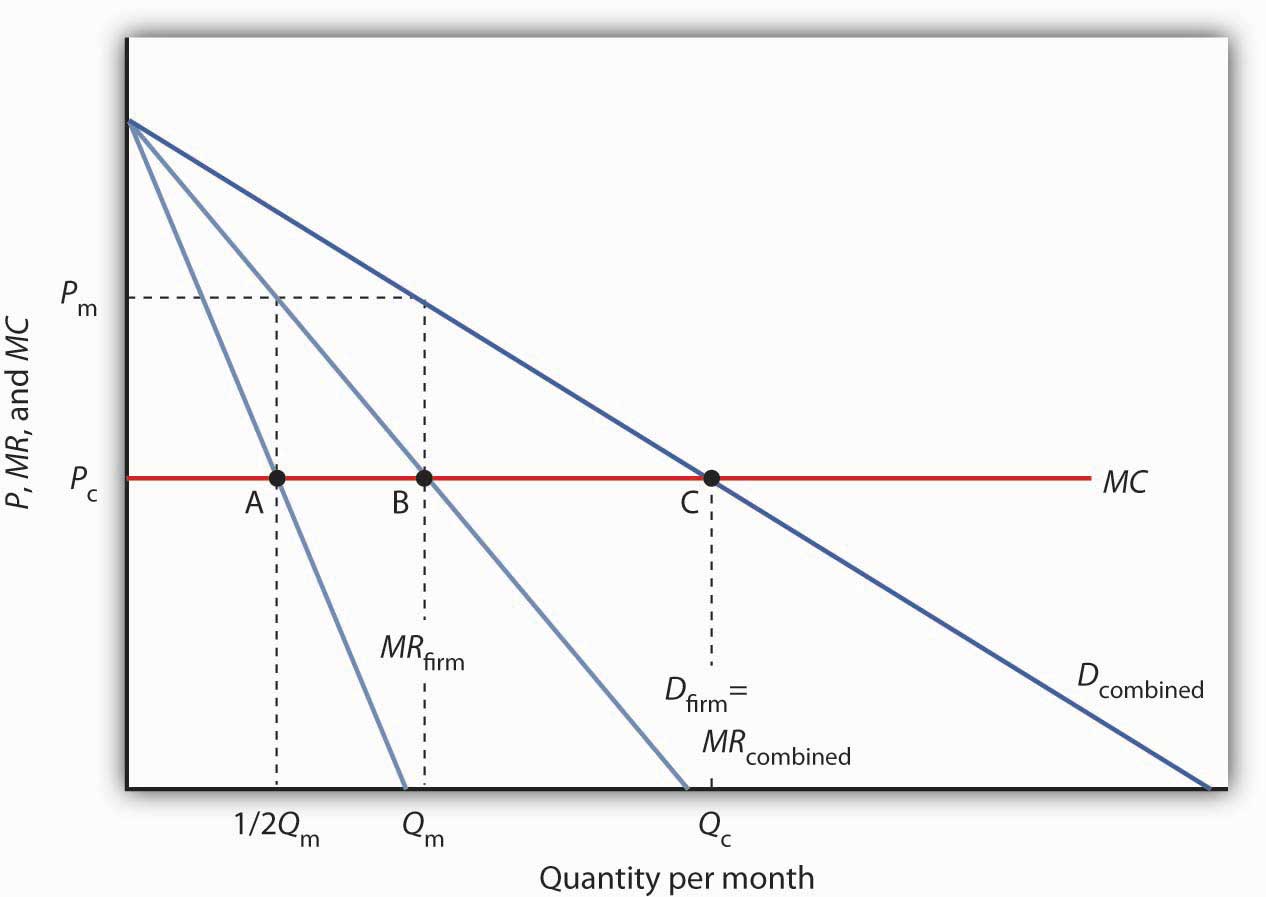

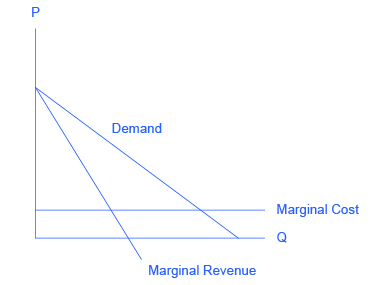

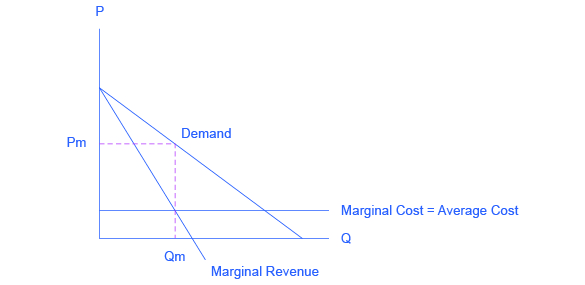

Suppose an industry is a duopoly , an industry with two firms. Figure 11.5 “Monopoly Through Collusion” shows a case in which the two firms are identical. They sell identical products and face identical demand and cost conditions. To simplify the analysis, we will assume that each has a horizontal marginal cost curve, MC. The demand and marginal revenue curves are the same for both firms. We find the combined demand curve for the two firms, D combined , by adding the individual demand curves together. Because one firm’s demand curve, D firm , represents one-half of market demand, it is the same as the combined marginal revenue curve for the two firms. If these two firms act as a monopoly, together they produce Q m and charge a price P m . This result is achieved if each firm selects its profit-maximizing output, which equals 1/2 Q m . This solution is inefficient; the efficient solution is price P c and output Q c , found where the combined market demand curve D combined and the marginal cost curve MC intersect.

Figure 11.5 Monopoly Through Collusion

Two identical firms have the same horizontal marginal cost curve MC. Their demand curves D firm and marginal revenue curves MR firm are also identical. The combined demand curve is D combined ; the combined marginal revenue curve is MR combined . The profits of the two firms are maximized if each produces 1/2 Q m at point A. Industry output at point B is thus Q m and the price is P m . At point C, the efficient solution output would be Q c , and the price would equal MC .

In the simplest form of collusion, overt collusion , firms openly agree on price, output, and other decisions aimed at achieving monopoly profits. Firms that coordinate their activities through overt collusion and by forming collusive coordinating mechanisms make up a cartel .

Firms form a cartel to gain monopoly power. A successful cartel can earn large profits, but there are several problems with forming and maintaining one. First, in many countries, including the United States, cartels are generally illegal 1 . They are banned, because their purpose is to raise prices and restrict output. Second, the cartel may not succeed in inducing all firms in the industry to join. Firms that remain outside the cartel can compete by lowering price, and thus they prevent the cartel from achieving the monopoly solution. Third, there is always an incentive for individual members to cheat on cartel agreements. Suppose the members of a cartel have agreed to impose the monopoly price in their market and to limit their output accordingly. Any one firm might calculate that it could charge slightly less than the cartel price and thus capture a larger share of the market for itself. Cheating firms expand output and drive prices down below the level originally chosen.

The Organization of Petroleum Exporting Countries (OPEC), perhaps the best-known cartel, is made up of 13 oil-producing countries. In the 1970s, OPEC successfully acted like a monopoly by restricting output and raising prices. By the mid-1980s, however, the monopoly power of the cartel had been weakened by expansion of output by nonmember producers such as Mexico and Norway and by cheating among the cartel members.

An alternative to overt collusion is tacit collusion , an unwritten, unspoken understanding through which firms agree to limit their competition. Firms may, for example, begin following the price leadership of a particular firm, raising or lowering their prices when the leader makes such a change. The price leader may be the largest firm in the industry, or it may be a firm that has been particularly good at assessing changes in demand or cost. At various times, tacit collusion has been alleged to occur in a wide range of industries, including steel, cars, and breakfast cereals.

It is difficult to know how common tacit collusion is. The fact that one firm changes its price shortly after another one does cannot prove that a tacit conspiracy exists. After all, we expect to see the prices of all firms in a perfectly competitive industry moving together in response to changes in demand or production costs.

Game Theory and Oligopoly Behavior

Oligopoly presents a problem in which decision makers must select strategies by taking into account the responses of their rivals, which they cannot know for sure in advance. The Start Up feature at the beginning of this chapter suggested the uncertainty eBay faces as it considers the possibility of competition from Google. A choice based on the recognition that the actions of others will affect the outcome of the choice and that takes these possible actions into account is called a strategic choice . Game theory is an analytical approach through which strategic choices can be assessed.

Among the strategic choices available to an oligopoly firm are pricing choices, marketing strategies, and product-development efforts. An airline’s decision to raise or lower its fares—or to leave them unchanged—is a strategic choice. The other airlines’ decision to match or ignore their rival’s price decision is also a strategic choice. IBM boosted its share in the highly competitive personal computer market in large part because a strategic product-development strategy accelerated the firm’s introduction of new products.

Once a firm implements a strategic decision, there will be an outcome. The outcome of a strategic decision is called a payoff . In general, the payoff in an oligopoly game is the change in economic profit to each firm. The firm’s payoff depends partly on the strategic choice it makes and partly on the strategic choices of its rivals. Some firms in the airline industry, for example, raised their fares in 2005, expecting to enjoy increased profits as a result. They changed their strategic choices when other airlines chose to slash their fares, and all firms ended up with a payoff of lower profits—many went into bankruptcy.

We shall use two applications to examine the basic concepts of game theory. The first examines a classic game theory problem called the prisoners’ dilemma. The second deals with strategic choices by two firms in a duopoly.

The Prisoners’ Dilemma

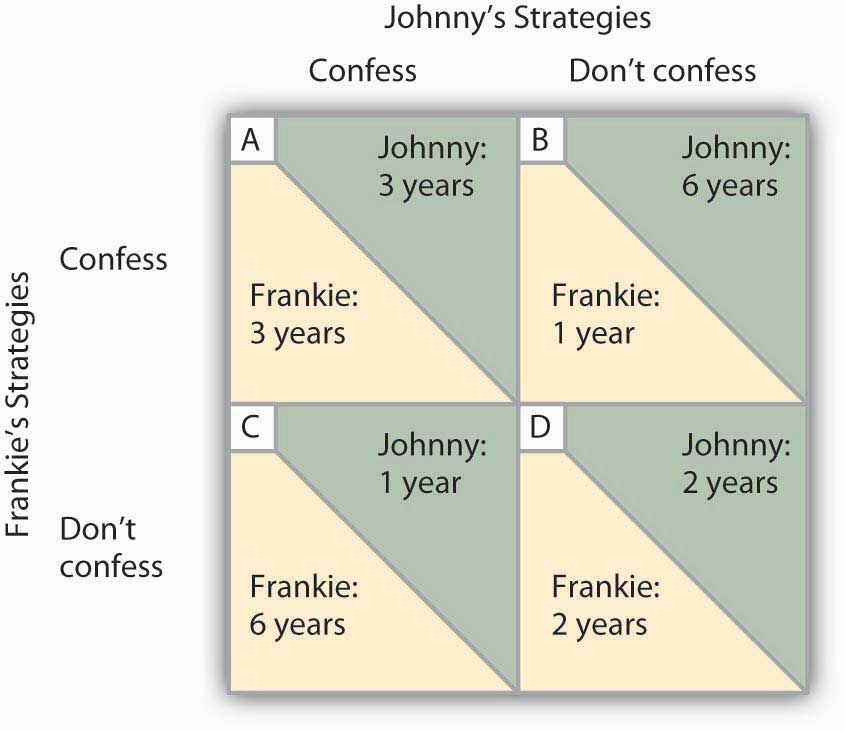

Suppose a local district attorney (DA) is certain that two individuals, Frankie and Johnny, have committed a burglary, but she has no evidence that would be admissible in court.

The DA arrests the two. On being searched, each is discovered to have a small amount of cocaine. The DA now has a sure conviction on a possession of cocaine charge, but she will get a conviction on the burglary charge only if at least one of the prisoners confesses and implicates the other.

The DA decides on a strategy designed to elicit confessions. She separates the two prisoners and then offers each the following deal: “If you confess and your partner doesn’t, you will get the minimum sentence of one year in jail on the possession and burglary charges. If you both confess, your sentence will be three years in jail. If your partner confesses and you do not, the plea bargain is off and you will get six years in prison. If neither of you confesses, you will each get two years in prison on the drug charge.”

The two prisoners each face a dilemma; they can choose to confess or not confess. Because the prisoners are separated, they cannot plot a joint strategy. Each must make a strategic choice in isolation.

The outcomes of these strategic choices, as outlined by the DA, depend on the strategic choice made by the other prisoner. The payoff matrix for this game is given in Figure 11.6 “Payoff Matrix for the Prisoners’ Dilemma” . The two rows represent Frankie’s strategic choices; she may confess or not confess. The two columns represent Johnny’s strategic choices; he may confess or not confess. There are four possible outcomes: Frankie and Johnny both confess (cell A), Frankie confesses but Johnny does not (cell B), Frankie does not confess but Johnny does (cell C), and neither Frankie nor Johnny confesses (cell D). The portion at the lower left in each cell shows Frankie’s payoff; the shaded portion at the upper right shows Johnny’s payoff.

Figure 11.6 Payoff Matrix for the Prisoners’ Dilemma

The four cells represent each of the possible outcomes of the prisoners’ game.

If Johnny confesses, Frankie’s best choice is to confess—she will get a three-year sentence rather than the six-year sentence she would get if she did not confess. If Johnny does not confess, Frankie’s best strategy is still to confess—she will get a one-year rather than a two-year sentence. In this game, Frankie’s best strategy is to confess, regardless of what Johnny does. When a player’s best strategy is the same regardless of the action of the other player, that strategy is said to be a dominant strategy . Frankie’s dominant strategy is to confess to the burglary.

For Johnny, the best strategy to follow, if Frankie confesses, is to confess. The best strategy to follow if Frankie does not confess is also to confess. Confessing is a dominant strategy for Johnny as well. A game in which there is a dominant strategy for each player is called a dominant strategy equilibrium . Here, the dominant strategy equilibrium is for both prisoners to confess; the payoff will be given by cell A in the payoff matrix.

From the point of view of the two prisoners together, a payoff in cell D would have been preferable. Had they both denied participation in the robbery, their combined sentence would have been four years in prison—two years each. Indeed, cell D offers the lowest combined prison time of any of the outcomes in the payoff matrix. But because the prisoners cannot communicate, each is likely to make a strategic choice that results in a more costly outcome. Of course, the outcome of the game depends on the way the payoff matrix is structured.

Repeated Oligopoly Games

The prisoners’ dilemma was played once, by two players. The players were given a payoff matrix; each could make one choice, and the game ended after the first round of choices.

The real world of oligopoly has as many players as there are firms in the industry. They play round after round: a firm raises its price, another firm introduces a new product, the first firm cuts its price, a third firm introduces a new marketing strategy, and so on. An oligopoly game is a bit like a baseball game with an unlimited number of innings—one firm may come out ahead after one round, but another will emerge on top another day. In the computer industry game, the introduction of personal computers changed the rules. IBM, which had won the mainframe game quite handily, struggles to keep up in a world in which rivals continue to slash prices and improve quality.

Oligopoly games may have more than two players, so the games are more complex, but this does not change their basic structure. The fact that the games are repeated introduces new strategic considerations. A player must consider not just the ways in which its choices will affect its rivals now, but how its choices will affect them in the future as well.

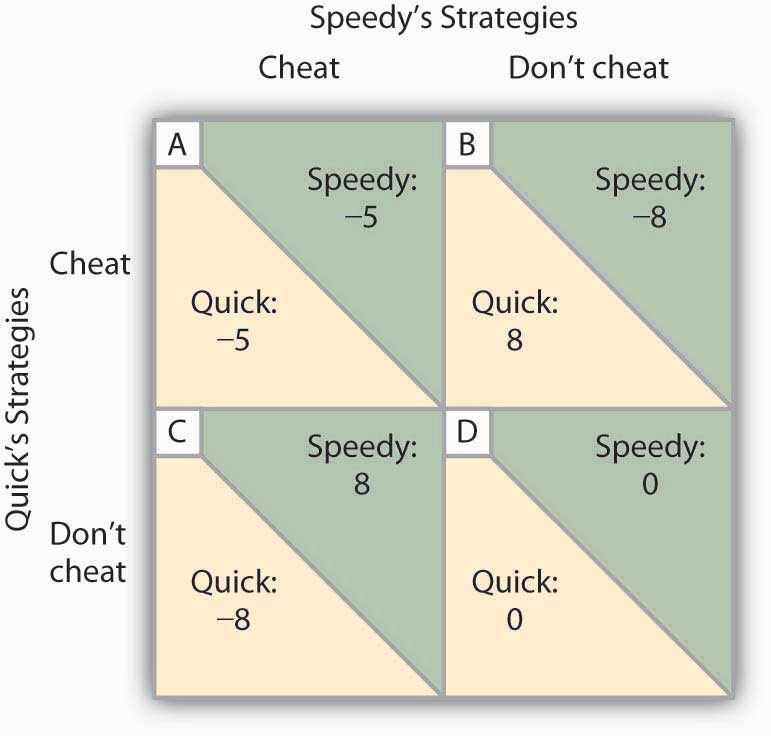

We will keep the game simple, however, and consider a duopoly game. The two firms have colluded, either tacitly or overtly, to create a monopoly solution. As long as each player upholds the agreement, the two firms will earn the maximum economic profit possible in the enterprise.

There will, however, be a powerful incentive for each firm to cheat. The monopoly solution may generate the maximum economic profit possible for the two firms combined, but what if one firm captures some of the other firm’s profit? Suppose, for example, that two equipment rental firms, Quick Rent and Speedy Rent, operate in a community. Given the economies of scale in the business and the size of the community, it is not likely that another firm will enter. Each firm has about half the market, and they have agreed to charge the prices that would be chosen if the two combined as a single firm. Each earns economic profits of $20,000 per month.

Quick and Speedy could cheat on their arrangement in several ways. One of the firms could slash prices, introduce a new line of rental products, or launch an advertising blitz. This approach would not be likely to increase the total profitability of the two firms, but if one firm could take the other by surprise, it might profit at the expense of its rival, at least for a while.

We will focus on the strategy of cutting prices, which we will call a strategy of cheating on the duopoly agreement. The alternative is not to cheat on the agreement. Cheating increases a firm’s profits if its rival does not respond. Figure 11.7 “To Cheat or Not to Cheat: Game Theory in Oligopoly” shows the payoff matrix facing the two firms at a particular time. As in the prisoners’ dilemma matrix, the four cells list the payoffs for the two firms. If neither firm cheats (cell D), profits remain unchanged.

Figure 11.7 To Cheat or Not to Cheat: Game Theory in Oligopoly

Two rental firms, Quick Rent and Speedy Rent, operate in a duopoly market. They have colluded in the past, achieving a monopoly solution. Cutting prices means cheating on the arrangement; not cheating means maintaining current prices. The payoffs are changes in monthly profits, in thousands of dollars. If neither firm cheats, then neither firm’s profits will change. In this game, cheating is a dominant strategy equilibrium.

This game has a dominant strategy equilibrium. Quick’s preferred strategy, regardless of what Speedy does, is to cheat. Speedy’s best strategy, regardless of what Quick does, is to cheat. The result is that the two firms will select a strategy that lowers their combined profits!

Quick Rent and Speedy Rent face an unpleasant dilemma. They want to maximize profit, yet each is likely to choose a strategy inconsistent with that goal. If they continue the game as it now exists, each will continue to cut prices, eventually driving prices down to the point where price equals average total cost (presumably, the price-cutting will stop there). But that would leave the two firms with zero economic profits.

Both firms have an interest in maintaining the status quo of their collusive agreement. Overt collusion is one device through which the monopoly outcome may be maintained, but that is illegal. One way for the firms to encourage each other not to cheat is to use a tit-for-tat strategy. In a tit-for-tat strategy a firm responds to cheating by cheating, and it responds to cooperative behavior by cooperating. As each firm learns that its rival will respond to cheating by cheating, and to cooperation by cooperating, cheating on agreements becomes less and less likely.

Still another way firms may seek to force rivals to behave cooperatively rather than competitively is to use a trigger strategy , in which a firm makes clear that it is willing and able to respond to cheating by permanently revoking an agreement. A firm might, for example, make a credible threat to cut prices down to the level of average total cost—and leave them there—in response to any price-cutting by a rival. A trigger strategy is calculated to impose huge costs on any firm that cheats—and on the firm that threatens to invoke the trigger. A firm might threaten to invoke a trigger in hopes that the threat will forestall any cheating by its rivals.

Game theory has proved to be an enormously fruitful approach to the analysis of a wide range of problems. Corporations use it to map out strategies and to anticipate rivals’ responses. Governments use it in developing foreign-policy strategies. Military leaders play war games on computers using the basic ideas of game theory. Any situation in which rivals make strategic choices to which competitors will respond can be assessed using game theory analysis.

One rather chilly application of game theory analysis can be found in the period of the Cold War when the United States and the former Soviet Union maintained a nuclear weapons policy that was described by the acronym MAD, which stood for m utually a ssured d estruction. Both countries had enough nuclear weapons to destroy the other several times over, and each threatened to launch sufficient nuclear weapons to destroy the other country if the other country launched a nuclear attack against it or any of its allies. On its face, the MAD doctrine seems, well, mad. It was, after all, a commitment by each nation to respond to any nuclear attack with a counterattack that many scientists expected would end human life on earth. As crazy as it seemed, however, it worked. For 40 years, the two nations did not go to war. While the collapse of the Soviet Union in 1991 ended the need for a MAD doctrine, during the time that the two countries were rivals, MAD was a very effective trigger indeed.

Of course, the ending of the Cold War has not produced the ending of a nuclear threat. Several nations now have nuclear weapons. The threat that Iran will introduce nuclear weapons, given its stated commitment to destroy the state of Israel, suggests that the possibility of nuclear war still haunts the world community.

Key Takeaways

- The key characteristics of oligopoly are a recognition that the actions of one firm will produce a response from rivals and that these responses will affect it. Each firm is uncertain what its rivals’ responses might be.

- The degree to which a few firms dominate an industry can be measured using a concentration ratio or a Herfindahl–Hirschman Index.

- One way to avoid the uncertainty firms face in oligopoly is through collusion. Collusion may be overt, as in the case of a cartel, or tacit, as in the case of price leadership.

- Game theory is a tool that can be used to understand strategic choices by firms.

- Firms can use tit-for-tat and trigger strategies to encourage cooperative behavior by rivals.

Which model of oligopoly would seem to be most appropriate for analyzing firms’ behavior in each of the situations given below?

- When South Airlines lowers its fare between Miami and New York City, North Airlines lowers its fare between the two cities. When South Airlines raises its fare, North Airlines does too.

- Whenever Bank A raises interest rates on car loans, other banks in the area do too.

- In 1986, Saudi Arabia intentionally flooded the market with oil in order to punish fellow OPEC members for cheating on their production quotas.

- In July 1998, Saudi Arabia floated a proposal in which a group of eight or nine major oil-exporting countries (including OPEC members and some nonmembers, such as Mexico) would manage world oil prices by adjusting their production.

Case in Point: Memory Chip Makers Caught in Global Price-Fixing Scheme

Figure 11.8

Tristendomusic – Chips array – CC BY-SA 2.0.

It may have been the remark by T.L. Chang, vice president of the Taiwan-based memory chip manufacturer Mosel-Vitelic that sparked the investigation by the U.S. Department of Justice Antitrust Division. Mr. Chang was quoted in Taiwan’s Commercial Times in May 2002 as admitting to price-fixing meetings held in Asia among the major producers of DRAM, or dynamic random access memory. DRAM is the most common semi-conductor main memory format for storage and retrieval of information that is used in personal computers, mobile phones, digital cameras, MP3 music players, and other electronics products. At those meetings, as well as through emails and telephone conferences, the main manufacturers of DRAM decided not only what prices to charge and how much to make available, but also exchanged information on DRAM sales for the purpose of monitoring and enforcing adherence to the agreed prices. The collusion lasted for three years—from 1999 to 2002. In December 2001, DRAM prices were less than $1.00. By May of 2002, price had risen to the $4 to $5 range.

The companies that were directly injured by the higher chip prices included Dell, Compaq, Hewlett-Packard, Apple, IBM, and Gateway. In the end, though, the purchasers of their products paid in the form of higher prices or less memory.

In December 2003, a Micron Technology sales manager pled guilty to obstruction of justice and served six months of home detention. The first chipmaker to plead guilty a year later was Germany-based Infineon Technologies, which was fined $160 million. As of September 2007, five companies, Samsung being the largest, had been charged fines of more than $732 million, and over 3,000 days of jail time had been meted out to eighteen corporate executives.

The sharp reduction in the number of DRAM makers in the late 1990s undoubtedly made it easier to collude. The industry is still quite concentrated with Samsung holding 27.7% of the market and Hynix 21.3%. The price, however, has fallen quite sharply in recent years.

Sources: Department of Justice, “Sixth Samsung Executive Agrees to Plead Guilty to Participating in DRAM Price-Fixing Cartel,” Press Release April 19, 2007; Stephen Labaton, “Infineon To Pay a Fine in the Fixing of Chip Prices,” The New York Times , September 16, 2004; George Leopold and David Lammers, “DRAMs Under Gun in Antitrust Probe”, Electronic Engineering Times , 1124 (June 24, 2002):1, 102; Lee Sun-Young, “Samsung Cements DRAM Leadership,” Korea Herald , online, March 31, 2008.

Answers to Try It! Problems

- North Airlines seems to be practicing a price strategy known in game theory as tit-for-tat.

- The banks could be engaged in tacit collusion, with Bank A as the price leader.

- Saudi Arabia appears to have used a trigger strategy, another aspect of game theory. In general, of course, participants hope they will never have to “pull” the trigger, because doing so harms all participants. After years of cheating by other OPEC members, Saudi Arabia did undertake a policy that hurt all members of OPEC, including itself; OPEC has never since regained the prominent role it played in oil markets.

- Saudi Arabia seems to be trying to create another oil cartel, a form of overt collusion.

1 One legal cartel is the NCAA, which many economists regard as a successful device through which member firms (colleges and universities) collude on a wide range of rules through which they produce sports.

Principles of Economics Copyright © 2016 by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Chapter 10. Monopolistic Competition and Oligopoly

10.2 Oligopoly

Learning objectives.

- Explain why and how oligopolies exist

- Contrast collusion and competition

- Interpret and analyze the prisoner’s dilemma diagram

- Evaluate the tradeoffs of imperfect competition

Many purchases that individuals make at the retail level are produced in markets that are neither perfectly competitive, monopolies, nor monopolistically competitive. Rather, they are oligopolies. Oligopoly arises when a small number of large firms have all or most of the sales in an industry. Examples of oligopoly abound and include the auto industry, cable television, and commercial air travel. Oligopolistic firms are like cats in a bag. They can either scratch each other to pieces or cuddle up and get comfortable with one another. If oligopolists compete hard, they may end up acting very much like perfect competitors, driving down costs and leading to zero profits for all. If oligopolists collude with each other, they may effectively act like a monopoly and succeed in pushing up prices and earning consistently high levels of profit. Oligopolies are typically characterized by mutual interdependence where various decisions such as output, price, advertising, and so on, depend on the decisions of the other firm(s). Analyzing the choices of oligopolistic firms about pricing and quantity produced involves considering the pros and cons of competition versus collusion at a given point in time.

Why Do Oligopolies Exist?

A combination of the barriers to entry that create monopolies and the product differentiation that characterizes monopolistic competition can create the setting for an oligopoly. For example, when a government grants a patent for an invention to one firm, it may create a monopoly. When the government grants patents to, for example, three different pharmaceutical companies that each has its own drug for reducing high blood pressure, those three firms may become an oligopoly.

Similarly, a natural monopoly will arise when the quantity demanded in a market is only large enough for a single firm to operate at the minimum of the long-run average cost curve. In such a setting, the market has room for only one firm, because no smaller firm can operate at a low enough average cost to compete, and no larger firm could sell what it produced given the quantity demanded in the market.

Quantity demanded in the market may also be two or three times the quantity needed to produce at the minimum of the average cost curve—which means that the market would have room for only two or three oligopoly firms (and they need not produce differentiated products). Again, smaller firms would have higher average costs and be unable to compete, while additional large firms would produce such a high quantity that they would not be able to sell it at a profitable price. This combination of economies of scale and market demand creates the barrier to entry, which led to the Boeing-Airbus oligopoly for large passenger aircraft.

The product differentiation at the heart of monopolistic competition can also play a role in creating oligopoly. For example, firms may need to reach a certain minimum size before they are able to spend enough on advertising and marketing to create a recognizable brand name. The problem in competing with, say, Coca-Cola or Pepsi is not that producing fizzy drinks is technologically difficult, but rather that creating a brand name and marketing effort to equal Coke or Pepsi is an enormous task.

Collusion or Competition?

When oligopoly firms in a certain market decide what quantity to produce and what price to charge, they face a temptation to act as if they were a monopoly. By acting together, oligopolistic firms can hold down industry output, charge a higher price, and divide up the profit among themselves. When firms act together in this way to reduce output and keep prices high, it is called collusion . A group of firms that have a formal agreement to collude to produce the monopoly output and sell at the monopoly price is called a cartel . See the following Clear It Up feature for a more in-depth analysis of the difference between the two.

Collusion versus cartels: How can I tell which is which?

In the United States, as well as many other countries, it is illegal for firms to collude since collusion is anti-competitive behavior, which is a violation of antitrust law. Both the Antitrust Division of the Justice Department and the Federal Trade Commission have responsibilities for preventing collusion in the United States.

The problem of enforcement is finding hard evidence of collusion. Cartels are formal agreements to collude. Because cartel agreements provide evidence of collusion, they are rare in the United States. Instead, most collusion is tacit, where firms implicitly reach an understanding that competition is bad for profits.

The desire of businesses to avoid competing so that they can instead raise the prices that they charge and earn higher profits has been well understood by economists. Adam Smith wrote in Wealth of Nations in 1776: “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.”

Even when oligopolists recognize that they would benefit as a group by acting like a monopoly, each individual oligopoly faces a private temptation to produce just a slightly higher quantity and earn slightly higher profit—while still counting on the other oligopolists to hold down their production and keep prices high. If at least some oligopolists give in to this temptation and start producing more, then the market price will fall. Indeed, a small handful of oligopoly firms may end up competing so fiercely that they all end up earning zero economic profits—as if they were perfect competitors.

The Prisoner’s Dilemma

Because of the complexity of oligopoly, which is the result of mutual interdependence among firms, there is no single, generally-accepted theory of how oligopolies behave, in the same way that we have theories for all the other market structures. Instead, economists use game theory , a branch of mathematics that analyzes situations in which players must make decisions and then receive payoffs based on what other players decide to do. Game theory has found widespread applications in the social sciences, as well as in business, law, and military strategy.

The prisoner’s dilemma is a scenario in which the gains from cooperation are larger than the rewards from pursuing self-interest. It applies well to oligopoly. The story behind the prisoner’s dilemma goes like this:

Two co-conspiratorial criminals are arrested. When they are taken to the police station, they refuse to say anything and are put in separate interrogation rooms. Eventually, a police officer enters the room where Prisoner A is being held and says: “You know what? Your partner in the other room is confessing. So your partner is going to get a light prison sentence of just one year, and because you’re remaining silent, the judge is going to stick you with eight years in prison. Why don’t you get smart? If you confess, too, we’ll cut your jail time down to five years, and your partner will get five years, also.” Over in the next room, another police officer is giving exactly the same speech to Prisoner B. What the police officers do not say is that if both prisoners remain silent, the evidence against them is not especially strong, and the prisoners will end up with only two years in jail each.

The game theory situation facing the two prisoners is shown in Table 3 . To understand the dilemma, first consider the choices from Prisoner A’s point of view. If A believes that B will confess, then A ought to confess, too, so as to not get stuck with the eight years in prison. But if A believes that B will not confess, then A will be tempted to act selfishly and confess, so as to serve only one year. The key point is that A has an incentive to confess regardless of what choice B makes! B faces the same set of choices, and thus will have an incentive to confess regardless of what choice A makes. Confess is considered the dominant strategy or the strategy an individual (or firm) will pursue regardless of the other individual’s (or firm’s) decision. The result is that if prisoners pursue their own self-interest, both are likely to confess, and end up doing a total of 10 years of jail time between them.

| Remain Silent (cooperate with other prisoner) | Confess (do not cooperate with other prisoner) | ||

| Remain Silent (cooperate with other prisoner) | A gets 2 years, B gets 2 years | A gets 8 years, B gets 1 year | |

| Confess (do not cooperate with other prisoner) | A gets 1 year, B gets 8 years | A gets 5 years B gets 5 years | |

| The Prisoner’s Dilemma Problem | |||

The game is called a dilemma because if the two prisoners had cooperated by both remaining silent, they would only have had to serve a total of four years of jail time between them. If the two prisoners can work out some way of cooperating so that neither one will confess, they will both be better off than if they each follow their own individual self-interest, which in this case leads straight into longer jail terms.

The Oligopoly Version of the Prisoner’s Dilemma

The members of an oligopoly can face a prisoner’s dilemma, also. If each of the oligopolists cooperates in holding down output, then high monopoly profits are possible. Each oligopolist, however, must worry that while it is holding down output, other firms are taking advantage of the high price by raising output and earning higher profits. Table 4 shows the prisoner’s dilemma for a two-firm oligopoly—known as a duopoly . If Firms A and B both agree to hold down output, they are acting together as a monopoly and will each earn $1,000 in profits. However, both firms’ dominant strategy is to increase output, in which case each will earn $400 in profits.

| Hold Down Output (cooperate with other firm) | Increase Output (do not cooperate with other firm) | ||

| Hold Down Output (cooperate with other firm) | A gets $1,000, B gets $1,000 | A gets $200, B gets $1,500 | |

| Increase Output (do not cooperate with other firm) | A gets $1,500, B gets $200 | A gets $400, B gets $400 | |

| A Prisoner’s Dilemma for Oligopolists | |||

Can the two firms trust each other? Consider the situation of Firm A:

- If A thinks that B will cheat on their agreement and increase output, then A will increase output, too, because for A the profit of $400 when both firms increase output (the bottom right-hand choice in Table 4 ) is better than a profit of only $200 if A keeps output low and B raises output (the upper right-hand choice in the table).

- If A thinks that B will cooperate by holding down output, then A may seize the opportunity to earn higher profits by raising output. After all, if B is going to hold down output, then A can earn $1,500 in profits by expanding output (the bottom left-hand choice in the table) compared with only $1,000 by holding down output as well (the upper left-hand choice in the table).

Thus, firm A will reason that it makes sense to expand output if B holds down output and that it also makes sense to expand output if B raises output. Again, B faces a parallel set of decisions.

The result of this prisoner’s dilemma is often that even though A and B could make the highest combined profits by cooperating in producing a lower level of output and acting like a monopolist, the two firms may well end up in a situation where they each increase output and earn only $400 each in profits . The following Clear It Up feature discusses one cartel scandal in particular.

What is the Lysine cartel?

Lysine, a $600 million-a-year industry, is an amino acid used by farmers as a feed additive to ensure the proper growth of swine and poultry. The primary U.S. producer of lysine is Archer Daniels Midland (ADM), but several other large European and Japanese firms are also in this market. For a time in the first half of the 1990s, the world’s major lysine producers met together in hotel conference rooms and decided exactly how much each firm would sell and what it would charge. The U.S. Federal Bureau of Investigation (FBI), however, had learned of the cartel and placed wire taps on a number of their phone calls and meetings.

From FBI surveillance tapes, following is a comment that Terry Wilson, president of the corn processing division at ADM, made to the other lysine producers at a 1994 meeting in Mona, Hawaii:

I wanna go back and I wanna say something very simple. If we’re going to trust each other, okay, and if I’m assured that I’m gonna get 67,000 tons by the year’s end, we’re gonna sell it at the prices we agreed to . . . The only thing we need to talk about there because we are gonna get manipulated by these [expletive] buyers—they can be smarter than us if we let them be smarter. . . . They [the customers] are not your friend. They are not my friend. And we gotta have ‘em, but they are not my friends. You are my friend. I wanna be closer to you than I am to any customer. Cause you can make us … money. … And all I wanna tell you again is let’s—let’s put the prices on the board. Let’s all agree that’s what we’re gonna do and then walk out of here and do it.

The price of lysine doubled while the cartel was in effect. Confronted by the FBI tapes, Archer Daniels Midland pled guilty in 1996 and paid a fine of $100 million. A number of top executives, both at ADM and other firms, later paid fines of up to $350,000 and were sentenced to 24–30 months in prison.

In another one of the FBI recordings, the president of Archer Daniels Midland told an executive from another competing firm that ADM had a slogan that, in his words, had “penetrated the whole company.” The company president stated the slogan this way: “Our competitors are our friends. Our customers are the enemy.” That slogan could stand as the motto of cartels everywhere.

How to Enforce Cooperation

How can parties who find themselves in a prisoner’s dilemma situation avoid the undesired outcome and cooperate with each other? The way out of a prisoner’s dilemma is to find a way to penalize those who do not cooperate.

Perhaps the easiest approach for colluding oligopolists, as you might imagine, would be to sign a contract with each other that they will hold output low and keep prices high. If a group of U.S. companies signed such a contract, however, it would be illegal. Certain international organizations, like the nations that are members of the Organization of Petroleum Exporting Countries (OPEC) , have signed international agreements to act like a monopoly, hold down output, and keep prices high so that all of the countries can make high profits from oil exports. Such agreements, however, because they fall in a gray area of international law, are not legally enforceable. If Nigeria, for example, decides to start cutting prices and selling more oil, Saudi Arabia cannot sue Nigeria in court and force it to stop.

Visit the Organization of the Petroleum Exporting Countries website and learn more about its history and how it defines itself.

Because oligopolists cannot sign a legally enforceable contract to act like a monopoly, the firms may instead keep close tabs on what other firms are producing and charging. Alternatively, oligopolists may choose to act in a way that generates pressure on each firm to stick to its agreed quantity of output.

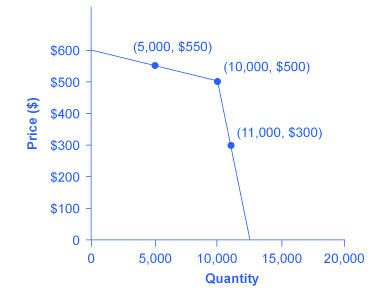

One example of the pressure these firms can exert on one another is the kinked demand curve , in which competing oligopoly firms commit to match price cuts, but not price increases. This situation is shown in Figure 1 . Say that an oligopoly airline has agreed with the rest of a cartel to provide a quantity of 10,000 seats on the New York to Los Angeles route, at a price of $500. This choice defines the kink in the firm’s perceived demand curve. The reason that the firm faces a kink in its demand curve is because of how the other oligopolists react to changes in the firm’s price. If the oligopoly decides to produce more and cut its price, the other members of the cartel will immediately match any price cuts—and therefore, a lower price brings very little increase in quantity sold.

If one firm cuts its price to $300, it will be able to sell only 11,000 seats. However, if the airline seeks to raise prices, the other oligopolists will not raise their prices, and so the firm that raised prices will lose a considerable share of sales. For example, if the firm raises its price to $550, its sales drop to 5,000 seats sold. Thus, if oligopolists always match price cuts by other firms in the cartel, but do not match price increases, then none of the oligopolists will have a strong incentive to change prices, since the potential gains are minimal. This strategy can work like a silent form of cooperation, in which the cartel successfully manages to hold down output, increase price , and share a monopoly level of profits even without any legally enforceable agreement.

Many real-world oligopolies, prodded by economic changes, legal and political pressures, and the egos of their top executives, go through episodes of cooperation and competition. If oligopolies could sustain cooperation with each other on output and pricing, they could earn profits as if they were a single monopoly. However, each firm in an oligopoly has an incentive to produce more and grab a bigger share of the overall market; when firms start behaving in this way, the market outcome in terms of prices and quantity can be similar to that of a highly competitive market.

Tradeoffs of Imperfect Competition

Monopolistic competition is probably the single most common market structure in the U.S. economy. It provides powerful incentives for innovation, as firms seek to earn profits in the short run, while entry assures that firms do not earn economic profits in the long run. However, monopolistically competitive firms do not produce at the lowest point on their average cost curves. In addition, the endless search to impress consumers through product differentiation may lead to excessive social expenses on advertising and marketing.

Oligopoly is probably the second most common market structure. When oligopolies result from patented innovations or from taking advantage of economies of scale to produce at low average cost, they may provide considerable benefit to consumers. Oligopolies are often buffeted by significant barriers to entry, which enable the oligopolists to earn sustained profits over long periods of time. Oligopolists also do not typically produce at the minimum of their average cost curves. When they lack vibrant competition, they may lack incentives to provide innovative products and high-quality service.

The task of public policy with regard to competition is to sort through these multiple realities, attempting to encourage behavior that is beneficial to the broader society and to discourage behavior that only adds to the profits of a few large companies, with no corresponding benefit to consumers. Monopoly and Antitrust Policy discusses the delicate judgments that go into this task.

The Temptation to Defy the Law

Oligopolistic firms have been called “cats in a bag,” as this chapter mentioned. The French detergent makers chose to “cozy up” with each other. The result? An uneasy and tenuous relationship. When the Wall Street Journal reported on the matter, it wrote: “According to a statement a Henkel manager made to the [French anti-trust] commission, the detergent makers wanted ‘to limit the intensity of the competition between them and clean up the market.’ Nevertheless, by the early 1990s, a price war had broken out among them.” During the soap executives’ meetings, which sometimes lasted more than four hours, complex pricing structures were established. “One [soap] executive recalled ‘chaotic’ meetings as each side tried to work out how the other had bent the rules.” Like many cartels, the soap cartel disintegrated due to the very strong temptation for each member to maximize its own individual profits.

How did this soap opera end? After an investigation, French antitrust authorities fined Colgate-Palmolive, Henkel, and Proctor & Gamble a total of €361 million ($484 million). A similar fate befell the icemakers. Bagged ice is a commodity, a perfect substitute, generally sold in 7- or 22-pound bags. No one cares what label is on the bag. By agreeing to carve up the ice market, control broad geographic swaths of territory, and set prices, the icemakers moved from perfect competition to a monopoly model. After the agreements, each firm was the sole supplier of bagged ice to a region; there were profits in both the long run and the short run. According to the courts: “These companies illegally conspired to manipulate the marketplace.” Fines totaled about $600,000—a steep fine considering a bag of ice sells for under $3 in most parts of the United States.

Even though it is illegal in many parts of the world for firms to set prices and carve up a market, the temptation to earn higher profits makes it extremely tempting to defy the law.

Key Concepts and Summary

An oligopoly is a situation where a few firms sell most or all of the goods in a market. Oligopolists earn their highest profits if they can band together as a cartel and act like a monopolist by reducing output and raising price. Since each member of the oligopoly can benefit individually from expanding output, such collusion often breaks down—especially since explicit collusion is illegal.

The prisoner’s dilemma is an example of game theory. It shows how, in certain situations, all sides can benefit from cooperative behavior rather than self-interested behavior. However, the challenge for the parties is to find ways to encourage cooperative behavior.

Self-Check Questions

- Suppose the firms collude to form a cartel. What price will the cartel charge? What quantity will the cartel supply? How much profit will the cartel earn?

- Suppose now that the cartel breaks up and the oligopolistic firms compete as vigorously as possible by cutting the price and increasing sales. What will the industry quantity and price be? What will the collective profits be of all firms in the industry?

- Compare the equilibrium price, quantity, and profit for the cartel and cutthroat competition outcomes.

| Firm B colludes with Firm A | Firm B cheats by selling more output | |

|---|---|---|

| Firm A colludes with Firm B | A gets $1,000, B gets $100 | A gets $800, B gets $200 |

| Firm A cheats by selling more output | A gets $1,050, B gets $50 | A gets $500, B gets $20 |

Review Questions

- Will the firms in an oligopoly act more like a monopoly or more like competitors? Briefly explain.

- Does each individual in a prisoner’s dilemma benefit more from cooperation or from pursuing self-interest? Explain briefly.

- What stops oligopolists from acting together as a monopolist and earning the highest possible level of profits?

Critical Thinking Questions

- Would you expect the kinked demand curve to be more extreme (like a right angle) or less extreme (like a normal demand curve) if each firm in the cartel produces a near-identical product like OPEC and petroleum? What if each firm produces a somewhat different product? Explain your reasoning.

- When OPEC raised the price of oil dramatically in the mid-1970s, experts said it was unlikely that the cartel could stay together over the long term—that the incentives for individual members to cheat would become too strong. More than forty years later, OPEC still exists. Why do you think OPEC has been able to beat the odds and continue to collude? Hint: You may wish to consider non-economic reasons.

- Mary and Raj are the only two growers who provide organically grown corn to a local grocery store. They know that if they cooperated and produced less corn, they could raise the price of the corn. If they work independently, they will each earn $100. If they decide to work together and both lower their output, they can each earn $150. If one person lowers output and the other does not, the person who lowers output will earn $0 and the other person will capture the entire market and will earn $200. Table 6 represents the choices available to Mary and Raj. What is the best choice for Raj if he is sure that Mary will cooperate? If Mary thinks Raj will cheat, what should Mary do and why? What is the prisoner’s dilemma result? What is the preferred choice if they could ensure cooperation? A = Work independently; B = Cooperate and Lower Output. (Each results entry lists Raj’s earnings first, and Mary’s earnings second.)

| A | B | ||

| A | (30, 30) | (15, 35) | |

| B | (35, 15) | (20, 20) | |

The United States Department of Justice. “Antitrust Division.” Accessed October 17, 2013. http://www.justice.gov/atr/.

eMarketer.com. 2014. “Total US Ad Spending to See Largest Increase Since 2004: Mobile advertising leads growth; will surpass radio, magazines and newspapers this year. Accessed March 12, 2015. http://www.emarketer.com/Article/Total-US-Ad-Spending-See-Largest-Increase-Since-2004/1010982.

Federal Trade Commission. “About the Federal Trade Commission.” Accessed October 17, 2013. http://www.ftc.gov/ftc/about.shtm.

Answers to Self-Check Questions

- Pc > Pcc. Qc < Qcc. Profit for the cartel is positive and large. Profit for cutthroat competition is zero.

- Firm B reasons that if it cheats and Firm A does not notice, it will double its money. Since Firm A’s profits will decline substantially, however, it is likely that Firm A will notice and if so, Firm A will cheat also, with the result that Firm B will lose 90% of what it gained by cheating. Firm A will reason that Firm B is unlikely to risk cheating. If neither firm cheats, Firm A earns $1000. If Firm A cheats, assuming Firm B does not cheat, A can boost its profits only a little, since Firm B is so small. If both firms cheat, then Firm A loses at least 50% of what it could have earned. The possibility of a small gain ($50) is probably not enough to induce Firm A to cheat, so in this case it is likely that both firms will collude.

Principles of Economics Copyright © 2016 by Rice University is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

18 Models of Oligopoly: Cournot, Bertrand, and Stackelberg

Cournot, Bertrand, and Stackelberg

The Policy Question How Should the Government Have Responded to Big Oil Company Mergers?

Exploring the policy question.

- How do oil companies compete—on quantities or prices?

- What policy solutions present themselves from this analysis?

Learning Objectives

18.1 cournot model of oligopoly: quantity setters.

Learning Objective 18.1 : Describe how oligopolist firms that choose quantities can be modeled using game theory.

18.2 Bertrand Model of Oligopoly: Price Setters

Learning Objective 18.2 : Describe how oligopolist firms that choose prices can be modeled using game theory.

18.3 Stackelberg Model of Oligopoly: First-Mover Advantage

Learning Objective 18.3 : Describe the different outcomes when oligopolist firms choose quantities sequentially.

18.4 Policy Example How Should the Government Have Responded to Big Oil Company Mergers?

Learning Objective 18.4 : Explain how models of oligopoly can help us understand how to respond to proposed mergers of oil companies that sell retail gas.

Oligopoly markets are markets in which only a few firms compete, where firms produce homogeneous or differentiated products, and where barriers to entry exist that may be natural or constructed. There are three main models of oligopoly markets, and each is considered a slightly different competitive environment. The Cournot model considers firms that make an identical product and make output decisions simultaneously. The Bertrand model considers firms that make an identical product but compete on price and make their pricing decisions simultaneously. The Stackelberg model considers quantity-setting firms with an identical product that make output decisions simultaneously. This chapter considers all three in order, beginning with the Cournot model.

| Number of firms | Similarity of goods | Barriers to entry or exit | Chapter | |

|---|---|---|---|---|

| Perfect competition | Many | Identical | No | |

| Monopolistic competition | Many | Distinct | No | |

| Oligopoly | Few | Identical or distinct | Yes | 18 |

| Monopoly | One | Unique | Yes |

Oligopolists face downward-sloping demand curves, which means that price is a function of the total quantity produced, which, in turn, implies that one firm’s output affects not only the price it receives for its output but the price its competitors receive as well. This creates a strategic environment where one firm’s profit maximizing output level is a function of its competitors’ output levels. The model we use to analyze this is one first introduced by French economist and mathematician Antoine Augustin Cournot in 1838. Interestingly, the solution to the Cournot model is the same as the more general Nash equilibrium concept introduced by John Nash in 1949 and the one used to solve for equilibrium in non-cooperative games in chapter 17 .

We will start by considering the simplest situation: two companies that make an identical product and that have the same cost function. Later we will explore what happens when we relax those assumptions and allow more firms, differentiated products, and different cost functions.

Let’s begin by considering a situation where there are two oil refineries located in the Denver, Colorado, area that are the only two providers of gasoline for the Rocky Mountain regional wholesale market. We’ll call them Federal Gas and National Gas. The gas they produce is identical, and they each decide independently—and without knowing the other’s choice—the quantity of gas to produce for the week at the beginning of each week. We will call Federal’s output choice [latex]q_F[/latex] and National’s output choice [latex]q_N[/latex], where [latex]q[/latex] represents liters of gasoline. The weekly demand for wholesale gas in the Rocky Mountain region is [latex]P=A—BQ[/latex], where [latex]Q[/latex] is the total quantity of gas supplied by the two firms, or [latex]Q=q_F+q_N[/latex]. Immediately, you can see the strategic component: the price they both receive for their gas is a function of each company’s output. We will assume that each liter of gas produced costs the company c, or that c is the marginal cost of producing a liter of gas for both companies and that there are no fixed costs.

If the profit function is [latex]\pi_F[/latex][latex]=[/latex] [latex]q_F(A-B(q_F+q_N)-c)[/latex] , then we can find the optimal output level by solving for the stationary point, or solving

[latex]\frac{\partial \pi_F}{\partial q_F}[/latex] [latex]=[/latex] [latex]_0[/latex]

If [latex]\pi_F=[/latex] [latex]q_F(A-B(q_F+q_N)-c)[/latex] , then we can expand to find

[latex]\pi_F[/latex] [latex]=[/latex][latex]Aq_F-Bq[/latex] [latex]\frac{F}{2}[/latex] [latex]-Bq_Fq_N-cq_F[/latex]

Taking the partial derivative of this expression with respect to [latex]q_F[/latex] ,

[latex]\frac{\partial \pi_F}{\partial q_F}[/latex] [latex]=[/latex][latex]A-2Bq_F-Bq_N-c[/latex] [latex]=[/latex] [latex]_0[/latex]

If we rearrange this, we can see that this is simply an expression of [latex]MR=MC[/latex] .

[latex]A-2Bq_F-Bq_N[/latex][latex]=[/latex][latex]c[/latex]

The marginal revenue looks the same as a monopolist’s [latex]MR[/latex] function but with one additional term, [latex]-[/latex] [latex]Bq_N[/latex] .

Solving for [latex]q_F[/latex] yields

[latex]q_F=[/latex] [latex]\frac{A-Bq_N-c}{2B}[/latex] ,

[latex]q^*_F=[/latex] [latex]\frac{A-c}{2B}-\frac{1}{2}[/latex] [latex]qN[/latex]

This is Federal Gas’s best response function, their profit maximizing output level given the output choice of their rivals. It is the same best response function as the ones in chapter 17 . By symmetry, National Gas has an identical best response function:

[latex]q^*_N=[/latex] [latex]\frac{A-c}{2B}-\frac{1}{2}[/latex] [latex]qF[/latex]

With these assumptions in place, we can express Federal’s profit function:

[latex]\pi_F=P \times q_F—c \times q_F = q_F (P-c)[/latex]

Substituting the inverse demand curve, we arrive at the expression

[latex]\pi_F=q_F(A-BQ-c)[/latex].

Substituting [latex]Q=q_A+q_B[/latex] yields

[latex]\pi_F=q_F(A-B(q_F+q_N)-c)[/latex].

The expression for National is symmetric:

[latex]\pi_N=q_N(A-B(q_N+q_F)-c)[/latex]

Note that we have now described a game complete with players, Federal and National; strategies, [latex]q_F[/latex] and [latex]q_N[/latex]; and payoffs, [latex]\pi_F[/latex] and [latex]\pi_N[/latex]. Now the task is to search for the equilibrium of the game. To do so, we have to begin with a best response function. In this case, the best response is the firm’s profit maximizing output. This will depend on both the firm’s own output and the competing firm’s output.

We know from chapter 15 that the monopolists’ marginal revenue curve when facing an inverse demand curve [latex]P=A-BQ[/latex] is [latex]MR(q)=A-2Bq[/latex]. This duopolistic example shows that the firms’ marginal revenue curves include one extra term:

[latex]MR_F(q_F)=A-2Bq_F-Bq_N[/latex] and [latex]MR_N(q_N)=A-2Bq_N-Bq_F[/latex]

The profit maximizing rule tells us that to find the profit maximizing output, we must set the marginal revenue to the marginal cost and solve. Doing so yields

[latex]q^*_F=\frac{A-c}{2B}-\frac{1}{2}qN[/latex]

for Federal Gas and

[latex]q^*_N=\frac{A-c}{2B}-\frac{1}{2}qF[/latex]

for National Gas. These are the firms’ best response functions, their profit maximizing output levels given the output choice of their rivals.

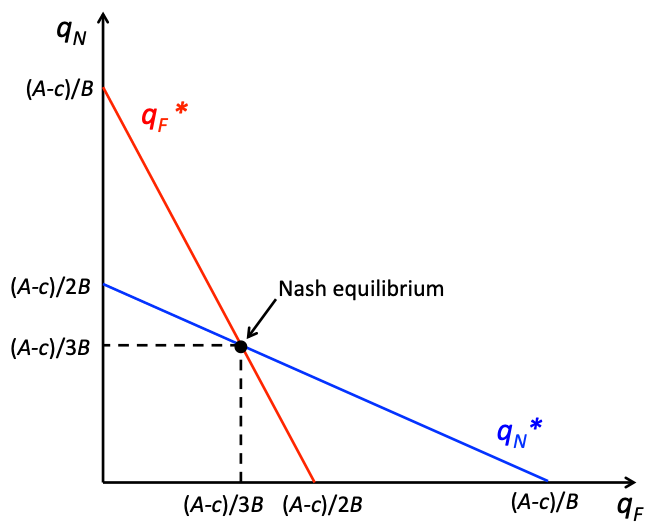

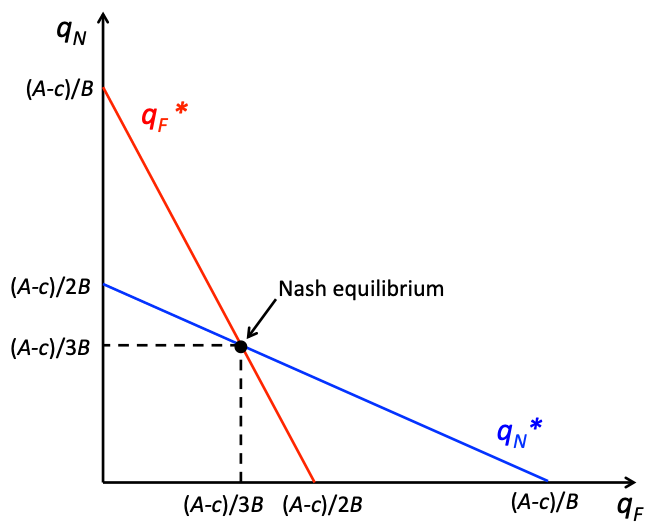

Now that we know the best response functions, solving for equilibrium in the model is relatively straightforward. We can begin by graphing the best response functions. These graphical illustrations of the best response functions are called reaction curves. A Nash equilibrium is a correspondence of best response functions, which is the same as a crossing of the reaction curves.

In figure 18.1 , we can see the Nash equilibrium of the Cournot duopoly model as the intersection of the reaction curves. Mathematically, this intersection is found by simultaneously solving

[latex]q^*_F=\frac{A-c}{2B}-\frac{1}{2}q_N[/latex] and [latex]q^*_F=\frac{A-c}{2B}-\frac{1}{2}q_F[/latex]

This is a system of two equations and two unknowns and therefore has a unique solution as long as the slopes are not equal. We can solve these by substituting one equation into the other, which yields a single equation with a single unknown:

[latex]q^*_F=\frac{A-c}{2B}-\frac{1}{2}[\frac{A-c}{2B}-\frac{1}{2}q_F][/latex]

Solving this by steps results in the following:

[latex]q^*_F=\frac{A-c}{2B}-\frac{A-c}{4B}+\frac{1}{4}q_F[/latex][latex]\frac{3}{4}q^*_F=\frac{A-c}{4B}[/latex] [latex]q^*_F=\frac{A-c}{3B}[/latex]

And by symmetry, we know that the two optimal quantities are the same:

[latex]q^*_N=\frac{A-c}{3B}[/latex]

The Nash equilibrium is

[latex](q^*_F,q^*_N)[/latex]

[latex](\frac{A-c}{3B}, \frac{A-c}{3B})[/latex].

Let’s consider a specific example. Suppose in the above example, the weekly demand curve for wholesale gas in the Rocky Mountain region is

[latex]p = 1,000 − 2Q[/latex], in thousands of gallons

Both firms have constant marginal costs of 400. In this case,

[latex]A = 1,000[/latex], [latex]B = 2[/latex] and [latex]C = 400[/latex].

[latex]q^*_F=\frac{A-c}{3B}=\frac{1,000 − 400}{(3)(2)}=\frac{600}{6}=100[/latex]

By symmetry, we know

[latex]q^*_N=100[/latex]

as well. So both Federal Gas and National Gas produce 100,000 gallons of gasoline a week. Total output is the sum of the two and is 200,000 gallons. The price is [latex]p= 1,000 − 2(200) = $600[/latex] for 1,000 gallons of gas, or $0.60 a gallon.

To analyze this from the beginning, we can set up the total revenue function for Federal Gas:

[latex]TR(q_F)=p×q_F[/latex] [latex]=(1,000 − 2Q)q_F[/latex] [latex]=(1,000 − 2q_F-2q_N)q_F[/latex] [latex]= 1,000 − 2q \frac{2}{F}-2q_Fq_N[/latex]

The marginal revenue function that is associated with this is

[latex]MR(q_F)=1,000 − 4q_F-2q_N[/latex].

We know marginal cost is 400, so setting marginal revenue equal to marginal cost results in the following expression:

[latex]1,000 − 4q_F-2q_N=400[/latex]

Solving for [latex]q_F[/latex] results in the following:

[latex]q_F=\frac{600 − 2q_N}{4}[/latex] [latex]q^*_F=150-\frac{q_F}{2}[/latex]

This is the best response function for Federal Gas. By symmetry, we know that National Gas has the same best response function:

[latex]q^*_N=150-\frac{q_F}{2}[/latex]

Solving for the Nash equilibrium, we get the following:

[latex]q^*_N=150-\frac{q_F}{2}[/latex] [latex]q^*_F=150 − 75+\frac{q_F}{4}[/latex] [latex]/frac{3}{4}q^*_F=25[/latex] [latex]q^*_F=100[/latex]

We can insert the solution for [latex]q_F[/latex] into [latex]q^*_N[/latex]:

[latex]q^*_N=150-\frac{(100)}{2}=100[/latex]

In the previous section, we studied oligopolists that make an identical good and who compete by setting quantities. The example we used in that section was wholesale gasoline, where the market sets a price that equates supply and demand and the strategic decision of the refiners was how much oil to refine into gasoline. In this section, we turn our attention to a different situation in which the oligopolists compete on price. The example here is the retail gas stations that bought the wholesale gas from the refiners and are now ready to sell it to consumers. We still have identical goods; for consumers, the gas that goes into their cars is all the same, and we will assume away any other differences like cleaner stations or the presence of a mini-mart.

Let’s imagine a simple situation where there are two gas stations, Fast Gas and Speedy Gas, on either side of a busy main street. Both stations have large signs that display the gas prices that each station is offering for the day. Consumers are assumed to be indifferent about the gas or the stations, so they will go to the station that is offering the lower price. So an individual gas station’s demand is conditional on its relative price with the other station.

Formally, we can express this with the following demand function for Fast Gas:

[latex]Q_F \left\{\begin{matrix} & & & \\ a-bP_F \text{ if }P_F P_F \end{matrix}\right.[/latex]

Speedy Gas has an equivalent demand curve:

[latex]Q_S \left\{\begin{matrix} & & & \\ a-bP_S \text{ if }P_S P_F \end{matrix}\right.[/latex]

In other words, these demand curves say that if a station has a lower price than the other, they will get all the demand at that price, and the other station will get no demand. If they have the same price, then each will get one-half of the demand at that price.

Let’s assume that Fast Gas and Speedy Gas both have the same constant marginal cost of [latex]c[/latex] and no fixed costs to keep the analysis simple. The question we now have to answer is, What are the best response functions for the two stations? Remember that best response functions are one player’s optimal strategy choice given the strategy choice of the other player. So what is Fast Gas’s best response to Speedy Gas’s price?

If Speedy Gas charges

[latex]P_S \gt c[/latex]

Fast Gas can set [latex]P_F \gt P_S[/latex] and they will get no customers at all and make a profit of zero. Fast Gas could instead set

[latex]P_F=P_S[/latex]

and get [latex]\frac{1}{2}[/latex] the demand at that price and make a positive profit. Or they could set

[latex]P_F=P_S −$0.01[/latex]

or set their price one cent below Speedy Gas’s price and get all the customers at a price that is one cent below the price, at which they would get [latex]\frac{1}{2}[/latex] the demand.

Clearly, this third option is the one that yields the most profit. Now we just have to consider the case where [latex]P_S=c[/latex]. In this case, undercutting the price by one cent is not optimal because Fast Gas would get all the demand but would lose money on every gallon of gas sold, yielding negative profits. Setting

[latex]P_F=P_S=c[/latex]

would give them half the demand at a break-even price and would yield exactly zero profits.

The best response function we just described for Fast Gas is the same best response function for Speedy Gas. So where are the correspondences of best response functions? As long as the prices are above [latex]c[/latex], there is always an incentive for both stations to undercut each other’s price, so there is no equilibrium. But at [latex]P_F=P_S=c[/latex], both stations are playing their best response to each other simultaneously. So the unique Nash equilibrium to this game is

[latex]P_F=P_S=c[/latex].

What is particularly interesting about this is the fact that this is the same outcome that would have occurred if they were in a perfectly competitive market because competition would have driven prices down to marginal cost. So in a situation where competition is based on price and the good is relatively homogeneous, as few as two firms can drive the market to an efficient outcome.